A definition of Insider Trading

The practice of purchasing or selling stocks or other securities based on knowledge that is not public information is known as insider trading. It entails a clear breach of trust or another trust-related offense. In these situations, the trader makes money by using inside information. Important regulations intended to make the market equitable for all participants are broken by this.

Insider trading has been engaged in numerous high-profile cases over the years, yet many people are still unclear about what it is.

When a trade is made based on "material" knowledge that is not made public, this is known as insider trading. Any fact that might have an impact on a company's stock price is referred to in the market as material information. Legally speaking, it's any knowledge that, if known, might influence whether to buy or sell something.

These details give the investor a competitive advantage when purchasing or selling shares. Because so few people possess the edge, it results in an unfair advantage.

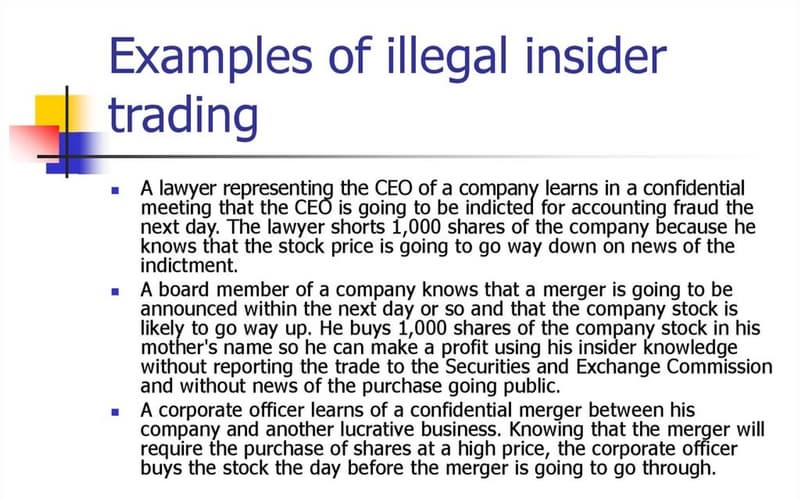

The trader must typically be someone who has a fiduciary duty to another individual, group, corporation, partnership, firm, or other entity. These obligations apply to a wide variety of market participants, including brokers and other agents who execute deals on a client's behalf. If you buy or sell shares based on information that no one else has access to when you have a fiduciary duty to someone else, you could get into trouble.

How does Insider Trading work?

A person can earn or prevent a loss thanks to insider knowledge. Either way, it amounts to an abuse of that person's expertise or authority.

Because it provides an unfair advantage, it is unlawful. Investors that are "in the know" stand a better chance of profiting. Others who don't have access to these insider secrets aren't afforded the same chance.

Corporate officers, employees, and government officials are among those who have been prosecuted for insider trading and found guilty. Anyone who gives away insider information to another individual might likewise be charged and found guilty.

In situations where there is no fiduciary duty, insider trading is nevertheless possible. In these situations, the crime frequently comes to light as a result of a previous crime. Corporate espionage may be one of these crimes. A financial or legal institution may be used by an organized crime ring to access confidential data. If discovered, anyone involved may be charged with insider trading. They might also be found guilty of additional, connected offenses.

Insider trading is not always prohibited. The Securities and Exchange Commission (SEC) considers a variety of elements before charging someone with insider trading. The SEC must primarily demonstrate that:

The defendant intended to personally benefit from buying or selling shares based on inside information while having a fiduciary duty to the corporation.

Insider Trading history

The reputation of insider trading wasn't always awful. In the early 20th century, it wasn't illegal and wasn't even frowned upon. In fact, it was previously described as a "benefit" of being an executive in a Supreme Court decision.

Following the 1929 stock market crash and the Great Depression, trading methods came under increased scrutiny. Insider trading was weakened by a variety of legal decisions and regulations, some of which even imposed harsh penalties on individuals who engaged in the practice. There wasn't a governing body in charge of formulating actual laws regarding the matter until 1934 when the SEC was established and the Securities Exchange Act was passed.

The Act neither outright prohibited insider trading nor did it define it, but the SEC was able to make a number of specific behaviors illegal through a set of regulations. A rule was adopted to extend to purchases in addition to sales since any fraud committed during the sale of stock was prohibited by law. The result was a patchwork of rules that were challenging to follow. As a result, the SEC's ability to enforce the rules was constrained.

That has changed since then. According to the SEC, hundreds of individuals and financial experts, including lawyers, company executives, and hedge fund managers, have been accused of engaging in insider trading.

Insider Trading examples

Martha Stewart

Other people outside just corporate directors could also be found guilty of insider trading. For her involvement in the 2001 ImClone case, Martha Stewart was charged by the SEC in 2003 with securities fraud, including insider trading, and obstructing the course of justice.

