ESG Investing – What is it?

Environmental, social, and governance (ESG) investing, sometimes referred to as "socially responsible investing," "impact investing," and "sustainable investing," is the practice of prioritizing the best ESG aspects or outcomes. ESG investing is frequently referred to as a method of investing "sustainably"—where investments are made while taking into account the economy, the environment, and human welfare. It is founded on the expanding premise that environmental and social concerns have an increasing impact on an organization's financial performance.

ESG investing's guiding ideas are not novel. Investment choices were affected by religious and moral convictions hundreds of years ago. Muslims created investments that abided by Sharia law, which forbade the use of weapons. Quakers and Methodists created the first ethical unit trusts in the UK and the US. Investor awareness of ethical market participation has grown as corporate social responsibility (CSR) and social sustainability have gained in popularity today. Following the publication of the Principles for Responsible Investments (PRI) in 2006—a collection of United Nations principles for the adoption of ESG considerations into business policy and strategy—ESG investing may have formally entered the mainstream of investment debate. 5 The PRI, which has more than 2,000 signatories, is widely regarded as the official reference point for everything related to ESG investment.

How does ESG Investing work?

Investors have recently shown a willingness to put their money where their principles are.

As a result, exchange-traded funds (ETFs) and other financial products that adhere to ESG investing principles are now being offered by brokerage firms and mutual fund providers. Robo-advisors like Betterment and Wealthfront have urged younger people to invest in these ESG-themed services.

Large institutional investors like public pension funds, who make significant investment decisions, are increasingly influenced by ESG investors. Investors had $17.1 trillion in assets chosen in accordance with ESG principles in 2020, up from $12 trillion just two years earlier, according to a US SIF Foundation industry analysis. ESG-specific mutual funds and ETFs also hit a record $400 billion in AUM in 2021, up 33% from the previous year. This growth is anticipated to be accelerated in the years to come.

ESG investments are often referred to as impact investments, sustainable investments, and responsible investments (SRI). Investors analyze a company's performance in terms of ESG using a variety of methods and regulations.

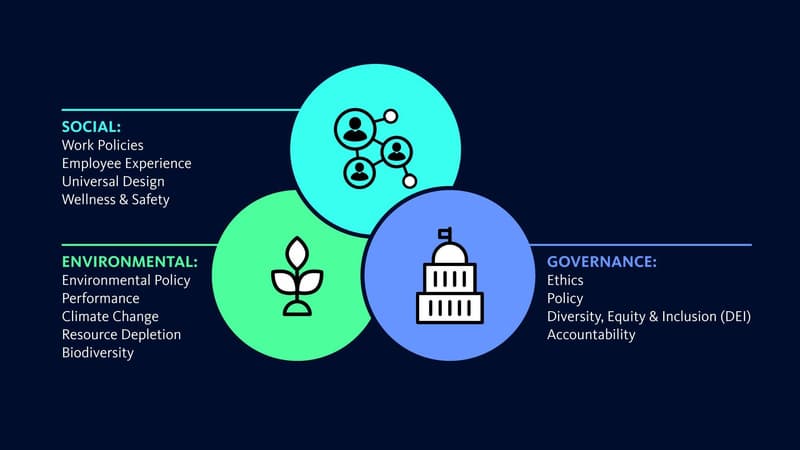

Environmental

Corporate climate policies, energy use, waste disposal, pollution, protection of natural resources, and treatment of animals are a few examples of environmental concerns. ESG factors can also be used to assess any potential environmental concerns a business may face and how it is addressing those risks.

There are many factors to consider, including direct and indirect greenhouse gas emissions, the management of toxic waste, and compliance with environmental regulations.

According to a report by the U.N. Intergovernmental Panel on Climate Change, human activity is unmistakably to blame for the planet's warming and some types of climate change are now irreversible. In order to prevent coal and other fossil fuels from destroying our world, UN Secretary-General António Guterres declared that this report "must sound the death knell for them."

Social

The company's interactions with both internal and external stakeholders are examined in social aspects.

Does it hold its suppliers to its own ESG standards? Does the company encourage employees to volunteer in the area or give a portion of its profits there? Do working circumstances show great regard for the health and safety of employees? Or does the company unethically exploit its customers?

