How to define a call option

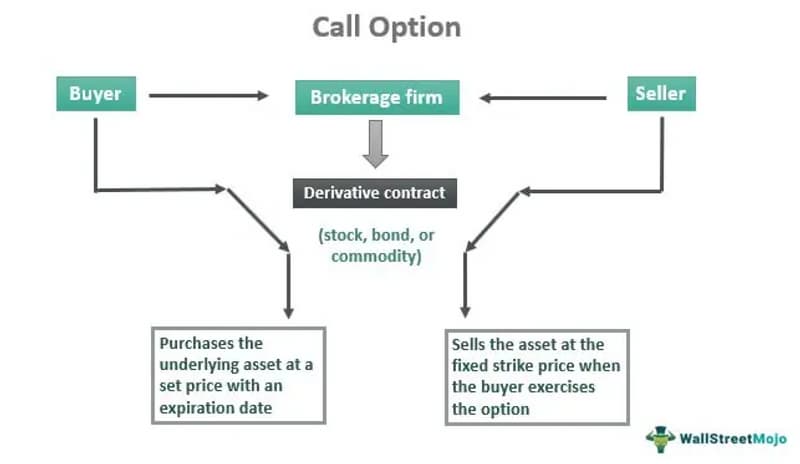

Options fall under the category of "derivative financial instruments" because their value is derived from another security or underlying asset. Here, we'll talk about stock options, where a stock serves as the underlying asset.

A call option is a contract that grants the owner the choice—but not the obligation—to purchase a certain underlying stock at a set price (referred to as the "strike price") within a preset window of time (referred to as the "expiration").

The call buyer pays the call seller a "premium" per share for this option to purchase the stock.

There are 100 shares of the underlying stock represented by each contract. To purchase or sell a call, an investor does not need to hold the underlying stock.

Consider purchasing a call option rather than the underlying stock outright if you believe the market price of the underlying stock will increase. Consider selling or "writing" a call option if you believe the market price of the underlying stock will decrease, move sideways, or remain unchanged.

For a call buyer, you have the option of "exercising" the call option or purchasing the underlying shares at the strike price if the market price of the underlying stock moves in your favor. American options let the option to be exercised at any time up until the expiration date. Only the expiration date allows for the exercise of European options.

Call options trading and buying can also be a part of a more intricate option strategy.

Types of call options

Call options trading can be done in one of two ways.

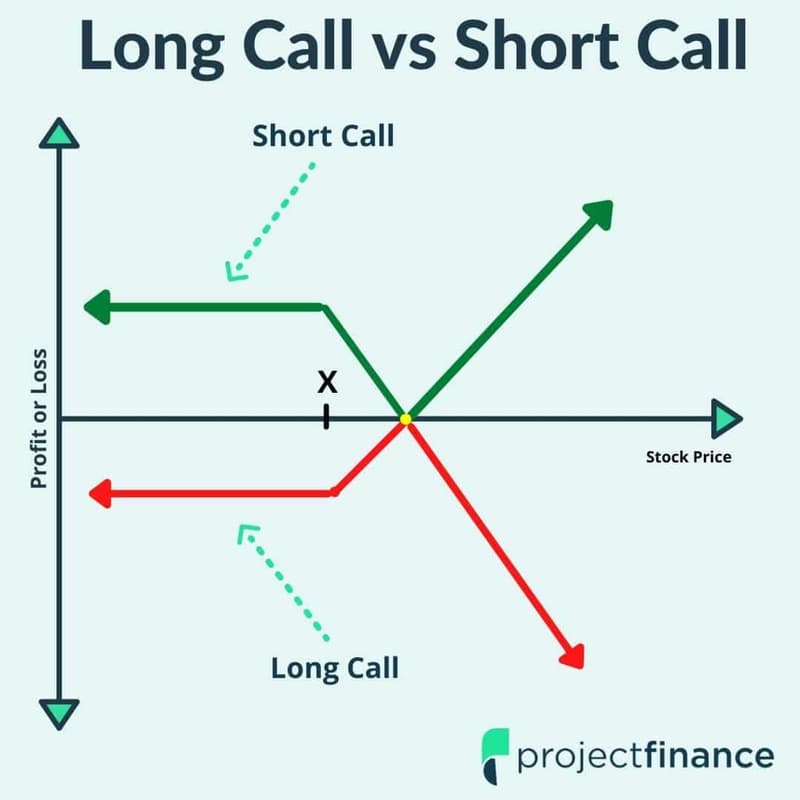

Long call option

Long call options are regular call options that grant the buyer the right but not the obligation to acquire a stock at a strike price in the future. The benefit of a long call is that it enables you to foresee the future and buy stock at a discount. A long call option might be bought, for instance, in advance of a newsworthy event, such as a company's earnings call. While the potential gains from a long call option are limitless, the potential losses are only the premiums. Therefore, the maximum losses a call option buyer can experience are those related to the option premiums. This is true even if the company does not announce a good earnings beat (or one that does not meet market expectations) and the price of its shares decreases.

