Defining risk management

Losses can be minimized with proper risk management. It can also prevent traders from losing all the money in their accounts. When traders lose money, that's the danger. If they are able to control their exposure to danger, traders increase their chances of success.

This crucial step is often disregarded, but it is necessary for effective active trading. Remember that even a successful trader may wipe away months or years of hard work with just a few bad bets if they don't have a solid risk management plan in place. The question then becomes how to create the most effective strategies for mitigating market dangers.

This post will outline several easy tactics that can be utilized to protect your trading winnings.

How does it work?

It doesn't matter who you are or what you do; every day, you face risks. For the objectives of personal investment management and risk assessment, an investor's personality, lifestyle, and age are among the most important considerations. An investor's risk profile is a combination of risk aversion and tolerance. In general, investors want larger returns to make up for the increased risk they're taking on with their investments.

A key principle in finance is the link between risk and return. The larger the amount of risk an investor is willing to face, the greater the potential reward. As a result, investors should be rewarded monetarily for accepting higher levels of uncertainty. A U.S. Treasury bond, for instance, is among the safest investments but offers a lower rate of return than a bond issued by a corporation. It is far more likely that a firm will fail than the United States government. Corporate bonds carry a greater chance of default than government bonds, hence corporations often pay their investors a higher interest rate.

Risk is typically quantified by looking at past actions and their results. Standard deviation is a widely used measure of risk in the financial sector. The standard deviation quantifies the degree to which a given result deviates from its long-term trend. An extreme standard deviation is indicative of substantial value volatility and, by extension, an elevated level of risk.

Whether an individual, a company or a financial advisor, a risk management strategy can be put in place to aid in the handling of potential losses on investments and in the conduct of business. Within the academic community, various theories, metrics, and approaches have been established for assessing and controlling danger. Standard deviation, beta, Value at Risk (VaR), and the Capital Asset Pricing Model are just a few examples (CAPM). Investors, traders, and company managers can mitigate some of the risks they face by employing hedging methods like diversification and derivative positions, which are made possible by the measurement and quantification of risk.

Do riskless securities exist?

While there is no such thing as a completely safe investment, there are some assets that carry so little risk that they are essentially risk-free.

Risk-free investments are frequently used as a reference point for evaluating and comparing other types of securities. These investments provide a return on investment (ROI) with negligible risk. These securities are popular among all sorts of investors since they may be used to safely store money in case of an emergency or to keep track of assets that need to be easily available at all times.

Certificates of deposit, government money market accounts and United States Treasury notes are all examples of completely safe investments and securities. In financial forecasting, the 30-day U.S. Treasury bill is typically used as the risk-free benchmark. It is guaranteed by the U.S. government and has a short maturity date, so it is not overly vulnerable to changes in interest rates.

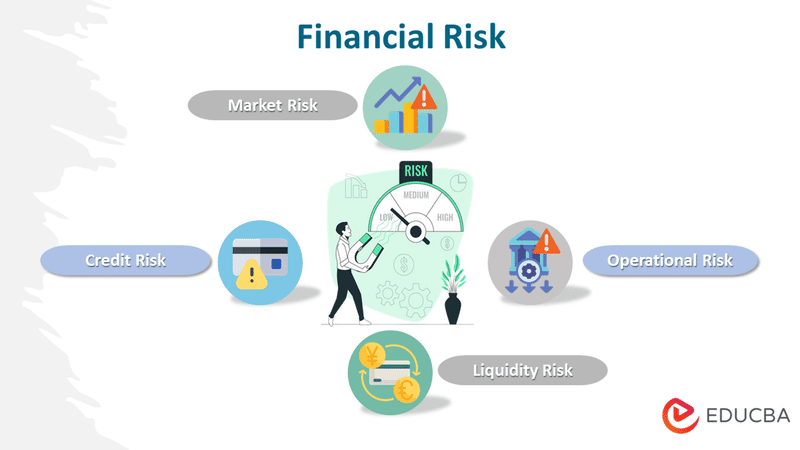

The types of financial risks

Various risks and potential benefits accompany various financial decisions. Investment risks that affect asset values are typically broken down into two categories in financial theory: systematic risk and unsystematic risk. There are systematic risks and unsystematic hazards that investors face.

Risks that can influence the entire economic market or a sizable portion of the market are called "systematic hazards," or "market risks." In investing, market risk refers to the potential for loss owing to variables beyond the control of an individual investor. It is difficult to reduce exposure to market risk by spreading assets across multiple investments. Interest rate risk, inflation risk, currency risk, liquidity risk, country risk, and sociopolitical risks are all examples of additional prevalent types of systematic risk.