This particular aspect of ESG is highlighted by the investment strategy known as socially responsible investing (SRI). In addition to battling against racial, gender, and sexual discrimination, SRI investors look for businesses that support moral and socially conscious ideals like diversity, inclusiveness, community focus, social justice, and corporate ethics.

Governance

ESG governance principles ensure that a company uses accurate and transparent accounting procedures, chooses its executives with integrity and diversity in mind, and is accountable to shareholders.

ESG investors could demand guarantees that businesses don't choose board members and top executives who have conflicts of interest, don't utilize political donations to get special treatment, or don't engage in criminal activity.

ESG Investing – the boom

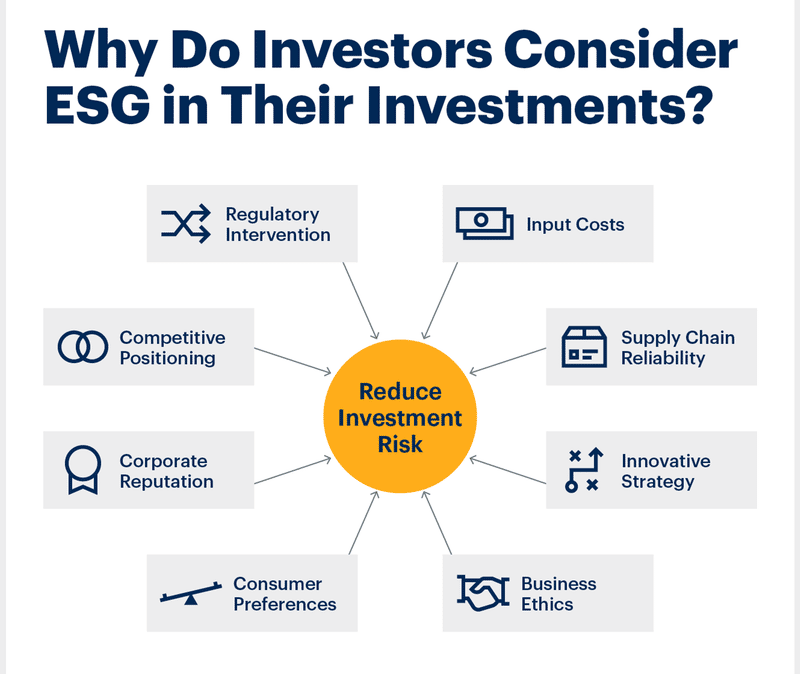

ESG investing has significantly increased over the past few years due to a growing awareness among businesses and individuals of the connections between social, environmental, and economic challenges. This pattern was noticeably influenced by the COVID-19 epidemic. Many investors turned to ESG funds for greater resilience when the pandemic in 2020 created market disruption and anxiety. In fact, $45.6 billion USD flowed into these funds globally in the first three months of 2020. Globally, there are $30.7 trillion in sustainable investment funds, and in the next 20 years, it's expected that the number will increase to over $50 trillion. More investors are trying to support businesses and goods that support and promote sustainability and adhere to new laws like those governing climate change. Due to their durability against typical market shocks, ESG funds have experienced steadily higher returns on investing in response to this demand, which has led to more corporate world action on ESG concerns. ESG and sustainability-focused portfolios usually outperform conventional portfolios over the long run. For instance, the US financial services company Morningstar discovered that, over a ten-year period, 80% of blend equity funds that invest sustainably outperformed conventional funds. In addition, they discovered that 77% of ESG funds that were around ten years ago are still around, as opposed to 46% of regular funds.

There are many reasons for the current ESG investing surge. There is a growing awareness of social, labor, and human rights challenges and risks for the business sector as supply chains become more complex. Investor decisions are also influenced by the growing awareness of environmental issues like climate change. The ESG investing boom is also thought to have been influenced by the increased participation of demographics that were previously less engaged in traditional investing, particularly young people and women. If firms wish to compete in their industry and advance society, they must embrace forward-looking ESG practices that reflect these changing societal values and norms.

Stakeholders, investors, and worried people all criticize and put pressure on industries that are hesitant to adopt these reforms. Legal requirements are also anticipated to become increasingly stricter for these industries. A Dutch court ordered Royal Dutch Shell to reduce greenhouse gas emissions by 45% by 2030 in May 2021. ExxonMobil and Chevron were under pressure from their shareholders the same week to lessen the firms' impacts on global warming. These occurrences are probably going to lead to more changes in these businesses.