Short call option

A short call option is the opposite of a long call option, as its name suggests. A seller of a short-call option commits to selling their shares at a certain strike price in the future. Short call options are frequently used for covered calls, or call options where the option seller already owns the underlying stock for their options. The call aids them in limiting their losses if the transaction is unsuccessful. For instance, if the call was uncovered (i.e., they did not hold the underlying stock for their option) and the stock had a substantial price increase, their losses would increase.

Buying a call option

People primarily purchase call options in order to profit from a stock they are bullish on. The following are some other factors:

- Low risk. This tactic offers a low-risk way to speculate on the underlying stock because when you go long on a call option, you only run the risk of losing the premium.

- Leverage. Low risk also means less leverage. You can purchase 100 shares of stock for just cents on the dollar for the cost of the premium.

- Stop loss/hedging. You can protect your short position on the underlying stock by purchasing a call option. In the event that the stock's value unexpectedly soars, you can reduce the downside. As a result, your call option is effectively transformed into a stop-loss tool.

- Tax and portfolio management. Without actually purchasing or selling the underlying stock, you can utilize options to adjust the allocation of your portfolio. This could be a tactic to lessen your exposure to a stock you hold that has a significant unrealized capital gain. However, unless the option is exercised, sold, or expires, nothing is recorded even if earnings on options are taxed.

Buying a call option vs. owning the stock

If a stock is expected to increase, buying call options may be appealing. It's one of the two major strategies for making a stock increase bet. The alternative is to directly own the stock. Purchasing calls can be more rewarding than complete ownership of a stock.

To compare the results for investors of the two call methods with directly holding the stock, let's look at an example.

The share price of XYZ stock is $50. For a $5 premium, call options with a six-month expiration date and a $50 strike price are offered. One call contract costs $500 since each options contract represents 100 shares. With $500 in cash on hand, the investor might either buy one call contract or ten shares of the $50 stock.

The payback profile for stockholders, call purchasers, and call sellers at expiration is shown below.

The stock price at expiration | Price movement | Stockholder's profit/loss | Call buyer's profit/loss | Call seller's profit/loss |

$70 | +40% | $200 | $1,500 | -$1,500 |

$65 | +30% | $150 | $1,000 | -$1,000 |

$60 | +20% | $100 | $500 | -$500 |

$55 | +10% | $50 | 0 | $0 |

$50 | 0% | $0 | -$500 | $500 |

$45 | -10% | -$50 | -$500 | $500 |

$40 | -20% | -$100 | -$500 | $500 |

$35 | -30% | -$150 | -$500 | $500 |

$30 | -40% | -$200 | -$500 | $500 |

Assumes no transaction fees | ㅤ | ㅤ | ㅤ | ㅤ |

It is evident that buying calls become more appealing when stock prices increase. A shareholder would make $200 if the stock increased by 40% to $70 per share ($70 market price - $50 purchase price = $20 gain per share x 10 shares = $200 total profit). Owning the call option, however, increases that profit to $1,500 ($70 market price minus $50 strike price is a $20 per share gain). $1,500 in profit ($20 minus $5 for the contract's cost; $15 gain per share multiplied by 100 shares).

Purchasing a call option instead of owning the shares offers substantially larger rewards in the event that the stock price rises significantly. In order to make a net profit on the option, the stock must increase above the strike price by an amount greater than the premium paid to the call seller.The call above achieves a break-even point of $55 per share.

If the stock doesn't increase above the strike price, the option holder loses the entire investment. A call buyer's loss, however, is limited to their initial investment. No matter how low the stock drops in this scenario, the call buyer never loses more than $500.

If the price of the stock remains unchanged or declines, the loss to the stockholder is smaller than the option holders. The investor has the option to keep waiting indefinitely for the stock to shift course by directly owning the shares. Compared to options, whose life expires on a set date in the future, this is a huge advantage. When trading options, you must accurately estimate both the direction of the stock and the timing of the trade.

Selling a call option

Three things can be done with a call option that you already hold. You have three options: exercise your option to buy the underlying asset so you may sell it for a profit; let it "expire worthlessly" and lose the premium you paid (although that is all you lose), or sell the option before it expires, also for a profit.

