Defining a stock buyback

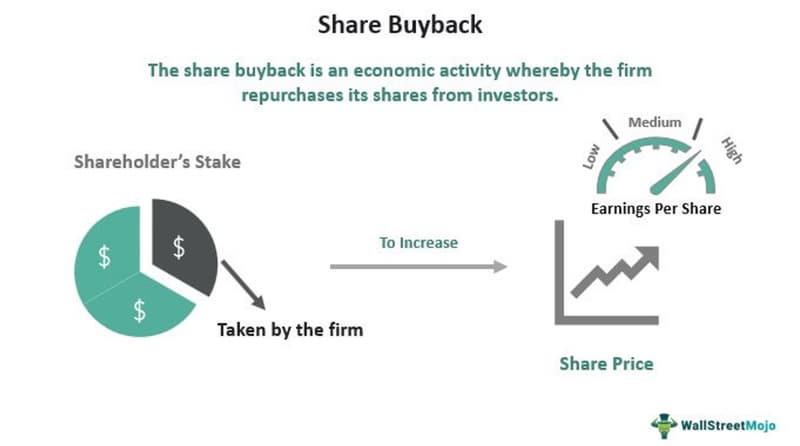

When a corporation uses its accrued capital to purchase back its shares from the market, this is known as a stock buyback. A stock buyback also referred to as a share repurchase, enables a business to reinvest in itself. The corporation absorbs the repurchased shares, lowering the number of outstanding shares on the market. The relative ownership stake of each investor rises since there are fewer shares available on the market.

There are two ways for businesses to carry out a buyback - through a tender offer or the open market:

- Tender Offer: Shareholders of corporations are given a tender offer, which asks them to submit all or a portion of their shares within a specific time limit. The offer includes a price range for the shares as well as the number of shares the corporation intends to repurchase. Investors who agree to tender their shares do so by stating the number of shares and the price they are willing to accept. Following receipt of all offers, the corporation selects the best combination to purchase the shares for the most affordable price.

- Open Market: A business may also purchase its stock on the open market at the going rate, which is frequently the case. However, when a repurchase is announced, the stock price immediately increases since the market views it as a positive indicator.

Why do companies repurchase their stock?

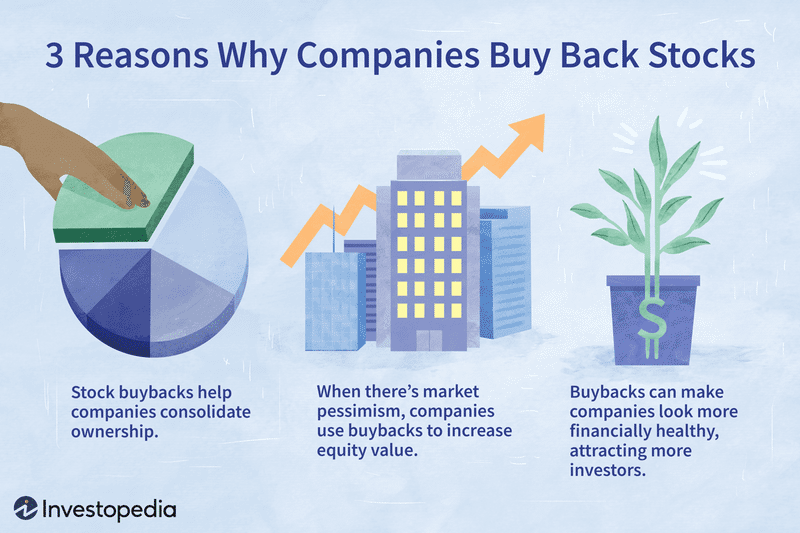

It may seem counter-intuitive that a company would decide to return the money given that it raises equity capital by selling regular and preferred shares. However, there are a number of circumstances in which a firm may benefit from repurchasing its shares, including lowering the cost of capital, consolidating ownership, maintaining stock prices, undervaluation, and enhancing its important financial ratios.

Stock Repurchases Reduce Costs

A tiny ownership interest in the issuing firm, including the opportunity to vote on financial and corporate policy decisions, is represented by each share of common stock. A company has 1,000,001 owners if it has a managing owner and 1,000,000 shareholders. Companies issue shares to raise equity capital to fund expansion, but holding on to all that unused equity cash implies sharing ownership without a solid rationale if there are no possible growth chances.

Businesses that have grown to dominate their industry, for instance, can discover that there isn't much room for expansion left. Carrying significant quantities of equity capital on the balance sheet becomes more of a burden than a benefit when there is so little capacity left to expand.

Since many shareholders expect dividend payments as returns on their investments, the corporation is essentially paying for the right to access money that it isn't using. As a result, repurchasing some or all of the outstanding shares may be a quick and easy approach to repay investors and lower the total cost of capital. Due to this, Walt Disney (DIS) bought back 73.8 million shares in 2016 for a total of $7.5 billion, thereby lowering the number of outstanding shares on the market.