Criteria for ESG Investing

Investment companies that use ESG investing frequently have their own priorities. For instance, Trillium Asset Management, based in Boston, uses a range of ESG indicators to assist identify businesses poised for great long-term success. As of December 2021, Trillium Asset Management has $5.6 billion under management.

Analysts determine the pertinent problems affecting particular sectors, industries, and businesses to create the criteria. The following investments are prohibited by Trillium's ESG criteria:

- Businesses that are exposed to nuclear or coal power, hard rock or coal mining, private prisons, agricultural biotechnology, tobacco, tar sands, or guns and firearms.

- Companies involved in substantial or recent legal battles over issues like product safety, corporate governance, human rights, animal welfare, or the environment.

Trillium, in contrast, seeks investments that adhere to the following ESG standards:

Environment

- publishes a sustainability or carbon report

- limits hazardous chemicals and contaminants

- reduces greenhouse gas emissions and the carbon footprint

- utilizes renewable energy

- decreases waste

Social

- responsible supplier chains

- avoids using foreign labor that can be unsafe at the workplace or using child labor

- supports LGBTQ+ rights and promotes diversity in all its forms

- has measures in place to prevent sexual misconduct

- pays reasonable (living) wages

Governance

- accepts diversity on the board of directors

- embraces corporate openness

- the CEO is not the board's chairperson

- delay in board elections

Benefits and drawbacks of ESG

Pros

- Sustainability and investment rewards may coexist. 2021 research from financial services provider Morningstar claims that sustainability funds can produce returns that are comparable to or even superior to those of standard funds.

- ESG can draw customers to spur company growth. Customers are looking for companies that offer more environmentally friendly products or services.

- ESG investing aids in making otherwise investment choices. ESG groups frequently emphasize moral behavior.

- ESG-focused businesses frequently do better on the stock market. ESG businesses frequently take more calculated risks, which can reduce investor risk and make an ESG business a more dependable long-term investment.

- ESG recruits and keeps talented employees. Providing a sense of purpose, it can improve staff motivation and raise overall productivity.

- ESG can reduce expenses. Companies can gradually cut expenditures, like operating expenses, when ESG principles are integrated into the structure of a company.

Cons

- There is no one-size-fits-all strategy used by ESG. A strategy that is successful for one business might not be successful for another. It is harder to pick where to concentrate on the environmental criteria because a company must choose to integrate its strategy into both its short- and long-term plans.

- ESG strategy needs to be genuine across all channels. Organizations that make inconsistent attempts to concentrate on ESG, utilize it as a ruse to boost their brand image, or are disengaged from the business plan will not succeed.

- It's not a given that the market will do well. Even while there are successful examples, putting an emphasis on ESG does not ensure that a company will perform well in the market.

- It might be challenging to put together a broad investing portfolio. A financial advisor may find it more challenging to put together a balanced portfolio for individuals who are committed to an ESG-led investment approach.

- It can be difficult to provide detailed performance reporting for each ESG criterion point. Since most ESG criteria aren't directly related to financial data, it takes more work to deliver quantifiable performance results. Furthermore, because reporting standards and frameworks are not regularly enforced, there are knowledge gaps between ESG data and the supply chain.

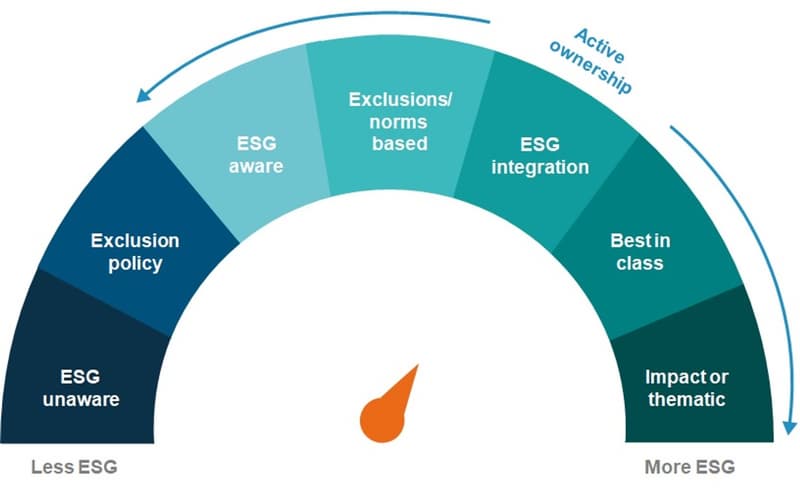

The different ways of ESG investments

There are many different types of ESG investments, but the most well-known ones and ways to investigate them are included below.