The term "unsystematic risk," which also goes by the names "specific risk" and "idiosyncratic risk," describes the type of risk that is unique to a given sector or business. Investment losses attributable to factors unique to a given company or industry constitute "unsystematic risk." A management shakeup, a recalled product, new regulations that cut into profits, or a disruptive new entrant to the market are all examples of such factors. Diversifying an investor's portfolio over a number of different asset classes can help reduce their exposure to non-systematic risks.

Some specific forms of risk exist alongside the more general systematic and unsystematic ones, and these include:

Business Risk

The ability of an organization to earn enough in sales and income to pay its operating costs and turn a profit is the essence of business risk. The costs of funding are the focus of financial risk, whereas the costs of running a business are the focus of business risk. Salary, production, rent, utilities, and office and administrative costs all fall under this category. The cost of goods, profit margins, competition, and overall demand for a firm's products or services all play a role in how much of a risk the company faces.

Credit or Default Risk

The chance that a debtor won't be able to make interest or principal payments as agreed is known as credit risk. Investors with bonds in their portfolios should be especially wary of this threat. The lowest default risk and highest yields can be found in government bonds, notably those issued by the federal government. However, corporate bonds carry a larger default risk but also pay higher interest rates. Investment-grade bonds have a lower probability of default than high-yield or junk bonds. Bond rating organizations like Standard & Poor's, Fitch, and Moody's help investors sort through the various bond options available to them.

Country Risk

What we mean by "nation risk" is the possibility that a country won't be able to pay back its debts. If a country fails to meet its financial commitments, it can have a negative impact on the value of all of its other financial instruments and on its ties with other nations. A country's issuer risk affects all investments that originate from that country, including stocks, bonds, mutual funds, options, and futures. Such danger typically occurs in developing economies or in those with a substantial budget shortfall.

Foreign-Exchange Risk

A foreign investment's price may fluctuate due to fluctuations in the value of the local currency. All investments denominated in a currency other than your home currency are subject to foreign exchange risk, also called exchange rate risk. As an example, if you live in the U.S. and invest in a Canadian stock in Canadian dollars, even though the share value improves, you may lose money if the Canadian dollar depreciates in proportion to the U.S. dollar.

Interest Rate Risk

The risk that the value of an investment will fluctuate because of changes in interest rates (either in absolute terms or as a spread between other rates or in the form of the yield curve) is known as interest rate risk. All bondholders face a substantial threat from this form of risk since it impacts bond values more directly than it does stock values. Bond prices in the secondary market fall when interest rates rise and vice versa.

Political Risk

The chance that an investment's profits will be negatively affected due to political instability or changes in a country is known as political risk. Threats of this nature can arise from shifts in political leadership, legislature, foreign policymakers, or military authority. It is important to keep in mind that political risk, or geopolitical risk, increases with the duration of an investment.

Counterparty Risk

The risk associated with a transaction's counterparty, or counterparty, failing to fulfill its end of the bargain. Credit, investment, and trading activities can all be subject to counterparty risk, particularly if they take place in OTC marketplaces. There is a danger of losing money while investing in stocks, options, bonds, or derivatives because of the actions of another party.

Liquidity Risk

The risk of not being able to quickly convert an investment into cash is known as liquidity risk. A premium for keeping securities that are not easily liquidated over time is usually necessary to attract investors.

Strategic planning of risk management

Planning Your Trades

"Every fight is won before it is fought," remarked Sun Tzu, a legendary Chinese military strategist. This idiom alludes to the idea that combat is not what decides wars, but rather a careful strategy. Just as "Plan the trade and trade the plan" is a frequent mantra among successful traders, so too is "Think the trade through before you enter it." The difference between victory and defeat in battle is largely the result of careful preparation.

Prior to engaging in frequent trading, you should verify that your broker is suitable for such activity. Infrequent traders may find a broker who is more suited to their needs. Their commission rates are excessively exorbitant, and they lack the analytical tools serious traders need.

When trading, careful advance planning is essential. Traders can do this in a number of methods, but two of the most important are using stop-loss (S/L) and take-profit (T/P) levels. Successful traders have a clear idea of the lowest price at which they will buy and the highest price at which they will sell. Then they can compare the returns to the stock's potential for reaching their targets. If the after-tax profit is high enough, they make the trade.