Here are a few explanations for why you could decide to sell your call option:

- Make a profit. The premium may increase over time as the value of the underlying asset rises (the fee the seller would receive). You could decide to sell your option and keep the profit from the higher cost you'd get instead.

- Avoid loss. You might choose to sell in order to recoup at least some of your premium before the option expires worthless if the underlying asset stays the same or falls.

- Do not pay commissions. Even if you think the stock will increase in value before expiration, the premium you obtain by selling the option rather than exercising it will allow you to avoid paying fees that might have a negative impact on your profit.

- Avoid leakage risk. Spillage occurs when an option is exercised, the underlying asset is sold, and the price received is less than expected.

Writing your own call options is another way to sell them. Written call options come in two primary variations:

Naked call option

You write (make) a call option for underlying assets that you do not possess in this situation. In this situation, you would write an option for a stock whose price you believe won't rise before the chosen expiration date. A buyer disagrees and gives you extra money for the contract you created. You keep the entire premium as your profit if the option expires worthless.

If the asset's value rises and you are forced to sell the buyer 100 shares at the strike price, you will lose the money that separates the strike price from the price you must pay for the shares after deducting the premium.

Covered call option

When you write a call option on an asset you already own, you have a covered option. The same factors are driving you: you think your asset will decrease or remain unchanged by the expiration date. To obtain the premium, you sell the option (fee paid by the buyer).

If the asset performs as you anticipated, you keep the premium, which helps to make up for the asset's value loss. You'll have to give the asset over to the bidder for the strike price if its value increases. You will forfeit the gain, less the premium you received, that you would have realized had you continued to own the asset.

Alexander Voigt, the founder, and CEO of day trading cautions against selling call options, saying the following: "Because it seems appealing to collect the options premium, investors are sometimes attracted to trade so-called naked options. However, there is an unlimited danger when selling options without first hedging the trade."

The greatest danger is associated with unexpected overnight price gaps brought on by news catalysts like earnings reports, he says. Investors also need to be aware that the call option buyer has the legal right to request the underlying stock at the strike price from the option seller prior to the option's expiration.

Calculating call option payoffs

The profit or loss that an option buyer or seller makes from a transaction is referred to as the call option payoff. Keep in mind that the strike price, expiration date, and premium are the three main factors to take into account while analyzing call options. These factors determine the payoffs produced by call options. In two instances, call option payoffs have occurred.

Rewarding call option buyers

Let's say you spend $2 more to buy a call option on business ABC. The option has a $50 strike price and a November 30 expiration date. If ABC's stock price hits $52—i.e., the sum of the premium paid plus the stock's purchase price—you will break even on your investment. Any gain over that figure is regarded as a profit. As a result, there is no limit to the gain from an increase in ABC's share price.

What happens if the share price of ABC falls below $50 by November 30? You can decide not to exercise your options contract, in which case you won't buy ABC's shares, as it just grants you the right to do so and not the responsibility. In this scenario, your losses are restricted to the option price you paid.

- spot price - strike price = payoff

- payoff - premium paid = profit

If ABC's spot price is $55 on November 30, using the method above, your profit is $3.

Rewarding call option sellers

For a call option, the payoff estimates for the seller are not much different. You will only profit if the price drops if you sell an ABC options contract with the same strike price and expiration date. Depending on whether your call is covered or naked, your losses could be restricted or unbounded. In the latter scenario, if the buyer of the option executes the contract, you are compelled to buy the underlying shares at spot prices (or possibly even higher). In this situation, the only source of your income (and profits) is the premium you receive when the options contract expires.

The following are the formulas for determining payoffs and profits:

- spot price - strike price = payoff

- payoff + premium = profit

According to the method above, if ABC's spot price is $47 on November 30th, your income is $1.

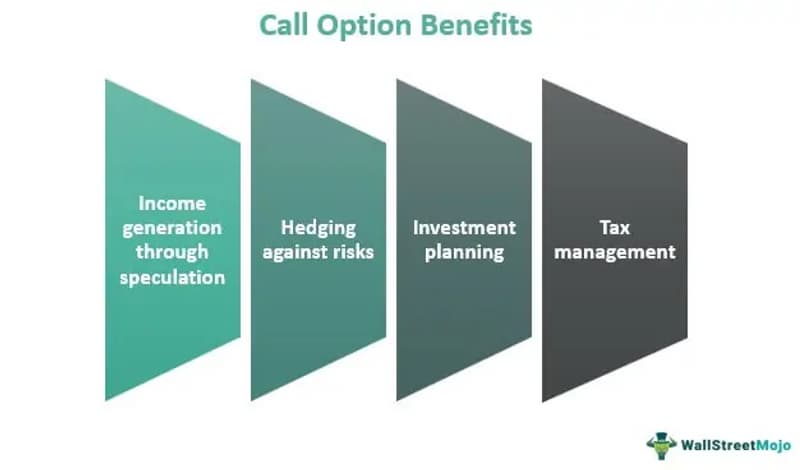

Benefits of call options

The three main functions of call options are frequently revenue production, speculating, and tax planning.