Stock Buybacks Consolidate Ownership

Shares are issued by companies to raise money for projects. There are numerous share classes that can be issued, but the common and preferred shares are the most prevalent. Common shares, also known as ordinary shares, have ownership rights and voting rights. Dividends are given to preferred shareholders before common shareholders, and they are paid first in the event of bankruptcy, which is how preferred shares vary from common shares.

A corporation that issues thousands of shares effectively has thousands of voting shareholders. The number of owners, voters, and capital claims is decreased through a buyback.

Stock Buybacks Preserve the Stock Price

Typically, shareholders expect the corporation to pay them increasing dividends on a regular basis. The maximization of shareholder wealth is another objective shared by business executives. However, if the economy enters a recession, firm executives must strike a balance between pleasing shareholders and remaining agile.

Why do some people prefer dividends over buybacks? A corporation can be required to reduce its dividends in order to retain cash if the economy weakens or enters a recession. The outcome would surely result in a stock sell-off. However, the stock price would probably suffer less if the bank chose to buy back fewer shares, achieving the same capital preservation as a dividend cut.

A company's price will surely rise if it commits to paying out dividends with consistent growth, but the dividend plan has potential drawbacks as well. Dividends cannot easily be reduced during a recession, while share buybacks may, with much less harm to the stock price.

The Stock Is Undervalued

Businesses that do buybacks frequently do so because they firmly believe that the value of their shares is undervalued. Undervaluation can happen for a number of reasons, but it frequently happens as a result of investors' limited capacity to look beyond a company's immediate results, dramatic news stories, or a generalized negative outlook. For instance, as the economy was emerging from the Great Recession in 2010 and 2011, a wave of stock buybacks swept the country.

Many businesses started issuing upbeat predictions for the future, but their stock prices continued to reflect the economic gloom that had dogged them in previous years. By repurchasing shares, these corporations made an investment in themselves in the hopes of profiting when share prices, at last, started to reflect new, more favorable economic realities.

In the event that a stock is significantly undervalued, the issuing firm may choose to repurchase part of its shares at a lower price and then reissue them once the market has recovered, boosting its equity capital without issuing any additional shares. However, if investors feel they have been taken advantage of by a corporation in this way, they can be hesitant to buy the re-issued shares.

If prices remain low, a repurchase and reissue could be a dangerous decision. However, it may make it possible for companies that require long-term capital funding to raise more equity without further eroding stock ownership.

Consider a scenario where a business issues 100,000 shares at $25 each, generating $2.5 million in equity. An unfortunate news story that casts doubt on the company's leadership ethics prompts terrified shareholders to start selling, bringing the share price down to $15. The business chooses to spend $750,000 to repurchase 50,000 shares at $15 each while waiting out the hysteria.

The company continues to be profitable, and in the following quarter, it introduces a brand-new, intriguing product line, pushing the price over the initial selling price to $35 per share. The corporation reissues the 50,000 shares at the new market price after regaining popularity, bringing in a total of $1.75 million in new capital. Due to the short-lived undervaluation of its stock, the corporation was able to increase its equity from $2.5 million to $3.5 million ($2.5 million - $750,000 = $1.75 million + $1.75 million = $3.5 million) without further diluting ownership.

Stock Buybacks Adjust the Financial Statements

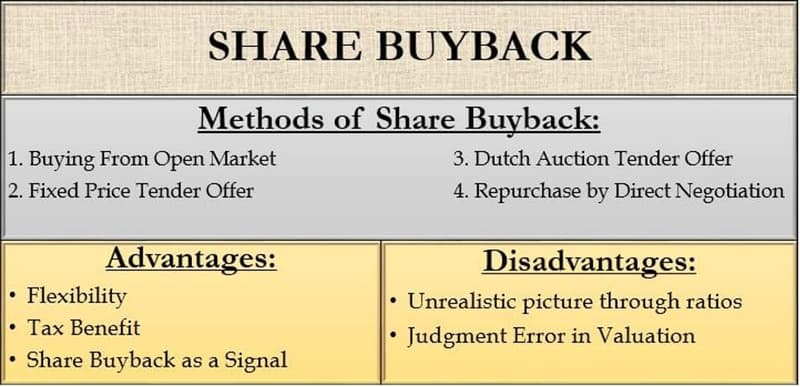

Another simple strategy to improve a company's appeal to investors is to buy back stock. A company's earnings per share (EPS) ratio will naturally rise when the number of outstanding shares is decreased because the annual earnings are now split by a smaller number of existing shares.

For instance, a corporation with 100,000 outstanding shares and annual revenue of $10 million has an EPS of $100. In contrast, if it buys back 10,000 of those shares, bringing its number of outstanding shares down to 90,000, its EPS rises to $111.11 without an increase in earnings.

