How a put option is defined

An agreement known as a "put option" grants the option buyer the right, but not the duty, to sell—or sell short—a certain amount of the underlying securities at a predetermined price within a predetermined time frame. The striking price is the predetermined price at which the buyer of the put option may sell the underlying security.

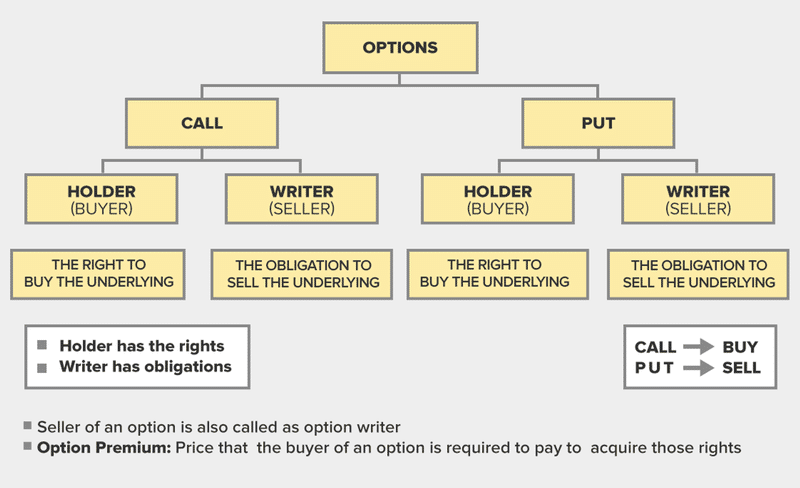

On a variety of underlying assets, such as stocks, currencies, bonds, commodities, futures, and indices, put options are traded. A call option, in contrast to a put option, grants the holder the right to purchase the underlying security at a predetermined price on or before the option contract's expiration date.

How does it work?

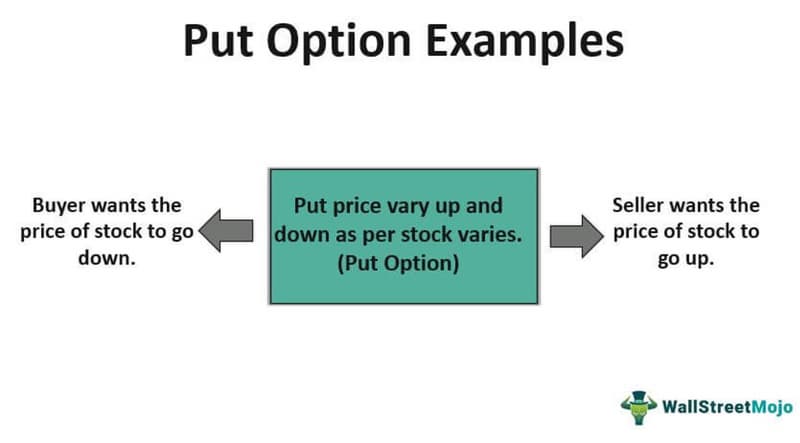

As the price of the underlying stock or investment drops, a put option becomes more attractive. A put option, on the other hand, loses value as the price of the underlying stock rises. They are therefore frequently employed for hedging purposes or to make downward price action speculations.

Put options are frequently employed by investors in the protective put risk management method, which is used as a type of investment insurance or a hedge to guarantee that losses in the underlying asset do not surpass a particular amount. In this approach, the investor purchases a put option to protect against stock declines in a holding. The investor would sell the stock at the strike price of the put if and when the option was executed. A short position in the stock would be created if the investor exercises a put option while without owning the underlying stock.

Factors influencing a puts price

Due to the effect of time decay, a put option's value typically declines as the time to expiration draws near. With less time to earn a profit from the deal, time decay quickens as an option's time-to-expiration approaches. The intrinsic value of an option is what remains after the temporal value has been lost. The discrepancy between a stock's underlying price and the strike price is what determines an option's intrinsic value. An option is said to be in the money if it has inherent value (ITM).

Option Intrinsic Value = Market Price of Underlying Security - Option Strike Price

Put options that are in the money (ATM) or out of the money (OTM) are worthless because there is no incentive to exercise them. Instead of exercising an out-of-the-money put option with an unfavorable strike price, investors have the option of shorting the company at the current higher market price. However, short selling is often riskier than purchasing put options outside of a bad market.

The option premium takes time value, or extrinsic value, into account. If a put option's strike price is $20 and the stock that the option is based on is now trading for $19, the option has $1 of intrinsic value. But the put option might cost $1.35 to exchange. Since the price of the underlying stock could fluctuate before the option expires, the additional $0.35 represents the time value. Put spreads are made up of different put options on the same underlying asset.

When selling put options, there are a number of things to consider. When thinking about a trade, it's crucial to grasp the value and profitability of an option contract; otherwise, you run the danger of the stock falling below the point at which it becomes profitable.

