Defining a hedge fund

A hedge fund is a limited partnership of private investors whose capital is managed by experienced fund managers. These managers employ a variety of tactics, such as borrowing money or trading in non-traditional assets, to generate returns on investments that are higher than average.

Investment in hedge funds is frequently viewed as a dangerous alternative investment option since it typically has a high minimum investment requirement or net worth requirement and frequently targets wealthy clientele.

Understanding hedge funds

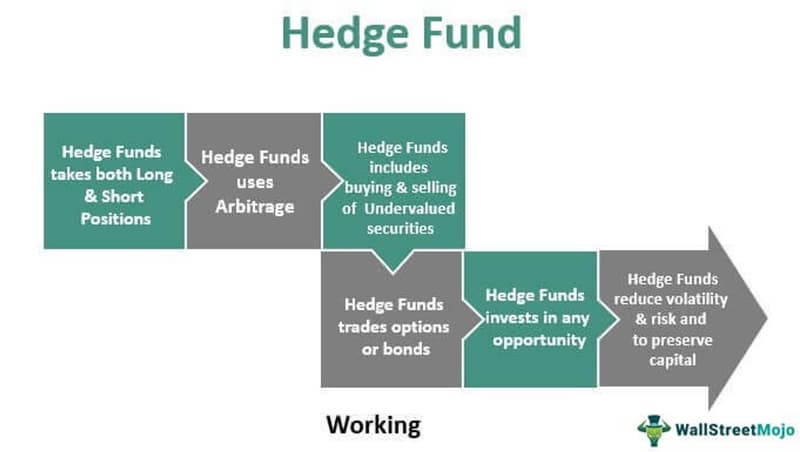

By investing a portion of the fund's assets in the opposite direction of the fund's primary objective, the manager of the fund frequently creates a hedged bet to counter any losses in the fund's core holdings.

In order to use the returns of the non-cyclical companies to make up for any losses in the cyclical stocks, a hedge fund that concentrates on a cyclical industry, such as travel, may invest a portion of its assets in the non-cyclical sector, such as energy.

Hedge funds invest in derivatives like options and futures, employ riskier techniques, and leverage their holdings. The reputation of their managers in the exclusive world of hedge fund investing is a major draw for many hedge funds.

A hedge fund investor is typically thought of as an accredited investor, which necessitates a minimum level of income or assets. Institutional investors like pension funds, insurance firms, and affluent people are typical investors.

Hedge fund investments are regarded as illiquid since the lock-up period, or the requirement that investors retain their money in the fund for at least a year makes them common. Additionally, withdrawals might only be permitted occasionally, like every quarter or every two years.

The types of hedge funds

Hedge funds focus on carefully chosen investments and security pools that are poised for rewards. The following four hedge fund subtypes are typical:

- Global macro hedge funds are actively managed investment vehicles that aim to make money from significant market fluctuations brought on by political or economic events.

- A worldwide or country-specific equity hedge fund may invest in profitable stocks while protecting itself against equity market declines by selling short overvalued equities or stock indices.

- By utilizing price or spread inefficiencies, a relative value hedge fund looks to profit from brief variations in the prices of comparable securities.

- An activist hedge fund invests in firms with the intention of increasing the stock price by demanding that expenses be reduced, assets are reorganized, or the board of directors is replaced.

What are some of the popular hedge fund strategies?

These are some of the most well-liked hedge fund strategies:

- Long/Short Equity: Long/Short equity generates profits by taking advantage of projected price movements that could go either up or down. This technique sells short equities that are seen to be expensive and buys long positions in stocks that are believed to be relatively underpriced.

- Equity Market Neutral (EMN): An investing strategy where the manager tries to take advantage of price variations in equities by holding an equal number of long and short positions in closely linked stocks is known as equity market neutral (EMN). These companies could belong to the same sector, industry, or nation, or they could just have similar traits in common, like market capitalization, that have a strong historical correlation. Regardless of whether the market as a whole is bullish or bearish, EMN funds are designed to provide good returns.

- Merger Arbitrage: In order to generate risk-free gains, merger arbitrage, also known as risk arb, entails simultaneously buying and selling the stocks of two merging companies. A merger arbitrageur assesses the likelihood that a merger won't close on schedule or at all.

- Global Macro: A global macro strategy based its holdings mostly on the general political and economic ideologies of different nations or on those nations' macroeconomic tenets. Long and short positions in the equity, fixed income, currency, commodities, and futures markets are examples of possible holdings.

- Volatility Arbitrage: This strategy aims to make money from the discrepancy between an asset's expected future price volatility and the implied volatility of options based on that asset. An example of an asset would be a stock. Additionally, it can be looking for volatility spreads to broaden or contract to expected levels. Options and other derivative contracts are used in this method.

