What is a shareholder?

In essence, shareholders are owners in a business who stand to profit from its success. Any individual, business, or institution that owns one or more shares of a company's stock qualifies as a shareholder. The company's profitability is mostly determined by its shareholders. Shareholders can be divided into two categories:

1. Equity Shareholders

They are proprietors of a company's equity, as the name implies. These stockholders have voting privileges on corporate concerns. Additionally, they have the option to utilize the aforementioned rights, including bringing class-action lawsuits against any situation that might be detrimental to the business.

2. Preference shareholders

When determining how a corporation will distribute its profits, preferred shareholders are given preference over equity stockholders. However, they are not entitled to vote on issues involving executive decisions made by a firm. Preference shareholders are also entitled to fixed dividend rates, even when the success of the company is at risk.

However, with the company's success, both Equity Shareholders and Preference Shareholders experience an increase in their worth. Equity Shareholders, however, are the ones who experience bigger capital gains or losses.

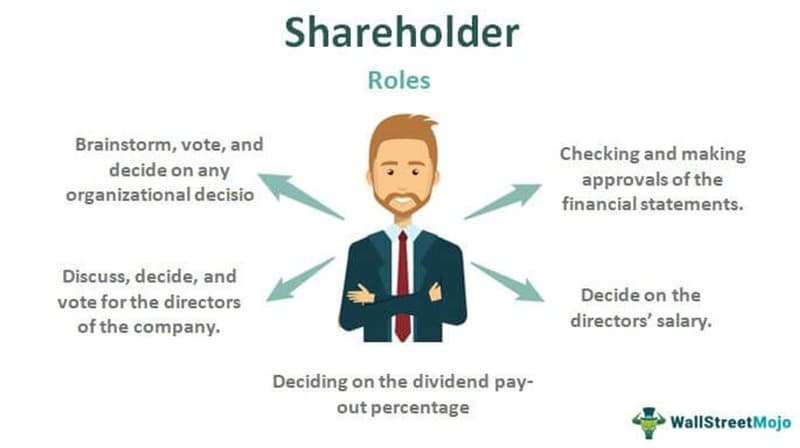

Why are shareholders important in a company?

These shareholders not only profit from their investment in a company's shares, but they also have a significant impact on how a corporation is run, financed, governed, and controlled. For illustration:

1. Company operations

These shareholders appoint top management, which has a direct impact on how the company operates. For instance, investors pick stocks that will produce the predicted earnings, putting businesses under constant pressure to fulfill their projected sales and profits.

2. Financing a company

Instead of ownership rights, shareholders provide funding to companies. Startups and privately held companies can also raise money by selling shares to a select group of investors or through private placements.

3. Governing a company

Board members of publicly traded firms are obligated to keep shareholders informed about the company's financial situation and operations. Senior executives of these companies actually spend time talking with market analysts, shareholders, and other entities about governance-related issues.

4. Control over a company

Shareholders can use their ability to select employees to direct a company's activities. For instance, if shareholders cannot agree on a sufficient price, they can successfully thwart takeover efforts.

Therefore, shareholders have a big influence on a company's overall success and profitability since they have authority over most parts of its operations.

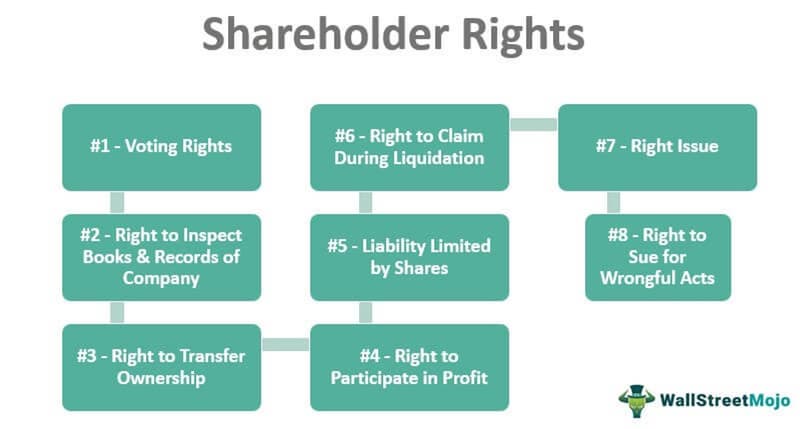

Shareholders rights

Does the fact that you recently purchased Disney shares, making you a part-owner of the firm, entitle you and your family to a free trip to Disneyland this summer? Do stockholders of Anheuser-Busch receive a case of beer every three months?