ESG stocks

Although it's generally a good idea to keep a modest number of individual stocks in your portfolio, if you really appreciate a certain company (and you believe it will perform well over the long term), you might want to buy its shares. Some businesses provide an impact report that details any environmental or cultural activities they've undertaken as well as how they address problems like carbon emissions. Visit a third-party website like Glassdoor to find out how an organization rates in terms of its work environment. Additionally, you should consider more commonplace elements like revenue and net income. Find out more about stock research techniques.

ESG mutual funds

Funds can swiftly diversify your holdings and quickly fill out your portfolio. ESG funds have become more prevalent recently. 303 open-end and exchange-traded funds existed in 2019, up from 270 in 2018, according to Morningstar data. Some of these funds concentrate on a certain subject, like green energy, making it simple to tailor the impact area of your portfolio. You can compare other funds to determine how their ESG scores compare if your broker has a mutual fund screening tool.

You should read the prospectus of a particular fund if you want to find out more precise information, such as which firms the fund invests in. This document, which should be accessible on the website of your online broker, will also provide other useful details including the fund's expenditure ratio. Annual costs expressed as a proportion of investment are called expense ratios. You can use a mutual fund calculator to determine how much it would cost you to own a particular fund.

ESG Investing vs. CSR vs. Socially Responsible Investing

Socially responsible investing, or SRI, is another phrase frequently used to describe the process of developing a sustainable investment portfolio. There are some differences between SRI and ESG, despite the fact that both concepts aim to create more responsible portfolios.

ESG is a system for measuring a company's or investment's sustainability in three distinct categories: environmental, social, and governance. More general words include impact investing, sustainable investing, ethical investing, and socially responsible investing. Frequently, "socially responsible investments" are graded based on the ESG.

In the past, different sustainable investing methods developed their portfolios in different ways. For instance, SRI employed an exclusionary-only strategy to eliminate investments some people deemed immoral, such as those in tobacco or alcohol. ESG investing included businesses that were thought to be having a beneficial impact but omitted those same investments.

These and other phrases have become increasingly interchangeable as the sustainable investment industry has expanded. In contrast to only excluding particular investments, some "socially responsible" portfolio providers offer ESG funds, while others with the same moniker only employ an exclusionary strategy. No matter what it's named, it's crucial to investigate the methods utilized to develop a portfolio.

The term "CSR," or corporate social responsibility, refers to a business strategy used by an organization to enhance a local neighborhood, the environment, or society at large. Beyond advancing their cause, CSR programs can boost a company's reputation with the general public. Planners of CSR initiatives may take ESG concerns into account when developing their CSR strategy.

ESG investing – how do you start?

Starting a portfolio and adding investments with an eye toward the environment, society, and governance need not be challenging. You will have a wide range of options to pick from because there are more ESG investments available than ever. Here is a guide to creating an ESG portfolio.

1. Whether to DIY or seek assistance

You must choose whether you want to establish an ESG-style investment portfolio on your own by selecting specific ESG investments or hiring a Robo-advisor to handle the task.

A. I desire to locate my own ESG investments

You might wish to create your own ESG portfolio if you appreciate the notion of researching a company's sustainability initiatives or making sure the firms in a fund are in line with your moral principles. Here's how to open a brokerage account if you need one. To assist you sort through different ESG (or sustainable/socially responsible/ethical) investments, keep in mind that certain brokerages feature screening tools. The next step can be taken once you have a brokerage account.