- Convertible Bond Arbitrage: Convertible bond arbitrage entails holding long and short positions in the underlying stock and a convertible bond at the same time. By properly hedging his long and short bets, the arbitrageur expects to benefit from market volatility.

The fund-of-funds technique, which combines and contrasts various hedge funds and pooled investment vehicles, is another well-liked tactic. This combination of asset classes and investing methods attempts to deliver a more consistent long-term investment return than any of the individual funds. The combination of underlying techniques and funds can be used to manage returns, risk, and volatility.

Hedge funds – how do they make money?

Through his business, A.W. Jones & Co., Australian financier Alfred Winslow Jones is credited with founding the first hedge fund in 1949. He raised $100,000 to create a fund he called the long/short equities model, which sought to use short selling to reduce the risk associated with long-term stock investing.

Jones became the first money manager to combine short selling, the use of leverage, and a reward structure based on performance in 1952 when he changed his fund into a limited partnership and introduced a 20% incentive fee as compensation for the managing partner.

The typical "2 and 20" fee structure used by hedge funds nowadays consists of a 20% performance fee and a 2% management charge.

The management fee is determined by the net asset value of each investor's shares; as a result, a $1 million investment would result in a $20,000 management fee for that year, which would be used to fund the hedge's operations and pay the fund manager.

The performance fee typically represents 20% of earnings. A fee of $40,000 is due to the fund if a $1 million investment grows to $1.2 million in a year.

The features and objectives of hedge funds

The market direction neutrality of most mutual funds is a recurring theme. Hedge fund management teams are more like traders than traditional investors because they anticipate making money regardless of market movements. More than others, some mutual funds use these strategies, however not all mutual funds really engage in hedging.

Hedge funds differ from conventional pooled assets in a number of significant ways, most notably in terms of their restricted access to investors.

Investors who are accredited or qualified

Investors in hedge funds must normally have a net worth of at least $1 million or a yearly income of over $200,000 for the two years prior.

Investors in hedge funds must have a net worth of at least $1 million.

Greater Investment Flexibility

The only restriction on a hedge fund's investment universe is its mandate. Any asset, including land, real estate, derivatives, currencies, and other alternative assets, can be purchased by a hedge fund. Contrarily, mutual funds typically have to adhere to stocks or bonds.

Frequently Use Leverage

As was shown during the Great Recession, hedge funds frequently employ leverage or borrowed money to boost their returns, possibly exposing them to a much wider variety of investment risks. Due to their high levels of leverage and increased exposure to CDOs, hedge funds were particularly badly affected during the subprime crash.

Fee Structure

Hedge funds charge both a performance fee and an expense ratio. The typical fee arrangement is referred to as two and twenty (2 and 20) and consists of a 2% asset management fee and a 20% share of gains realized.

Hedge funds have a number of other distinct traits, but since they are private investment vehicles only available to affluent investors, they may essentially do whatever they want—as long as they are transparent with investors about their approach.

It may seem highly perilous to go to such a large latitude, and it certainly can be. Hedge funds have been a part of some of the most dramatic financial disasters. Having said that, the flexibility given to hedge funds has allowed some of the best money managers to produce some incredible long-term returns.

Two and Twenty Structure

The other component of the manager compensation scheme—the 2 and 20—which is utilized by the vast majority of hedge funds—receives the most criticism.

The 2 and 20 pay structure, as previously established, provides the hedge fund manager with 2% of assets and 20% of profits annually. It's the 2% that get criticism, and it's easy to understand why. The hedge fund manager still receives a 2% AUM fee even if he loses money. A manager who is in charge of a $1 billion fund may earn $20 million annually without doing anything. Even worse is the fund manager who keeps $20 million while losing money on his fund. After that, they must justify why account values dropped even though they received $20 million. It's a hard sell, and it typically fails.

In the hypothetical case mentioned above, the fund did not charge an asset management fee but rather took a larger performance cut (25% as opposed to 20%). As a result, a hedge fund manager has the chance to increase his or her wealth, working with rather than against the fund's investors. In the world of hedge funds today, this no-asset-management-fee structure is unfortunately uncommon. Even while many funds are beginning to switch to a 1 and 20 configuration, the 2 and 20 structure still predominates.

Benefits of hedge funds

Compared to conventional investment funds, hedge funds have certain valuable advantages. Hedge fund advantages worth noting include:

- Strategies for investing that can produce profits in both soaring and tumbling share and bond markets

- The decrease in volatility and overall risk of portfolios in balanced portfolios

- A boost in returns

- A wide range of investment types enables investors to exactly tailor their investment plan

- Access to some of the most skilled investment managers worldwide

Pros

- Profits in both booming and tumbling markets

- Balanced portfolios reduce volatility and risk.