Although these speculative benefits are extremely rare, they nonetheless prompt the question: What privileges and rights do shareholders have? Many investors are not aware of their rights as stock owners, despite the fact that they may not be entitled to free transportation and drinks. These are some of the benefits that shareholders receive.

Understanding shareholders rights

For the three primary forms of securities that firms issue: bonds, preferred stock, and common stock, each company has a hierarchical system of rights. Or, to put it another way, there is a hierarchy of rights.

The easiest way to comprehend the importance of each form of security is to consider what occurs when a business declares bankruptcy. You may imagine that if the company filed for bankruptcy, as a common shareholder with an interest in the business, you would be first in line to get some of its assets. In actuality, when a corporation goes out of business, common shareholders are at the bottom of the corporate food chain. The first group to receive payment from the company's assets during insolvency proceedings are the creditors who still owe money.

Priority is then given to bondholders, the next preferred shareholders, and then regular stockholders. The "absolute priority" rules used in bankruptcies to determine which participants would receive which portions of the payment determine this hierarchy.

In addition to the absolute priority principles, each class of security has different privileges. A company's charter, for instance, can specify that only common stockholders have voting rights and that preferred owners must get dividends before common stockholders. Because a bond arrangement, or indenture, is a contract between the issuer and the bondholder, the rights of bondholders are governed differently. The bondholder's payments and privileges are governed by the indenture (tenets of the contract).

A breakdown of shareholder rights

1. Director appointments

Through the adoption of an ordinary resolution, shareholders have a direct say in the appointment of directors. Additionally, shareholders have the power to appoint several kinds of directors. As follows:

- An additional director who will serve in that capacity until the next meeting of the general body;

- A substitute director who will serve in that capacity for three months;

- An aspiring director; Whenever a casual vacancy occurs in the office of a director appointed at a general meeting of a public business, a new director is appointed.

In addition to this, a shareholder may object to any resolution adopted at the general body meeting for the nomination of a director.

2. Legal action against directors

The Companies Act of 2013's regulations permit shareholders to file a lawsuit against the director. As follows:

- Any action taken by the director in any way that is detrimental to the company's affair

- Any action taken that is illegal or unconstitutional

- Fraud

- When the company's assets are transferred at a discounted pricing

- Whenever the company's funds are diverted

- Any act carried out in bad faith

- The selection of corporation auditors

3. Right to appoint the company auditors

According to the Companies Act of 2013, the board of directors must appoint the company's initial auditor. Additionally, the audit committee and board of directors recommend that the shareholders meeting at the annual general body. The appointment is typically made for a five-year term, and it may be extended with the passage of a motion at the annual general body meeting.

4. Voting rights

The annual general body meeting is open to shareholders, who may also participate and cast ballots there. Every Indian corporation must abide by the rules set forth in the Companies Act of 2013. Every corporation must hold at least one annual general meeting. The adoption of financial accounts, the appointment or confirmation of directors and auditors, and other obligatory agenda items are considered during the meeting.

According to the Companies Act of 2013, a resolution presented by a member of a corporation may only be approved by a shareholder vote. The following methods of voting are recognized by the 2013 Companies Act:

- Using a show of hands to cast votes

- Polling-based voting

- Voting conducted electronically

- Using a postal ballot to cast your vote

When a shareholder is unable to attend the meeting, he or she may choose a proxy to act on his or her behalf. Although the proxy is not permitted to participate in the meeting's quorum for purposes of voting, it is permitted by adhering to a method outlined in the Companies Act of 2013.

5. Right to call for general meetings

A general meeting may be called by shareholders. If general body meetings are not conducted in accordance with the law, they may also turn to the Company Law Board for assistance.