Put option - Buying

Put options may serve as the buyer's equivalent of insurance. A shareholder can buy a "protective" put on an underlying stock to assist safeguard against loss due to a decline in the stock price.

Importantly, though, buyers of puts don't have to be owners of the underlying stock. Because put options have a bigger potential profit than shorting a stock outright, some investors purchase puts to gamble on the price of a particular stock falling.

The put option is deemed to be "in the money" if the stock falls below the strike price. Because the market price of the stock is lower than the strike price, a put option that is in the money has "intrinsic value." Next, the customer has two options:

- First, if the buyer already owns the stock, the put option contract can be exercised, transferring ownership of the stock to the put seller at the strike price. This exemplifies the "protected" put since the put buyer can still sell the shares at the higher strike price rather than the lower market price even if the stock's market price drops.

- Second, the buyer doesn't have to sell any underlying stock in order to realize the value by selling the put before expiration.

The put is "out of the money" and expires worthless if the stock remains at or above the strike price. The put buyer then forfeits their entire investment, while the put seller keeps the premium received for the put.

Example of buying a put:

XYZ is trading at $50 per share. For a $5 premium, puts with a $50 strike price and a six-month expiration can be sold. One put contract has a total cost of $500 ($5 premium x 100 shares).

The put buyer's profit or payback on the put with the stock at various values is depicted in the graph below.

Since one contract equals 100 shares, the total value of the option rises by $100 for every $1 reduction in the stock's market price below the striking price.

When put options move below the break-even mark, they start to (1) make money, (2) have intrinsic value, or (3) be "in the money." By deducting the put's cost from the strike price, you may calculate the break-even point. The break-even point in this scenario is $45 ($50 - $5 = $45). While the option will still have some value if the stock trades between $45 and $50, there won't be a profit.

The option is "out of the money" and loses value if the stock price stays over the $50 strike price. As a result, the option value declines, capping the investor's potential loss at the $5 premium per share or $500 total paid for the put.

Put option - Buying vs. Short Selling

One of the two major ways to bet against a stock is to purchase put options, which might be tempting if you believe a stock is about to decrease. The other is shorting, sometimes known as short selling.

When an investor "shorts" a stock, they borrow it from their broker, sell it to lock in the current market price, and then plan to purchase it back if and when the stock price drops. The profit is the difference between the sell and buys prices. The attraction for put purchasers is that buying puts has a higher potential return than shorting a company.

Example of shorting vs. purchasing a put:

An investor can buy a put option with a $50 strike price and a six-month expiration date on XYZ stock for a $5 premium. One put contract costs $500 since each options contract is worth 100 shares. With $500 in cash on hand, the investor can either buy one put contract or short 10 shares of the $50 XYZ stock.

The payback profile for short sellers, put buyers, and put sellers at expiration is shown below.

The stock price at expiration | Price movement | Short-seller's profit/loss | Put buyer's profit/loss | Put seller's profit/loss |

$70 | +40% | -$200 | -$500 | $500 |

$65 | +30% | -$150 | -$500 | $500 |

$60 | +20% | -$100 | -$500 | $500 |

$55 | +10% | -$50 | -$500 | $500 |

$50 | 0% | $0 | -$500 | $500 |

$45 | -10% | $50 | $0 | $0 |

$40 | -20% | $100 | $500 | -$500 |

$35 | -30% | $150 | $1,000 | -$1,000 |

$30 | -40% | $200 | $1,500 | -$1,500 |

Assumes no transaction fees | ㅤ | ㅤ | ㅤ | ㅤ |

Why do put buyers become ecstatic? According to the aforementioned chart, a short seller will make $200 if the price drops 40%.

$50 (market price) × 10 shares = $500

10 shares (repurchased) x $30 = $300

- $200 in profit ($500 - $300)

Owning a put option, however, amplifies that downward movement and results in a $1,500 profit for the put owner.

$50 strike price - $30 market price = $20 gain per share

$20 - $5 (contract cost) = $15 gain per share x 100 shares, or $1,500

- Profits: $1,500

If the stock loses significantly, buying puts has a higher profit potential than going short. If the stock doesn't fall below the strike by expiration, the put buyer could lose their entire investment; however, the loss is limited to their initial investment. The put buyer never loses more than $500 in this scenario.

In contrast, shorting a stock yields fewer profits if the price drops, but the trade turns profitable as soon as the price drops. The trade is already profitable at $45, while the put buyer has only reached breakeven. However, the largest benefit for short sellers is that they have a bigger window of opportunity for the stock to fall. Even if options eventually expire, a short-seller does not have to close out a short-sold position as long as the brokerage account has the funds to support it.