Based on information from Merrill Lynch broker Peter Bacanovic, Stewart sold over 4,000 shares of biotech business ImClone Systems. After Samuel Waksal, the CEO of ImClone Systems, liquidated all of his firm stock, Bacanovic gave him a tip. This occurred at the same time that ImClone was awaiting word from the Food and Drug Administration (FDA) regarding the approval of their cancer therapy, Erbitux.

ImClone's medication was denied by the FDA shortly after these sales, which led to a 16% drop in share price in one day. Stewart's early sale prevented her from suffering a $45,673 loss. However, the sale was conducted as a result of a tip she had regarding Waksal selling his shares; this information was not generally known. Following a 2004 trial, Stewart was charged with lesser offenses including obstruction of justice, conspiracy, and lying to federal agents. Stewart spent five months in a prison run by the federal government.

Amazon

Brett Kennedy, a former financial analyst for Amazon.com Inc. (AMZN), was accused of insider trading in September 2017. Authorities assert that prior to the announcement, Kennedy provided fellow University of Washington alumnus Maziar Rezakhani with information on Amazon's first-quarter 2015 financial results. Rezakhani paid Kennedy $10,000 in exchange for the data. According to the SEC, Rezakhani profited $115,997 trading Amazon shares after receiving a tip from Kennedy in a related case.

Is Insider Trading considered illegal?

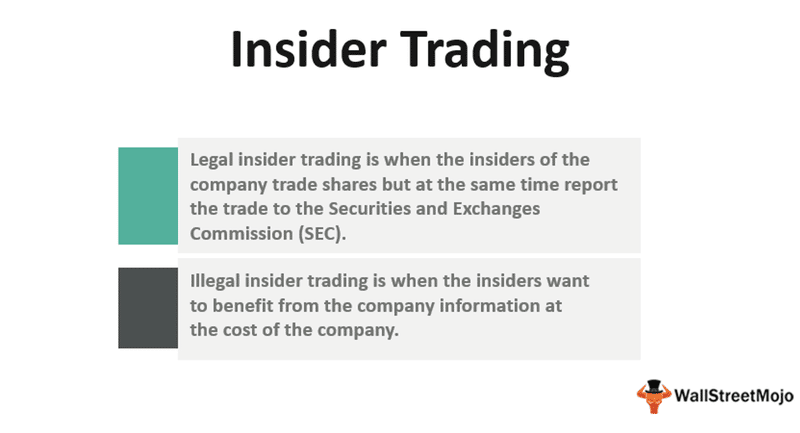

Even while the phrase "insider trading" is typically used negatively, not all insider trading is prohibited. People working for firms and associated with their business operations frequently buy and sell shares in those companies, all within the Securities and Exchange Commission's proper disclosure and supervision (SEC). Additionally, it is not unlawful to just have knowledge of a firm. However, misappropriating this non-public information could constitute utilizing confidential information to obtain an edge over the competition, which is prohibited.

Anyone who has important information about a company that is not available to the general public is considered an insider. The executives, board members, and significant proprietors of a corporation are most frequently mentioned in this context. However, it also covers accountants, attorneys, and anybody else who has knowledge that could alter a company's market value.

It is not necessarily forbidden for insiders to purchase and sell stock in their own firms. However, the SEC must be informed of their trades.

There is nothing wrong, for instance, if a company's CFO decides to sell some of its stock to pay for its child's college tuition. However, selling the stock immediately before the release of the quarterly report would probably be against the law if the CFO knows that the company failed its earnings target. The SEC would probably look into the transaction and decide whether to press accusations of insider trading or not.

It would also be unlawful for the CFO to pass on knowledge about the disappointing earnings report to their relative, friend, hairdresser, or an arbitrary individual on the metro. Insider trading can occur even if a person is not an insider. A person can be found guilty of insider trading if they engage in trading for their own benefit based on inside information. When a person with a fiduciary duty, such as an employee at a legal firm, learns information about the corporation, this is frequently the case. They risk going to jail if they are found to have violated their fiduciary obligation by using this information to trade business shares.

How is Insider Trading illegal?

The Securities Exchange Act of 1934 formally made trading based on insider information unlawful. The phrase pertaining to securities fraud can be found in Section 10 of that statute. By enacting Rule 10b-5, which broadens the definition to include buying stocks, the SEC further clarified the law.

Some types of insider trading, however, have always been prohibited under common law. The U.S. Supreme Court declared in 1909 that a corporate director may not sell stock to a person without informing them of a forthcoming action that would reduce the stock's value. The highest court ruled in Strong v. Repide that such behavior constituted fraud and deceit under common law.

Why is Insider Trading illegal?

