Understanding an acquisition

The stock prices of the two companies typically move in predictable opposite directions after an acquisition, at least in the immediate term. The acquiring business typically pays a premium for the acquisition to incentivize the target company's shareholders to support the takeover, which causes the target company's stock to increase.

Simply put, if the takeover bid results in a lower stock price than the current price of the target firm, shareholders have no incentive to approve such a move.

Of course, the rule is not always true. In other words, if a target company's stock price suddenly dropped owing to poor profits, being bought out at a discount might be the only way for investors to recover some of their money. This is especially true if the target company is heavily indebted and unable to secure funding from the financial markets to restructure its debt.

On the other hand, following an acquisition transaction, the stock of the acquiring business often decreases. This is due to the fact that the acquiring company frequently pays a premium for the target business, depleting its cash reserves and/or incurring substantial debt in the process. However, there are a variety of other factors that could cause the stock price of the acquiring business to decrease:

- Investors think the target company was purchased for an excessive premium.

- The integration of several workplace cultures is problematic.

- Timelines for mergers are complicated by regulatory constraints.

- Power battles in management reduce productivity.

- The purchase results in additional debt or unanticipated costs.

It's crucial to keep in mind that even if the stock price of the acquiring firm may temporarily decline, in the long run, it should increase provided that its management accurately appraised the target company and successfully combined the two companies.

Pre-acquisition stock movement

Potential target companies' stock prices frequently increase before a merger or acquisition is formally disclosed. Stocks are regularly bought by investors in anticipation of a takeover, which can lead to volatility that is in their favor. Even a whispered rumor of a merger can do this. However, there could be dangers in doing this because the stock price of the target firm could drastically fall, leaving investors in the dark, if a takeover rumor doesn't materialize.

In general, a takeover indicates that the executive team of the acquiring firm is upbeat about the potential for long-term earnings growth at the target company. Additionally, investors frequently perceive an increase in merger and acquisition activity as a promising sign for the market.

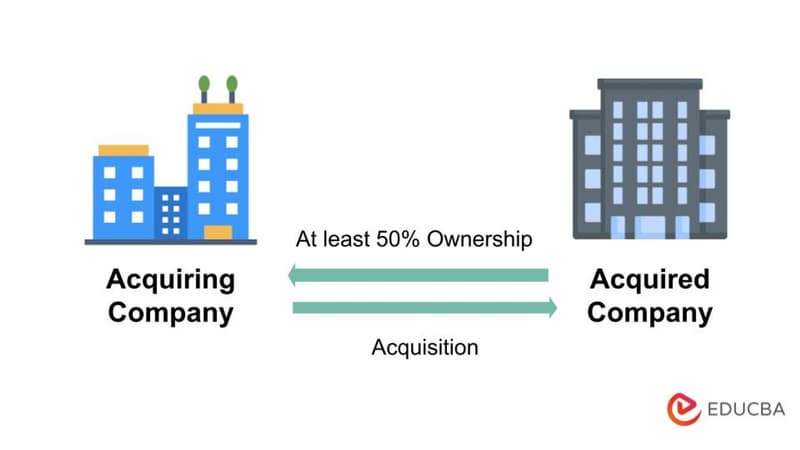

How an acquisition takes place

When a potential buyer, sometimes a competitor or affiliated business, makes a tender offer to purchase enough outstanding shares of a company's stock to take control of the business, a merger or acquisition takes place. The board of directors of the target for the takeover may occasionally approve these plans. The board may occasionally resist and label it a "hostile" takeover, but if the suitor can acquire a sufficient number of voting shares, it can win the majority and seize control. In order to provide shareholders with a profit incentive to sell, tender offers typically propose purchasing shares at a price higher than the stock's existing market trading price.

A tender offer may require speedy action from stockholders in order to be accepted. These offers occasionally include terms that define the maximum number of shares that may be purchased as well as minimum share requirements that must be reached in order for the deal to be honored.

An investor might, for instance, offer to purchase all outstanding shares of a stock with an $8 per share price for $9, provided that at least 51% of shareholders agree to sell. The investor would then commit to purchase no more than 60% of the outstanding shares. Investors who don't agree to sell as soon as possible risk missing the deal. In this scenario, they would still own stock in the business; it would just be run by the new investor.

Types of acquisitions

Public corporations can be bought in a number of ways, including with cash, stock-for-stock mergers, or a mix of both.