- There are various investment types available.

- Top investment managers oversee

Drawbacks of hedge funds

Of course, there is risk associated with hedge funds as well:

- They run the risk of suffering substantial losses when they choose concentrated investment strategies.

- Compared to mutual funds, hedge funds are frequently far less liquid.

- Investors are often required to place their money in a lockbox for several years.

- Leveraging or borrowing money can make a loss that would have been very small into a substantial loss.

Mutual fund vs. Hedge fund

Hedge funds are distinct from mutual funds, and they are not subject to the Securities and Exchange Commission's (SEC) the same level of tight regulation.

Mutual funds, which are accessible to the general public and average investors, are a practical and cost-effective solution to create a diversified portfolio of stocks, bonds, or short-term investments.

Only accredited investors—those with an annual income above $200,000 or a net worth surpassing $1 million, minus their primary residence—can contribute money to hedge funds. These investors are thought to be capable of managing the possible risks that hedge funds are allowed to incur.

While mutual funds utilize stocks or bonds as their instruments for long-term investment plans, hedge funds can invest in real estate, stocks, derivatives, and currencies.

Hedge funds often restrict possibilities to redeem shares and frequently impose a locked period of one year before shares can be paid in, in contrast to mutual funds where an investor can choose to sell shares at any time.

The 2% management fee and 20% performance fee structure is used by hedge funds. For the typical investor, the expense ratio for all mutual funds and exchange-traded funds in 2021 was 0.40%.

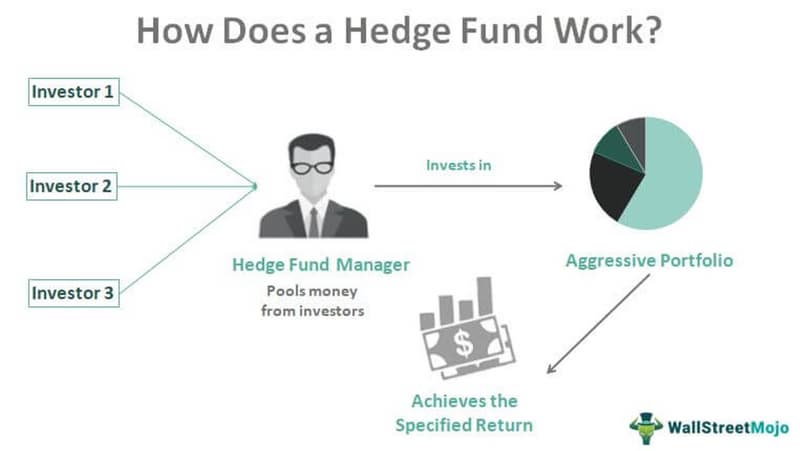

Hedge funds and their partnerships

The goals of a hedge fund are to reduce risk and increase investment profits. There are some similarities between this structure and these goals and mutual funds, but that's about it. Compared to mutual funds, hedge funds are typically thought to be more aggressive, riskier, and exclusive. In a hedge fund, the general partner runs the fund in accordance with its strategy while the limited partners provide funding for the assets.

The use of trading strategies that fund managers are allowed to utilize gives hedge funds their name. Managers can protect themselves in line with the goal of these vehicles to generate money by buying long (if they anticipate a market rise) or selling short (if they anticipate a market collapse) equities (if they anticipate a drop). Even though hedging tactics are used to lower risk, most people believe that these actions come with higher dangers.

When well-known money managers left the mutual fund business in the 1990s in search of fame and wealth as hedge fund managers, hedge funds took off. According to the 2019 Preqin Global Hedge Fund Report, the business has expanded significantly since that time, with total assets under management (AUM) being valued at more than $3.25 trillion.

Additionally, there are more active hedge funds now. In the United States in 2021, there will be 3,635 hedge funds, a 2.5% increase from 2020.

Looking back at the original hedge fund

The first hedge fund was established in 1949 by Alfred Winslow Jones, a former writer and sociologist, and his business, A.W. Jones & Co. When Jones was writing an article about financial patterns earlier that year, he was motivated to give money management a try. By shorting other stocks, he aimed to reduce the risk associated with owning long-term stock investments while raising $100,000 (including $40,000 from his own pocket).

The traditional long/short stocks paradigm is the name given today to this breakthrough in investing. Jones used leverage as well to increase returns. He changed the investment vehicle's organizational design in 1952, changing it from a general partnership to a limited partnership and adding a 20% incentive fee as the managing partner's pay. Jones cemented his status as the father of the hedge fund by becoming the first money manager to combine short selling, the use of leverage, shared risk through a partnership with other investors, and a reward structure based on investment success.

Hedge fund examples

The most well-known hedge funds as of 2022 include:

- With a 55-year history and more than $50 billion in assets under management, Elliot Management Corporation (AUM). Its main investments are in the energy industry.

