How a price target is defined

A price target is an estimate of the future price of a security. To predict the value of share prices in the future, analysts develop price targets. These are used by some investors in an effort to make better-informed choices regarding when to buy, sell, or hold onto security. Price targets are applicable to all securities, including ordinary stock.

Price targets may increase or decrease depending on the state of various markets. If an analyst raises a stock's price target, it indicates that they anticipate an increase in the share price. They anticipate a decline in share prices if they cut their price goal.

Price targets are only one analyst's view, and they are not always accurate, so it's important to keep that in mind. For this reason, price targets are normally only used by traders as a rough indication of how much stock may or may not be worth.

Typically, earnings per share (EPS), company valuations, historical trends, economic conditions, and competition behavior are taken into consideration when stock brokers and analysts establish price targets.

The analyst's price target is often based on where they believe the stock should trade in the following 12 to 18 months.

Analysts develop price targets using a variety of algorithms for various asset classes. But it’s vital to realize that different investors employ different methods and elements when determining price objectives. As a result, you’ll often see several price objectives for the same asset.

Analyst reports on specific markets or firms typically include price targets. The analyst's buy, sell or hold recommendations for that firm or security are frequently included in those reports.

How do they work?

The value of a specific security's shares can be estimated by traders using price targets.

When determining a price target for an asset, stock analysts take into account a number of distinct variables. An analyst may examine a company's earnings, cash flow, revenue, shareholder dividends, or sales using a quarterly or yearly report.

But it's crucial to keep in mind that a price goal is merely a valuation estimate for an item. When you buy ordinary stock, there is no assurance that the price target will be met.

You frequently see various price targets for the same investment because different analysts consider various aspects of a company's performance when determining a price target.

Factors that determine the price target

The price objective is predicated on forecasts of future supply and demand, technical levels, and fundamentals for an asset. When choosing a price objective, various experts and financial organizations utilize different valuation techniques and take into consideration varied economic situations.

By multiplying the market price by the company's trailing 12-month earnings, fundamental analysts can construct a multiple of the price-to-earnings (P/E) ratio, which they can use to determine a stock's price target.

In some circumstances, especially with volatile stocks, analysts will look for additional guidance to form their price targets. This could include examining a company's balance sheet and other financial statements and comparing them to historical results, current economic conditions, and the competitive environment, assessing the management's effectiveness, and examining other ratios.

Technical analysts use indicators, price action, statistics, trends, and price momentum to forecast a security's future price. They use defined regions of support and resistance to help them determine a price target. A price that travels between at least two comparable highs and lows without crossing over or under those lines at any time in between will be charted by an analyst to achieve this.

How are price targets set on stocks?

The price targets of stocks are determined by some traders using research materials provided by qualified technical analysts. However, you can set your own price targets for a variety of assets. As their price target, some traders select a percentage gain, while others conduct additional research and use formulae to develop their own price targets.

The majority of the approaches used by analysts to determine a stock's target price fall into one of two categories: relative valuation and absolute valuation.

Relative valuation:

Relative valuation establishes the value of a company's shares by comparing it to other businesses in the same industry. Price-to-cash-flow (P/CF), price-to-sales (P/S), price-to-book (P/B), and price-to-earnings (P/E), one of the more popular ways, are examples of relative valuation techniques.

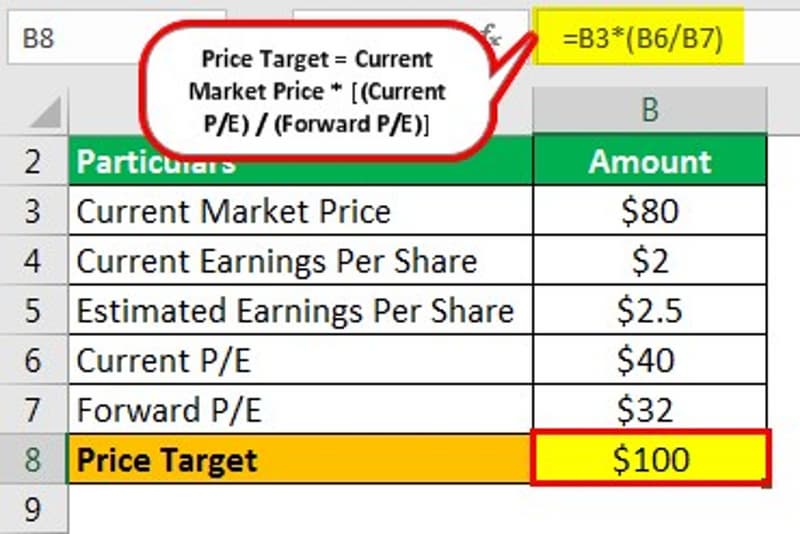

Although analysts are free to use any calculating method they desire, they frequently multiply the present and forward price-to-earnings (PE) ratios of securities to determine price targets.

A PE ratio indicates how much money investors are currently ready to part with for every dollar in profit that a stock makes. By dividing a security's price per share by its earnings per share, you may determine its PE ratio. For illustration, suppose the common stock of a vehicle manufacturer trades for $110 per share and has earned $15.50 each month over the last 12 months.

The current PE ratio is therefore $7.09. This suggests that for every dollar of profitability in that stock, investors are willing to pay $7.09.

PE ratio ($7.09) = Price per share ($110) ÷ Earnings per share ($15.50)

You must figure out the stock's forward PE ratio in order to get your price goal. How much you anticipate the earnings-per-share of a firm to change over the following 12 months is expressed as a forward PE ratio. By dividing the current share price by the anticipated EPS for the following 12 months, you can get the forward PE ratio.