On the other hand, failed traders frequently enter a transaction without first determining whether they would make a profit or a loss on the trade. Like gamblers on a hot (or cold) run, traders let their feelings control their decisions when they're feeling particularly up or down. Profits can inspire traders to imprudently hang on for even greater gains, while losses might provoke them to hold on and try to get their money back.

Consider the One-Percent Rule

The one-percent rule is widely used by day traders. As a general rule, you shouldn't risk more than 1% of your trading account or capital on any given trade. That means you shouldn't have more than a $100 position in any one asset if you have a $10,000 trading account.

Investors with balances of less than $100,000 often employ this tactic, and some even go as high as 2% if they have the financial means to do so. Many investors with larger balances in their trading accounts may choose a lower proportion. For the simple reason that the position grows in proportion to the amount of your account. The easiest approach to limit your losses is to keep the rule below 2%; above that, you run the risk of losing a substantial chunk of your trading capital.

Setting Stop-Loss and Take-Profit Points

The point at which a trader will sell a stock at a loss is known as the stop-loss point. When a trader's expectations are not met, this is a common occurrence. The points are meant to restrict losses before they spiral out of control and discourage an "it'll come back" mentality. In the event that a stock price drops below a critical support level, for instance, investors often sell immediately.

Meanwhile, a take-profit point is a price at which a trader will sell a stock in order to realize a profit. When the potential gains are constrained by the costs, this is the case. If a stock has made a significant upward move and is getting close to a crucial resistance level, traders may want to get out before a period of consolidation begins.

How to More Effectively Set Stop-Loss Points

Stop-loss and take-profit levels are commonly determined using technical analysis, but fundamental analysis can also play a significant part in determining when to enter or exit a trade. For instance, if a trader is holding stock in anticipation of earnings and excitement is building, the trader may wish to sell before the news hits the market if expectations have been too high, regardless of whether or not the take-profit price has been reached.

The most common approach to determining these values is based on moving averages because they are simple to compute and commonly followed by traders. There are a number of important moving averages, but the 5, 9, 20, 50, 100, and 200-day averages stand out. The easiest way to determine if a level will serve as support or resistance for a stock price is to apply it to the stock's chart and see how the price behaves at that point in the past.

Stop-loss and take-profit targets can also be helpfully positioned on trend lines of support and resistance. In order to draw this, one must simply connect the points where volume was much higher than normal and the high or low point. The goal, like with moving averages, is to identify the points at which the price begins to respond to the trend lines, preferably on a lot of volumes.

Below are some factors to think about when deciding on these values:

- To avoid having a stop-loss order executed due to a purely random price movement, it is best to use a lengthier moving average when trading highly volatile stocks.

- Move the averages about until the prices are where you want them to be. More signals can be suppressed if the moving average is increased in size, as is the case with longer targets.

- Stop-loss orders should be placed no closer than 1.5 times the current high-to-low range (volatility), otherwise, they will be executed irrationally.

- If the market is especially volatile, you may need to increase or decrease the stop loss. Stop-loss points can be lowered if the stock price isn't fluctuating much.

- In light of the fact that volatility and uncertainty can develop, it is important to use fundamental events, such as earnings announcements, as crucial time periods to be in or out of a trade.

Calculating Expected Return

The predicted return cannot be calculated without also establishing stop-loss and take-profit levels. This calculation's significance cannot be emphasized, since it compels merchants to carefully consider and defend their trade decisions. This allows them to objectively evaluate potential transactions and pick the ones that will yield the greatest returns.

The formula for this is as follows:

(Chance of Profit) * (Profit to Take) % [(Loss Probability) x (Loss Stop Percentage)]

With this number in hand, the active trader can compare it to other opportunities before deciding which stocks to trade. Breakouts and breakdowns from support and resistance levels in the past can be used to estimate the likelihood of future gains or losses, or experienced traders can use their intuition.

Diversify and Hedge

Never invest all your trading money into one stock or one currency pair. Investing all of one's funds in a single security or instrument is a surefire way to suffer a catastrophic loss. Therefore, it is important to spread your money about by investing in different things and in different places, such as different industries, different sizes of companies, and different parts of the world. This not only aids in risk mitigation but also provides new doorways for exploration.

You might have to take a cautious approach at some point. When the results are announced, you might want to think about making a stock investment. If you want to safeguard your position, you can think about taking the opposing position through options. You can remove the hedge when trade activity slows down.