Additionally, prior to a planned buyback, short-term investors frequently attempt to profit quickly by making an investment in a company. The sudden flood of investors raises the company's price-to-earnings ratio (P/E) and unfairly inflates the stock's valuation. Another significant financial statistic that benefits are the return on equity (ROE) ratio.

A repurchase might be seen as a sign that the company is solvent and no longer requires more equity financing. The market may also conclude that management has sufficient faith in the business to make more investments in it.

Share repurchases are typically viewed as less hazardous than investing in R&D for new technologies or purchasing a competitor; they are a profitable move as long as the business keeps expanding. Additionally, share buybacks are often viewed by investors as a sign that shares will increase in value in the future. Share buybacks may consequently result in a spike in stock purchases from investors.

How do stock buybacks affect a company's value?

Stock buybacks can have a significant influence on the key measures investors use to assess a public business since they take cash out of the balance sheet of a firm and may reduce the number of shares outstanding.

It's crucial to realize that after a corporation buys back its own shares, the shares are either canceled, lowering the total number of outstanding shares permanently, or kept by the firm as treasury shares. These are not included in the calculation of shares outstanding, which has an impact on numerous crucial indicators of a company's financial health.

By dividing a company's net profit by the total number of outstanding shares, important indicators like earnings per share (EPS) are determined. If you give a corporation fewer outstanding shares, the EPS will increase, which will give the impression that the company is doing well.

The price-to-earnings ratio (P/E ratio), which assesses a company's relative valuation by comparing its stock price to its EPS, serves a similar purpose.

For investors, what do stock buybacks mean?

The way that investors see a stock repurchase varies. The manner in which it is done and the effect it has on your portfolio are two factors. These elements aren't always obvious right away.

When a repurchase is commonplace and anticipated, the market will often factor it in, according to Russell. "However, if a stock has been under pressure, and a significant rise is announced, it can spark a rally. Investors might believe the company is "defending" its price in the situation.

The decrease in the supply of shares is one of the main benefits of buybacks for investors. Prices can increase when there aren't as many shares available. You might hold fewer shares following a repurchase, but those shares are now worth more. You won't have to pay capital gains tax on your investment income until you sell it if you keep it in a taxable brokerage account. You can benefit from the long-term capital gains tax rate if you hang onto your remaining shares for a period of time greater than a year.

Additionally, your overall ownership stake in the company rises when there are fewer shares available for trading on the open market. Due to your increased right to a larger portion of the company's earnings, you may eventually benefit from a higher dividend payment.

Disadvantages of stock buybacks

If the timing is off, a stock repurchase could backfire on the corporation. Depending on the reasons for the buyback, it may also generate problems for investors. A firm may be in critical need of funding if, for instance, it buys back stock in an effort to drive up prices and entice more investors.

Let's examine some of the major negative effects that a stock buyback may have.

- Increase of Required Capital: An increase in capital expenditure would be necessary if a corporation announced a buyback at a time when stock values were high. The optimum use of the company's available capital might not be this.

- Trigger Higher Earnings Per Share: Generally speaking, a higher EPS is positive and indicative of a strong company. However, if the corporation is carrying out a buyback only to raise EPS, this does not necessarily imply that you will see any long-term advantages. A sudden buyback announcement can even signal a decline in the company's earnings. It might also imply that its operating expenses are excessively expensive. This puts the company's finances in jeopardy.

- Debt-Driven Buybacks: Many buybacks are financed by taking on more debt, which may be detrimental to a company's long-term growth and the share price as a whole in the future for a very short-term gain.

- Some buybacks mask CEO compensation: Many businesses give stock to executives as bonuses, which devalues the shares of other shareholders. Due to the possible increase in stock price, the buyback will mask this, though.

So, if a corporation in which you own stock announces a repurchase, should you be concerned? No, not always. Understanding the company's reasoning for choosing to repurchase some of its own stock and taking a broader view of the company's fundamentals are both beneficial.

For instance, take into account the company's debt load, any potential expansion ambitions, and the dividend history of the stock. To determine the direction of the share price movement, examine the stock's most recent performance and contrast it with its historical performance. If the company has done this before, take a look at what motivated the buybacks in the past. Also, take into account the state of the larger market.

Stock buybacks are a common occurrence in the market that occasionally affect prices, according to Russell. When a stock rises from a low following a buyback announcement, investors should take notice. That may occasionally be a sign that something is changing.

What is the process to repurchase stock?

An open market operation, a set price tender offer, a Dutch auction tender offer, or direct negotiations with shareholders can all be used to conduct a stock buyback.

1. Open market stock buyback

A business immediately purchases its shares from the market. The company's brokers are used to carry out the transactions. As a large number of shares must be purchased, share buybacks often take place over an extended period of time. In contrast to other approaches, open market stock buybacks do not subject a corporation to any legal requirements to execute the buyback program.