The biggest disadvantage of short selling is that, if the stock rises further, losses could theoretically never end. Although no stock has yet reached infinity, short-sellers run the risk of losing more money than they invested in the investment. The short-seller might need to put up more money if the stock price kept rising in order to keep the position open.

Put option – Selling

Writers of put options are obligated to purchase the underlying stock at the strike price. To acquire the stock from the put buyer, the put seller must either have enough cash in their account or be able to use margin. A put option won't, however, normally be exercised unless the stock price is below the strike price, or until the option is "in the money." Put sellers typically anticipate a flat or rising price for the underlying stock. Sellers of put options place a bullish wager on the underlying stock and/or do so in an effort to profit.

The option is "in the money" if the stock drops below the strike price before the expiration. The stock will be put to the seller, who will then have to purchase it at the strike price.

The put is "out of the money" if the stock rises or stays at the strike price, and the put seller keeps the premium. If the seller wishes to try to increase their income, they can write another put on the stock.

Example of selling a put:

XYZ is trading at $50 per share while selling a put. Puts with a $50 strike price and a six-month expiration can be sold for a $5 premium. One put contract sells for $500 overall ($5 premium multiplied by 100 shares).

The graph below displays the seller's payoff or profit on the put at various stock prices.

Since each contract represents 100 shares, the cost of the option to the seller rises by $100 for every $1 decline in the stock price below the striking price. The strike price less the premium received, or $45 per share, is where the break-even point is reached. The maximum profit for the put seller is a $5 premium per share or $500 overall. The put seller retains the entire premium if the stock stays over $50 per share. As the stock's value drops, the put option keeps losing the put seller money.

Put sellers, in contrast, to put purchasers, have substantial risk as well as the limited upside. The maximum payment to a put seller is the premium, which is capped at $500. However, if the buyer exercises the put option, the put seller is required to purchase 100 shares of stock at the striking price. If the underlying stock price dropped to zero, potential losses might be more than any initial investment and could reach the full value of the shares. If the underlying stock fell to zero, the option seller in this case may lose up to $5,000 ($50 strike price paid x 100 shares).

The advantages of put options

As they give more possibilities for how to invest and make money, put options continue to be well-liked. To hedge or mitigate the risk of a stock's price decline is one draw for put buyers. Other justifications for using put options are:

- While creating a capital gain, reduce risk-taking. Risk can be reduced by using put options. A short seller, on the other hand, is exposed to infinite risk if the stock drops lower, whereas an investor hoping to profit from the decline of XYZ stock could buy just one put contract and cap the potential downside at $500. The payout of both methods is comparable, but the put position reduces possible losses.

- Profit from the premium in some way. Investors can sell options to make money, and if done moderately, this can be a good approach. Selling puts can be tempting to generate additional returns, particularly in a rising market where the stock is unlikely to be put to the seller.

- Realize more alluring purchase prices. Put options are used by investors to get better purchasing prices for their equities. On a stock that they would like to own but is currently too pricey, they can sell puts. They can buy the stock and receive the premium as a discount if the price drops below the put's strike. They can keep the premium and try the method again if the stock stays above the strike.

In summary

Even if the market price for the security has dropped, put options nevertheless allow the holder to sell it at a fixed price. As a result, both speculative traders and hedging techniques might benefit from them. Puts are one of the most basic derivative contracts, along with call options.

FAQ

Are buying and short selling similar?

Although selling short and buying options are both bearish tactics, there are some significant distinctions between the two. The most a put buyer may lose is the premium they paid for the put, thus buying puts doesn't need a margin account and can be done with little funds. Contrarily, short selling is substantially more expensive and theoretically carries unlimited risk due to fees like stock borrowing charges and margin interest (short selling generally needs a margin account). Therefore, it is believed that shorting is significantly riskier than buying puts.

Which is better – Buy in the money (ITM) or Out of the money (OTM)?

It largely depends on variables like your trading goal, risk tolerance, available funds, etc. Because you have the option to sell the underlying security at a greater price with in-the-money (ITM) puts as opposed to out-of-the-money (OTM), the dollar investment is higher. But the fact that OTM puts likewise have a decreased chance of becoming profitable by expiry cancels out their cheaper price. OTM puts may be the best option if you don't want to spend a lot on protective puts and are ready to take the chance that your portfolio will only slightly fall.

Is it possible to lose all of the premium money paid on your put option?

Yes, if the price of the underlying securities does not trade below the strike price by the time the option expires, you could lose the whole amount of premium paid for the put.

What are writing put options?

A short or written put option, as opposed to a long-put option, binds the investor to take delivery of or buy shares of the underlying stock at the option contract's strike price.

If you have limited capital, should you consider writing put options?

Writing puts is an advanced options strategy intended for seasoned traders and investors; other advanced option methods, including writing cash-secured puts, also need a sizable amount of capital. Put writing would be a dangerous undertaking and not one that is advised if you are new to options and have minimal funds.