You are now prepared to determine the price goal after determining your forward PE ratio and current PE ratio. The formula for price target that is most frequently employed is:

Price target = Current Price x (Current PE ratio / Forward PE ratio)

Let's return to our earlier example of stock in that sizable publicly traded automaker to more clearly demonstrate what we mean. The current PE ratio, which is 7.09, is known. Let's say you calculated a forward PE ratio of $6.12 based on projected profit growth. You should first divide $7.09 by $6.12. You are now left with 1.16. Finally, multiply the $110 per share market value of your present stock by 1.16.

The price target that remains is $127.60. This price prediction assumes that your stock will be worth $127.60 per share in a year based on historical earnings, the stock price at the moment, and predicted future earnings per share.

Absolute valuation:

Absolute valuation: Most frequently, a discounted cash flow analysis, or DCF analysis, is used to do this. Based on the company's projected future cash flows, the DCF analysis forecasts the current value of a stock. Based on predicted growth rates, an analyst would forecast future cash flows over the following ten years and then indefinitely for this stock study. She would then use a predetermined discount rate to discount all future cash flows to their present value in order to establish the company's value. In theory, you might determine the stock's genuine value by dividing the computed value by the number of shares that are currently trading on the market. An analyst may project a higher target price if the calculated value of the stock is greater than its existing value.

The issue with this approach is how challenging it is to predict future cash flows and growth rates over the course of the organization. The technique necessitates extensive investigation of the company's past cash flow and growth as well as knowledge of the business' cyclical nature. For instance, an analyst may assign an unusually high growth rate for the first five years of the DCF study if the company in question is young and expanding quickly. If the business is more developed and has already gone through its high growth phase, this can appear different. It goes without saying that the analyst has a lot of choices over a number of crucial factors.

How accurate are price targets that analysts set?

When an analyst sets a price target, that objective is often a prediction of what they think the stock's future fair value will be. A price goal, however well-informed that estimate may be, is still simply a best-guess prediction of what will happen in the future. That doesn't guarantee it will occur.

Price targets are normally calculated by multiplying your current stock price by your forward PE ratio and dividing your current PE ratio by your ahead PE ratio. Nobody is certain of the forward PE ratio's actual value, which makes this situation hard. This is due to the fact that it indicates the EPS that security will have produced in a year.

The most likely projection a technical analyst can make is based only on looking at previous earnings, economic trends, and other company data.

As a result, the actual market price of a stock—i.e., the price it is actually trading at—might not necessarily coincide with the analyst's established price objective. As a result, analysts frequently release updated price estimates on a regular basis as new information becomes available or if market data significantly shifts.

How frequently do stocks reach their price objectives?

Since price objectives are predictions for the future, equities rarely reach them. Although a security's price may appear to be in an uptrend or decline, things can change very fast.

The target price of a stock may have been determined by a technical analyst without taking into account a variety of circumstances, hence targets are typically just used as a general reference for traders.

Only 30% of the 12-month predictions turned out to be fairly accurate, according to a 2012 study by the University of Waterloo and Boston College that examined price targets set by 11,000 experts in 41 countries. Only 18% of stocks reach their three-month price target when looking at short-term price targets.

The final verdict

The target price of a stock is a wonderful indicator of how Wall Street perceives a certain business and its prospects going forward. The target price of a stock can be calculated by analysts using a variety of techniques, but each one requires making some informed assumptions. In the end, it is crucial to conduct thorough research before determining whether to purchase, sell, or keep a stock; examining a stock's target price is simply one component of this process.

FAQ

How accurate are price targets?

Despite analysts' best efforts, a price target is still a guess because analysts’ expectations vary depending on how they predict future performance. Studies have shown that historically, the overall accuracy rate is roughly 30%. Price goals can, nevertheless, influence investor sentiment, particularly if they come from reputable analysts.

Where can you find price targets of stocks?

In research reports on particular firms, analysts typically include their price goals along with buy, sell, and hold recommendations for the shares of the company. Financial news outlets frequently quote stock price targets.

Where can I find today’s price target?

There are many internet sources that are well checking out if you're looking for the most recent analyst price targets and stock ratings.

Many technical analysts write daily or weekly updates about markets like the NYSE, indices like the Nasdaq or the Dow Jones, or what they consider to be the best stocks to trade right now. Then, analysts establish price estimates and provide justifications for them. Buy ratings and sell ratings are frequently included in analyst reports.

You can also check out popular financial websites like CNN Business or the Markets section of the Wall Street Journal. These websites frequently collect daily data from various analysts to provide you with a broad market consensus on the target price.

Analyst price targets are rarely a good indicator of how a company will move in the future. They are only hunches. Investing is risky by nature. Keep your investment goals in mind at all times.

What is the general time frame for a price target?

Any time span is acceptable for a pricing target. Because stock brokers or analysts set their own price goals for individual equities, they are free to anticipate how long it will take for those stocks to rise to their projected value.

Typically, price targets are set for either 12 or 18 months.

What special considerations should you keep in mind with price targets?

When the trade's predicted value has been realized, traders typically try to cut their losses on a stock. Price targets can aid traders in determining when to buy or sell a stock, but traders should set their own price targets before initiating and closing out positions.

The underlying presumptions of experts' price targets are not always clear to individual investors. Investors should only utilize analysts' price predictions and recommendations as one component of their due diligence process, which may also involve looking at a company's financials and regulatory filings.