Using Covered Calls for Income

Through the use of a covered call strategy, some investors employ call options to earn money. This tactic entails holding the underlying stock while also granting another party the right to buy your equity by issuing a call option. The investor hopes that the option will expire worthlessly and collects the option premium (below the strike price). This method increases the investor's income but may also reduce the amount of money they may make if the price of the underlying stock rises significantly.

Covered calls are effective because the option buyer will exercise their right to purchase the stock at the lower strike price if the stock climbs over the strike price. Therefore, the stock's advance above the strike price does not result in a profit for the option writer. The premium paid represents the option's maximum profit for the writer.

Using Calls for Speculation

Buyers have the chance to get substantial exposure to a stock for a reasonable cost by using calls for speculative options contracts. They can result in large gains if a stock rises when used alone. However, they also include the risk of a 100% loss of the premium if the call option expires worthless as a result of the underlying stock price remaining below the strike price. Buying call options have the advantage that risk is always limited to the option premium.

Investors can also concurrently buy and sell many call options, forming a call spread. These will impose a limit on the strategy's potential gains and losses, but they are occasionally more cost-efficient than a single-call option because the premium received from the sale of one option balances out the premium paid for the other.

Utilizing Tax Management Options

Options can be used by investors to rebalance their portfolios without actually purchasing or selling the underlying security.

As an illustration, a shareholder who owns 100 shares of the stock XYZ may be responsible for a sizable unrealized capital gain. Shareholders may utilize options to lessen their exposure to the underlying investment without actually selling it if they don't want to cause a taxable event.

The cost of the options contract itself represents the only expense incurred by the shareholder in the aforementioned scenario.

What’s the verdict?

The right, but not the obligation, to buy a stock, bond, commodity, or other asset or instrument at a specific price within a predetermined window of time is provided to the option buyer by financial contracts known as call options. A stock, bond, or item makes up the underlying asset. Options are sometimes leveraged speculative instruments. The call buyer makes money when the value of the underlying asset increases. Through the collection of premiums from the sale of options contracts, a call option seller can make money. Depending on the strategy and call option type that produces profits, different call options have different tax treatments.

FAQ

How do call options function?

An example of a derivative contract is a call option, which grants the holder the right but not the duty to buy a certain number of shares at a predetermined price, or the "strike price" of the option. The option holder can exercise their option by purchasing at the strike price and selling at the higher market price to lock in a profit if the market price of the stock climbs above the option's strike price. Options, however, are only valid for a short while. The options expire worthless if the market price does not increase over the strike price within that time.

Why would you consider buying a call option?

If investors are confident—or "bullish"—about the prospects of the underlying shares, they may think about purchasing call options. Due to the leverage they offer, call options may be a more alluring way for these investors to bet on a company's prospects. After all, each options contract offers the chance to purchase 100 shares of the relevant company. An appealing strategy to improve purchasing power for an investor who is convinced that a company's shares will increase is to purchase shares indirectly using call options.

Is buying a call option considered bullish or bearish?

Purchasing calls are bullish since the buyer only makes money if the share price increases. Selling call options, on the other hand, is a bearish move because the seller stands to gain if the shares do not increase. The earnings of a call seller are restricted to the premium they receive when they sell the calls, in contrast to a call buyer's theoretically unlimited gains.

What is the difference between a call and a put option?

Assets may be sold by sellers under the put option and purchased by buyers under the call option. Financial instruments enable buyers to profit by acquiring assets at a reduced price when their market value increases. The former, on the other hand, enables sellers to offer underlying assets for sale at a specified price in the future, regardless of how much less the stock, bond, commodity, or other asset's present market value is.

What is a real-world call option example?

Assume the price of a share of Microsoft stock is $108. You want to create money in addition to the stock's dividend and possess 100 shares of the company. Additionally, you think that over the following month, shares are unlikely to increase in price above $115 per share.

A 115 call is trading for 37 cents per contract when you look at the call options for the upcoming month. As a result, you sell one call option and receive the $37 premium (37 cents multiplied by 100 shares), which is an annualized income of about 4%.

The option buyer will exercise the option if the stock price climbs above $115, and you will be required to provide the 100 shares of stock for $115 each. You still made $7 in profit per share, but you missed out on any potential gains above $115. You retain the shares and the $37 in premium income if the stock price doesn't increase above $115.