Cash and Stock

In this offer, the acquiring company makes cash and stock to the target company's investors.

Stock-for-stock merger

Shareholders in the target company will have their shares exchanged for stock in the new company in a stock-for-stock merger. In proportion to their existing shares, new shares are issued. Rarely is the share exchange one-for-one.

Leveraged buyout

In this type of acquisition, the acquiring business finances the target company with debt.

Cash

The shareholder's shares are no longer in their portfolio after being purchased at the requested price.

Tender offers

Tender offers entail the investor offering to purchase a sufficient number of outstanding shares of the target company's stock to obtain a controlling interest in the business. This is occasionally referred to as a hostile takeover.

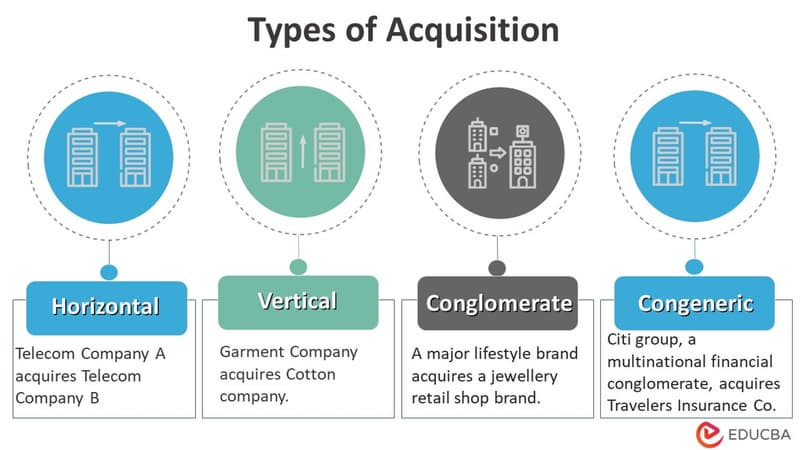

All these acquisitions can take place in a horizontal, vertical, congeneric, or conglomerate manner.

Acquisition actors that impact the stock

The stock of the acquired firm typically increases since the acquiring company most likely paid a premium for its shares in order to attract stockholders. However, there are also circumstances where the merger news causes the shares of the recently acquired firm to decline. That frequently happens when the target company was acquired at a discount because it had been going through financial difficulties.

Your equity may be affected by a number of variables, including the conditions outlined in your specific grant or security and the conditions that are agreed upon as part of the purchase. These phrases may affect:

Exercised shares

Your exercised shares are frequently paid out in cash or changed into common shares of the acquiring business. Additionally, you might be able to exercise shares right up until or right after the deal closes.

Vested options

If the acquisition price is close to the exercise price in your grant, your gain may be modest if the contract stipulates that any vested options are cashed out the net of the striking price. Your vested options are effectively turned into a bonus in either case, which may have tax repercussions. Acceleration clauses, which quicken your vesting timetable, may also be present in acquisitions.

Unvested options

Similar to new-hire option pools, firms frequently allocate whole troughs of shares to the creation of new option grants for staff at acquired companies. Depending on the discussions, a few things could happen to your unvested options:

- You might be given a fresh grant with a new schedule for this sum or more in shares of the new business.

- They might be changed into cash and disbursed gradually.

- They might be abandoned.

Vesting

Before the acquirer pays you in cash or stock for your earlier shares, you might additionally need to meet specific milestones, usually related to time spent at the new company. This aids the acquiring business in keeping talent and coordinating personnel with its objectives. You'll most likely receive a new vesting schedule for any additional options or incentives you acquire, or one that corresponds to your previous grant.

Once a trade is completed, a portion of the cash or stock you get in exchange for common shares and exercisable options may be temporarily held in a different escrow account. This is intended to cover any unresolved matters (such as taxes or legal actions) following the closing. It could take months or possibly a year to receive this money back.

Holdback

This means that the acquiring company temporarily retains a portion of your vested value, however, this normally only applies to founders or executives. Holdbacks frequently feature unique vesting schedules and conditions that encourage the founder to remain with the new business for a set period of time.

Triggers

Senior staff, executives, and founders might be given preferential treatment and be eligible for deal-closing bonuses.

- Single trigger: This typically indicates that upon a change in control (i.e., acquisition or IPO) at the company, all of your shares vest.

- Double trigger: In this case, you would lose your job at the new company and all of your stock would vest following a change in control.