6. Right to inspect registers and books

Since shareholders are a company's major stakeholders, they have the right to see the company's books and accounts and, if they so want, to inquire about them.

7. Right to get copies of financial statements

The right to get financial statement copies is held by shareholders. The corporation has a responsibility to send its financial statements, whether in a quarterly or yearly statement, to each and every shareholder.

8. Winding up of the company

Before the company is dissolved, all of the shareholders must be informed of the situation, and full credit must be provided to all of the stockholders.

Shareholders rights plan

Despite its name, this plan is different from the government's conventional outline of shareholder rights (the six rights mentioned above). The rights of a shareholder in a particular corporation are outlined in shareholder rights plans. (The details are typically available through the company's corporate website's investor relations section or by getting in touch with them personally.)

The majority of the time, these plans are made to give the board of directors of the firm the authority to defend shareholder interests in the event that an outsider tries to acquire the business. In order to avoid a hostile takeover, a corporation will establish a shareholder rights plan that can be used when another individual or business buys a specific proportion of the company's existing shares.

An illustration of how a shareholder rights plan functions are as follows: Consider the scenario when Cory's Tequila Company learns that Joe's Tequila Company has acquired more than 20% of its common shares. Then, a shareholder rights plan can specify that present common owners have the option to purchase shares at a discount from the going stock price (often a 10% to 20% discount).

This move is occasionally described as a "flip-in poison pill." Investors make immediate profits and, more crucially, dilute the shares held by the rival whose takeover attempt is now more challenging and expensive by being able to buy additional shares at a reduced price. Companies can employ a variety of strategies like these to protect themselves from an unwanted takeover.

- Advantages: On the one hand, this keeps the company from going public and helps the current shareholders and directors.

- Disadvantages: The company's valuation will drop as a result of the shares being issued at a discount, and institutional investors won't express interest in purchasing the company's claims or investing money because of the cautious management style.

Do shareholders have liabilities?

The dangers of becoming a shareholder in a firm are really minimal. This is due to the fact that a company is a distinct legal entity.

It is also important to keep in mind that if you serve as a director of the company, you may have a considerably larger range of obligations than a typical shareholder. If you have authority that is typically reserved for directors, this might happen. Directors are in charge of running the day-to-day operations of the business. According to the law, directors are required to perform more tasks than stockholders.

In summary

Certain rights are granted by purchasing stock, which serves as an ownership claim in an organization. While common shareholders might receive the least amount of money during a liquidation, this is offset by other possibilities including rising share prices. Being an informed investor means being aware of your rights. Despite efforts by the SEC and other regulatory organizations to enforce some shareholder rights, knowledgeable investors who are fully aware of their rights are less vulnerable to dangers.

FAQ

What additional perks can shareholders receive?

Some businesses provide shareholders with small bonuses. On Carnival Cruises, rooms are discounted for shareholders who own at least 100 shares of Carnival. Investors in Royal Caribbean Cruises feel the same way. By making reduced hotel reservations, Intercontinental Hotels Group (IHG) investors can further their financial gains. A discount on a new car is available to shareholders who have owned at least 100 shares of Ford (F) for the previous six months.

Is corporate governance important?

Investors should thoroughly investigate the corporate governance practices of the companies they invest in in addition to the six fundamental rights of common shareholders. These guidelines dictate how a company interacts with and communicates with its shareholders.

What are the duties of shareholders?

The primary responsibility of shareholders is to vote in their role as shareholders at general meetings to pass resolutions. This obligation is crucial because it gives the shareholders the ability to exert complete control over the business and its management. A poll vote, where each vote is proportional to the number of shares each shareholder owns, or a show of hands are the two ways that shareholders can cast their votes. The preferred method of voting at general meetings is usually a show of hands.

At a shareholder's meeting, there are two resolutions that can be voted on: an ordinary resolution and a special resolution.

Do shareholders have a right to profit?

Shareholders have a right to profit from the business, but they are not allowed to decide for themselves. Instead, the board of directors should decide this during a board meeting.

What right does a shareholder not have?

When determining how a company will distribute its profits, preferred shareholders are given preference over equity shareholders. However, they are not entitled to vote on issues involving executive decisions made by a company.