B. I need assistance with ESG investing

Building a portfolio of investments takes time, especially if you're looking for investments that fit under a specific framework, like ESG. Robotic advisors could simplify this. Digital advisors called Robo-advisors create and manage investment portfolios depending on your goals and risk tolerance. They are typically far less expensive than local advisors. And robo-advisors are hopping on the ESG bandwagon now more than ever, frequently letting investors select into a sustainable portfolio for no additional cost.

The following Robo-advisors provide socially conscious portfolios:

- Betterment: Offers three impact portfolios from which to pick, including Social, Climate, and Broad Impact.

- Wealthfront: Provides a pre-made portfolio for socially conscious investing. With socially conscious ETFs, any portfolio may be altered.

- Merrill Edge Guided Investing: Customers can invest in an ESG portfolio and seek limits on particular ETFs through Merrill Edge Guided Investing.

Just keep in mind, if you decide that's important to you, to look at potential Robo-process advisors to make sure they employ both inclusionary and excluding filters. The remaining steps are not necessary if you decide to deal with a Robo-advisor.

2. Recognize your own ESG standards

Compared to "ethical investment" or "socially responsible investing," ESG has some fairly distinct boundaries, but that doesn't necessarily mean it aligns completely with your values. Consider some of the values that are most important to you and see if any of them fall outside of what "ESG" encompasses. Values vary from person to person. If they do, make sure you search for assets that also take these principles into account. Muslim investors, for instance, might wish to make sure that their assets abide by Islamic law.

3. Pick ESG investment options

You can begin building your portfolio once you have a brokerage account and have decided which industries you want to invest in.

You may learn how a company or fund performs in terms of ESG investing characteristics by reading reviews from independent research companies like Morningstar, and then decide whether you want to invest in them.

You'll probably include funds like ESG mutual funds, exchange-traded funds, or ESG stocks when building your own ESG portfolio.

Examples of ESG Investing

ESG investing can take many different forms, such as purchasing a stock with a good ESG score or investing in an ESG fund. From our list of the top ESG funds, below are a few instances of ESG investments:

- Socially responsible and balanced a 1919 (SSIAX)

- Institutional Pax Large Cap Fund (PXLIX)

- International Thornburg Better World I (TBWIX)

- Investor in core equity for Parnassus (PRBLX)

- MSCI USA ESG Select ETF from iShares (SUSA)

FAQ

How are ESG Investing and sustainable investing different?

Sustainability and ESG are closely related. ESG investment evaluates businesses based on standards for strong corporate governance, environmental responsibility, and pro-social behavior. When combined, these qualities can promote sustainability. ESG, then, examines how a company's management and stakeholders make decisions, while sustainability takes into account how those decisions affect the global environment.

What does it mean for a business to adopt ESG?

When a company adopts ESG principles, its corporate strategy is centered on the three pillars of environment, social responsibility, and good governance. This entails adopting actions to lessen waste production, pollution, and CO2 generation. Additionally, it entails having an inclusive and diverse staff, from entry-level employees to the board of directors. ESG may be expensive and time-consuming to implement, but it can also pay off in the long run for those who see it through.

How can you identify which investments are ESG?

ESG evaluations and scoring systems have recently been released by a number of financial institutions. For instance, MSCI has released a rating system that covers more than 8,500 firms globally and assigns them letter grades and scores based on how well they adhere to ESG norms and activities. ESG scores for publicly traded firms have also been made available by a number of other organizations including Morningstar.

How can an organization use ESG to attract investors?

Organizations must understand and accept the change in the investing landscape. The term "investor" is no longer restricted to a small number of people. Instead, investing is becoming more widely recognized as a way for people to use their money as a kind of political expression, drawing investors from all over the world. Due to the growing introduction of more progressive and holistic ESG ideals into the investment world, the variety of considerations investors take into account when making decisions has expanded significantly.

How do you calculate ESG?

Since different organizations use different approaches to determine ESG values, there is no single source for these scores. Most suppliers list particular ESG metrics, like the impact of climate change and political contributions, however, those metrics frequently vary depending on the provider.

There are also differences in how the providers obtain their data. For instance, MSCI ESG Research, one of the biggest independent producers of ESG ratings, incorporates information gathered through company disclosures as well as databases maintained by governmental, academic, and non-profit organizations. An industry-specific questionnaire is used by the Dow Jones Sustainability Index to collect self-reported data from participating businesses.