- With an AUM of more than $235 billion and a rate of return of 32% for the first half of 2022, Bridgewater Associates is a market leader on a worldwide scale.

- The Man Group's key objective is a responsible investment, which it achieves through the compliance of its funds with environmental, social, and governance ESG investing goals. It offers a variety of long/short equity funds, private market funds, real estate funds, multi-asset funds, and fixed funds.

Hedge funds and regulations

Compared to other types of investment vehicles, hedge funds are subject to less oversight from the Securities and Exchange Commission (SEC). That's because high-net-worth individuals who satisfy the above-mentioned net worth requirements are the main sources of funding for hedge funds, often known as accredited or qualified investors. U.S. securities regulations require that at least a majority of hedge fund participants be qualified, even though some funds operate with non-accredited investors. The SEC exempts hedge funds from the same regulatory scrutiny because it believes that they are wealthy and smart enough to comprehend and manage the possible risks associated with their broader investment mandate and techniques.

However, hedge funds have grown to be so significant and strong that the SEC is beginning to pay more attention. According to most estimates, thousands of hedge funds are active today, managing more than $1 trillion in assets. Additionally, activity regulators are cracking down hard as violations like insider trading happen more regularly.

Factors to consider

Investors frequently take into account the size of the fund or business, its track record and longevity, the minimum investment necessary to participate, and the fund's redemption terms while conducting research to find hedge funds that suit their investing objectives.

When choosing to invest in a hedge fund, investors should additionally consider the following, according to the SEC:

- Read the paperwork and agreements of the hedge fund to learn more about investing in the fund, the fund's tactics, the fund's location, and the dangers associated with the investment.

- Recognize the level of risk associated with the investment strategies used by the fund and how it relates to your own investment objectives, time horizons, and risk tolerance.

- Find out if the fund is using speculative or leveraged investment strategies, which often involve using both the capital of the investors and borrowed funds to make investments.

- Examine any potential conflicts of interest that hedge fund managers have reported, and look into the history and reputation of the managers.

- Knowing how a fund's assets are valued is important because hedge funds sometimes invest in extremely illiquid securities, and manager fees are influenced by how a fund's assets are valued.

- Recognize the methods used to calculate a fund's performance and whether it takes into account the cash or assets the fund has received as opposed to the manager's estimation of the value change.

- Recognize any restrictions on the amount of time you have to redeem your shares.

In conclusion

Investment in hedge funds is regarded as a dangerous alternative commitment option and necessitates a high minimum investment from certified investors or net worth. Investing in debt and equity securities, commodities, currencies, derivatives, and real estate are all part of hedge fund strategies. Hedge funds are subject to lax SEC regulation and are compensated through a 20% performance fee and 2% management fee structure.

FAQ

What tools can investors use to compare hedge fund performances?

Investors compare funds using the annualized rate of return to identify those with high predicted returns. An investor can find a universe of funds employing a similar approach by using analytical software like Morningstar to define rules for a certain strategy.

Can hedge funds be compared with other investments?

Mutual funds, exchange-traded funds (ETFs), and hedge funds are all collections of money donated by numerous investors with the goal of making money for both themselves and their clients.

Hedge funds are actively managed by professionals that buy and sell specific investments with the declared goal of outperforming market returns or the returns of a particular market sector or index. Hedge funds seek the highest possible profits while taking the biggest risks to doing so. They are less strictly regulated than similar products and have the freedom to invest in esoteric investments like options and derivatives that mutual funds cannot.

Why do people consider investing in hedge funds?

A wealthy investor with the means to diversify into a hedge fund may be drawn to it because of the manager's reputation, the particular assets in which it is invested, or the innovative approach it uses.

What significant hedge fund regulatory change occurred recently?

After the Jumpstart Our Business Startups Act (JOBS) was enacted in April 2012, the hedge fund sector underwent one of the most major regulatory changes. The JOBS Act's fundamental goal was to promote small business financing in the United States by relaxing securities regulations.

Hedge funds were significantly impacted by the JOBS Act as well. The restriction on hedge fund advertising was repealed in September 2013. Hedge funds can still only accept contributions from authorized investors, but the SEC has granted a motion to loosen the restrictions on their ability to advertise. By widening the pool of accessible investment money, allowing hedge funds the chance to solicit would in fact aid small business growth.

What are notable hedge funds to keep in mind?

Today's notable hedge funds include Renaissance Technologies, which was established by Jim Simons, a mathematical prodigy. Renaissance focuses on systematic trading utilizing mathematical and statistically developed quantitative models. The Wall Street Journal special contributor Gregory Zuckerman claims that Renaissance has generated 66% yearly profits on average since 1988 (39% net of costs).