Downside Put Options

If you are allowed to trade options, you can protect yourself from a bad trade by purchasing a downside put option (sometimes called a protective put). The buyer of a put option acquires the right, but not the duty, to sell the underlying stock at an agreed-upon price on or before the option's expiration date. If you already own 100 shares of XYZ company and pay $1.00 for the 6-month $80 put option, you will be effectively stopped out of the market at a price of $79 (the $80 strike less the $1 premium paid).

Risk and reward

The risk-return tradeoff is the balance between the goal for the lowest possible risk and the best potential profits. In general, the potential return on an investment declines as the level of risk increases, and vice versa. To get the desired return, each investor must determine the level of risk they are OK with taking. A person's age, income, investment objectives, liquidity requirements, time horizon, and personality will all play a role.

The following graph graphically depicts the risk/return tradeoff in investment, where a greater standard deviation indicates a greater level of risk, as well as a greater possible return.

Keep in mind that greater risk does not always result in greater rewards. Even if the risk-return tradeoff suggests that investments with a higher degree of risk could potentially yield better profits, this is not a given. The risk-free rate of return represents the lowest possible risk in an investment, as it is the theoretical rate of return for a risk-free investment. In other words, it is the rate of return an investor could anticipate earning on a risk-free investment over a given time frame. Since you wouldn't take on extra risk unless the possible return was higher than the risk-free rate, that rate is the very minimum you should be making on any investment.

Risk and diversification

One of the simplest and most efficient ways to reduce exposure to risk is through diversification. Correlation and risk are key to understanding diversification. 11 Diversified portfolios hold a wide variety of securities from different industries, each with its own risk profile and return potential.

Financial experts agree that diversification is the single most significant factor in reducing the risk of a portfolio and making it more likely that the investor will be able to achieve their long-term financial goals.

Diversification can be planned for and ensured in a number of ways:

- Diversify your holdings among various financial instruments such as cash, equities, bonds, mutual funds, exchange-traded funds, and other funds. Try to find investments that haven't had returns that move in the same direction or to the same extent. That way, even if some of your holdings are decreasing, your portfolio as a whole may be increasing.

- Never invest all of your money in one basket. Securities from a wide range of industries, geographies, and market caps should be included. Diversifying your portfolio by including growth, income, and value strategies is also a good idea. The same holds true for bonds, wherein you should think about various maturities and credit grades.

- Securities with varying degrees of risk should be included. You don't have to stick to "blue chip" stocks. The reverse is true, in reality. Large gains can be protected against the possibility of a loss by diversifying into investments with varying rates of return.

Diversifying your holdings is not a one-and-done job. By rebalancing their holdings on a regular basis, investors and businesses can ensure that their portfolios are always at an appropriate level of risk for their long-term objectives.

In conclusion

A trader must always have a plan in place before making any moves. Stop losses allow a trader to limit not just their financial exposure but also the number of times a trade is abandoned for no good reason. In conclusion, organize your strategy ahead of time so that you can be certain of your victory.

FAQ

How can risk be defined?

In finance, the risk is defined as the potential for real gains to differ from those projected for a certain outcome or investment. The probability of a whole or partial loss of initial investment is a risk.

Risk is typically quantified by looking at past actions and their results. Standard deviation is a widely used measure of risk in the financial sector. The volatility of asset prices relative to their long-term averages can be measured by calculating their standard deviation over a certain period.

What do the 5 W's in risk management stand for?

Perhaps it is because we have forgotten the fundamentals. The five Ws of security (what, why, who, when, and where) are the foundation for any discussion of information security.

What do the 7 principles of risk management mean?

- Ensure risks are identified early.

- Factor in organizational goals and objectives.

- Manage risk within context.

- Involve stakeholders.

- Ensure responsibilities and roles are clear.

- Create a cycle of risk review.

- Strive for continuous improvement.

Which prestige enterprise affixes risk ratings?

Morningstar is one of the best independent rating services for mutual funds and ETFs. The level of risk in a portfolio can be adjusted to suit the investor's comfort level with taking chances.

What is the link between time and risk?

One of the most important aspects of risk assessment and risk management is the time horizon and liquidity of assets. When money is needed quickly, investors are less likely to put it in high-risk ventures or those that can't be liquidated quickly, and more likely to put it in risk-free securities.

Individual investment plans' time horizons will be a key consideration. If they have a long time until retirement, younger investors may be more comfortable taking on greater investment risk in exchange for potentially larger returns. Given their anticipated greater liquidity needs, older investors are likely to have a distinct risk tolerance.