As a result, a corporation has the freedom to end the stock repurchase program whenever it wants. A corporation can buy back its shares at the current market price without having to pay a premium, which is the main benefit of open-market stock buybacks.

2. Fixed-price tender offer

A business offers to buy back the shareholders' shares at a set price and date in a tender offer. There is nearly always a premium included in the tender offer price compared to the current share price. The corporation will then receive the number of shares that interested shareholders have submitted for sale. In general, a set price tender offer can make it possible to finish a stock repurchase quickly.

3. Dutch auction tender offer

In a Dutch auction, a firm offers to buy back shares from owners and gives a range of potential prices, with the minimum price of the range being set above the going market rate. The shareholders then submit their bids by indicating the number of shares they are ready to sell as well as the lowest price. A corporation evaluates the shareholder bids and chooses the appropriate price within a predetermined price range to finish the repurchase program.

The primary benefit of the Dutch auction is that it enables a corporation to obtain direct feedback from shareholders regarding the buyback price. A further benefit of employing this approach is that the stock repurchase program can be finished in a short amount of time.

4. Direct negotiation

In order to purchase back its shares from one or more significant shareholders, a corporation contacts them directly. In this case, a premium is included in the share purchase price. The primary advantage of this strategy, it should be noted, is that a corporation can bargain the repurchase price directly with a shareholder. This makes this procedure extremely cost-effective in certain circumstances. Direct discussions with shareholders, however, can take some time.

2022 – The biggest stock buybacks

Here are the top five largest stock buybacks that have been announced so far in 2022, listed by total cash value.

Company | Date | % of Shares | Buyback Amount |

Apple Inc. (AAPL) | May 28, 2022 | 3.5% | $90 billion |

Cisco Systems (CSCO) | February 16, 2022 | 6.4% | $15 billion |

Exxon Mobil (XOM) | February 1, 2022 | 2.9% | $10 billion |

Broadcom Inc. (AVGO) | May 26, 2022 | 4.3% | $10 billion |

Norfolk Southern Corp (NSC) | March 29, 2022 | 14.6% | $10 billion |

How does stock repurchasing affect the economy?

In spite of the aforementioned, buybacks might benefit a corporation. What about the economy overall? Stock repurchases may have a somewhat favorable impact on the national economy. Since they result in higher stock values, they frequently have a considerably more significant, beneficial impact on the financial markets.

However, the actual economy and the stock market are mutually reinforcing in many ways. For instance, studies have demonstrated the "wealth effect," a phenomenon where increases in the stock market have a beneficial impact on consumer confidence, consumption, and significant purchases.

Reduced borrowing rates for firms are another way that advances in the financial markets have an impact on the actual economy. These businesses are then more inclined to invest in R&D or expand their operations. These actions boost hiring and revenue, which in turn helps the household balance sheet to improve. Additionally, they raise the likelihood that customers will be able to borrow more money to start a business or buy a property.

In conclusion

Do share repurchases make sense? The question might not have a clear-cut solution, as is so often in finance. Buybacks decrease a firm's total assets and the number of outstanding shares, which has a variety of effects on both the company and its investors. When you examine important ratios like EPS and P/E, a share reduction increases EPS and decreases P/E for a more enticing bargain. Ratios, such as ROA and ROE, rise when the denominator falls and the return rises.

A buyback will almost always boost a stock's value on the open market, which is good for shareholders. Investors should, however, inquire as to whether a company is only employing buybacks to support ratios, offer temporary solace to a faltering stock price, or escape from excessive dilution.

FAQ

Can stock buyback be considered a good thing?

If a company doesn't need to fund expansions or other projects or wants to control the share price in the market, it may benefit from a share repurchase. Repurchases could or could not be advantageous to investors, depending on their objectives and financial situation. However, investors can buy back shares at a cheaper price if a firm repurchases them and then issues them at a lower price, making a profit for themselves.

Who does a stock buyback benefit?

The situation that caused the buyback will determine the answer. The company typically gains from a repurchase, but if a corporation is having trouble, investors may also profit since they can reinvest the money in a more successful business.

What does a stock buyback do?

A share repurchase removes outstanding shares from the market and gives investors their money back.

What’s the difference between a stock buyback and a dividend?

Share buybacks and dividend payments are frequently used by public firms to distribute excess profits to shareholders. A business pays its shareholders directly in cash when it pays dividends. Companies that engage in share buybacks make shareholders offer to buy back their shares.

How can a stock buyback give you profit?

The value of a company's stock may rise right away after an announcement that the board of directors has approved a fresh share buyback program. Board-authorized share buybacks are typically not revealed by the companies, but traders can profit from share buybacks by buying stock when the announcement of the buyback is made public.