Maintaining equity in the securities markets is one of the Securities and Exchange Commission's (SEC) objectives. People who possess inside knowledge have a competitive advantage over other merchants if they are able to act on that knowledge. "Protect investors, maintain fair, orderly, and efficient markets, and enable capital formation" is the SEC's stated objective.

Imagine spending hours reading, calculating, and creating financial models. Based on all available facts, that person decides whether to buy or sell a stock. An accountant at the company in question is friends with another person. This person receives a tip regarding the business's profits after playing a game of tennis. This second individual, who hasn't done any investigation, is more knowledgeable about the upcoming direction of the share price movement.

The same is true for someone who works for a brokerage and may learn knowledge that other traders do not. Or consider a government official selling short stock in a business right before denying permission. Based on asymmetric information, a person could profit in a variety of ways. That doesn't seem like a fair arrangement to the majority of investors. One of the SEC's primary responsibilities is the investigation and suppression of insider trading.

Insider Trading vs. Insider Information

A person with a connection to a company's business activities has access to information that the general public does not. Since criminal insider trading doesn't occur unless insider information is used to create a profit or prevent a loss, this non-public information is only important if disclosing it will alter the market's perception of the company's value.

Insider trading carries a bad reputation. However, insider trading happens any time a firm employee purchases or sells company stock. Trading by insiders is acceptable as long as it is properly stated and does not involve the use of insider information to boost profits or minimize losses. Insider trading, on the other hand, is when a trader uses inside information to an advantage over other traders.

When is Insider Trading legal?

The most effective way to prevent insider trading is to outlaw any trades made by corporate officers within their own organization. However, even this does not cover all scenarios. Families of CEOs would also need to be covered by the ban. Friends, family members of friends, and even casual acquaintances could still use non-public information acquired from these executives, even in that case.

Additionally, it's possible that a company's owners are privy to information regarding the direction of the business that is not known to others. However, prohibiting the selling of equity in a corporation would contradict the stock market's fundamental tenets.

Traders must continually assess the information's reliability and evaluate it from a variety of sources. Some people have claimed that there shouldn't be any insider trading rules, including the late economist Milton Freidman. He believed that enabling insider trading would speed up the public disclosure of information, which he considered to be a good thing.

Others contend that oversight can assist stop widespread deception and fraud that undermines the marketplace's fairness. By creating a stock sale plan and submitting it to the SEC, insiders can defend themselves from claims of unjustified insider trading.

For instance, a chief executive officer (CEO) who is about to retire might have a schedule in place for exercising their stock options over the course of several years. They can make the public aware of that plan to defend themselves. The plan can then aid in defending against charges of insider trading if a transaction occurs to fall in line with a significant market event.

FAQ

Does the term “insider trading” have a negative connotation?

Due to the perception that it is unfair to the typical investor, the term "insider trading" generally carries a negative connotation. Insider trading basically refers to the act of someone who has material, non-public information about a stock of a publicly traded company trading in that stock. Depending on whether insider trading complies with SEC regulations, it may be legal or illegal.

When is insider trading considered legal?

Weekly legal insider trading takes place on the stock market. The attempt of the SEC to keep a fair marketplace exists at the root of the legality issue. Basically, as long as they notify the SEC of these trades promptly, it is permissible for corporate insiders to trade company shares. The Securities Exchange Act of 1934 marked the beginning of the legal disclosure of stock-related transactions. Directors and significant stockholders, for instance, are required to report their holdings, transactions, and ownership changes.

Insider trading – what are the penalties?

Trading on the basis of significant non-public knowledge is prohibited by SEC regulation 17 CFR 240.10b5-1, also known as rule 10b5-1. If this law is broken, there may be both criminal and civil repercussions. By using insider information, the individual could face fines of up to $5 million, or three times their gains or losses. Additionally, they risk receiving a criminal penalty that might range from probation to 20 years in jail. For violations of insider trading, corporations are also subject to fines of up to $25 million.

What is a notable example of insider trading?

U.S. vs. O'Hagan

In 1988, James O'Hagan worked as a lawyer with Dorsey & Whitney. Grand Metropolitan PLC, which intended to launch a tender offer for Pillsbury, was first represented by the firm. With this information, O'Hagan purchased a sizable number of stock options in the company. He anticipated that once the tender offer was made public, the value of the options would skyrocket. Later, at the right time, he sold his options. He made 4.3 million dollars.

Based on the information that was unavailable to the general public, he decided to buy the options. He did this without telling his company. On 57 counts, he was convicted. On appeal, however, his conviction was reversed.

What does insider trading mean for investors?

Penalties for insider trading frequently include fines and jail time. The result can be either, but it frequently comprises both. The severity of the case determines the specific punishment.

There could be additional outcomes to a case. These can be either professional or financial, or frequently both. The SEC has taken action to prohibit persons who engage in illegal trading from holding board positions with publicly traded businesses.