Escrow

Various acquisition scenarios

How an acquisition affects you will depend on the terms of the acquisition agreement, the grant of your option, and the previous funding rounds that your company has received. The final outcome may be affected by your shares' unvested vs. vested status, accelerations, your company's most recent valuation, preference rights for investor shares, and more.

The two parties, their CEOs, boards, corporate development teams, lawyers, as well as the bankers that facilitate the deal, talk in detail about an acquisition. According to the type of acquisition, the following are the most frequent scenarios for what could happen to equity:

Scenario | What it means | Tax implications |

Acquired for cash: An acquiring company buys the acquiree for cash and pays out money to each security holder based on an agreed-upon valuation. | You usually get money only for outstanding shares and vested options. | Likely |

Acquired for stock: The stock of an acquired company is effectively traded in for stock in the acquiring company at an agreed-upon ratio. | It depends if the acquiring company is public or private. Exercised and vested shares usually are paid out. | Private company: Taxes depend on the type of shares and options (ISOs, NSOs, or RSUs). Public company: Stock may or may not be taxable based on the structure of the deal. |

Acquired for both stock & cash: A portion of equity stakes are cashed out, and the remainder turns into stocks or options. | You and most other employees will likely get offered the same ratio of shares and cash. | Depends on how much cash and what type of option grants you receive. |

Acquired for lower than the previous valuation: This might happen when an acquired company has a lot of outstanding debt and/or fails to live up to its valuation. | Depending on your strike price, and investor liquidity preferences, this could mean your stock becomes worth nothing. | If your stock is worth nothing, you may be able to write off stock losses on your taxes. |

What to consider when receiving equity

Employees receiving grants, options, or stocks expect to profit financially when a startup or publicly traded company is purchased. However, in a few M&A transactions, the staff earned substantially less than they had anticipated. The equity ramifications of any future withdrawal should be understood. When you first join a company, it's frequently the finest moment to get knowledge.

Here are some things to think about when analyzing your employment offer:

- Liquidation preference: Ask a corporation about their liquidation preferences whenever you're contemplating an offer from them. These preferences decide "who gets how much" in the event of a merger or acquisition. (Preferred stock typically transforms into common shares if a firm goes public.) Even if you already work for a company, it is worthwhile to inquire about potential outcomes. Employers that are astute are aware that their staff members have employment options, and providing this information about general liquidation preferences fosters trust.

- Early exercise and taxes: Early exercise can provide tax benefits. If the acquiring business pays cash for your vested shares, you will suddenly have a sizeable amount of income to pay taxes on. Depending on the type of stock and the date it was issued, exercising early may qualify you for more advantageous tax treatment. Additionally, you might want to educate yourself on the alternative minimum tax (AMT), which may apply if you exercise incentive stock options (ISOs).

- If the target company is publicly traded: You might not be able to sell straight away since public corporations are subject to different limitations than private companies, such as trading windows and rules.

Advantages and disadvantages of acquisitions

Pros

- When a firm is acquired, the shareholders benefit. The share price of the company typically rises after it is acquired. At any moment, a shareholder may sell shares on the stock exchange for the going market rate.

- In order to persuade the target firm to sell, the acquiring company will typically pay a premium price higher than the existing stock price. Following the news, a surge of traders will rush to buy at the discounted price, raising the stock's value.

- If the target firm is being offered for acquisition by the acquiring company for the price of one share plus $10 in cash and the shares are currently trading for $30, each share has a $40 economic value. The stock price of the target company could rise by that amount as a result. The market's response to the acquiring business in this case affects market activity.

- Investors frequently start to buy the shares before the buyout is disclosed if there is even the slightest rumor of an upcoming acquisition, which causes the stock price to rise. Investors receive a cash reward when the buyout takes place.

- Shareholders may experience higher corporate earnings during a stock swap buyout as the consolidated firm and the target company align.

- The stock of the target firm often trades in line with that of the acquiring company when the buyout is a stock agreement with no cash involved.

Cons

- The fact that they are no longer stockholders in the company is a drawback for shareholders in a buyout. This implies that an investor will not be able to join in the project or benefit from its future success if the long-term value is greater than the cash amount they are paid.

- Investors are normally liable for paying income tax or capital gains tax on any cash earnings.

- Shares may be distributed to an investor who has no desire to acquire the company during a stock swap buyout.

- The target company may suffer if the stock price of the acquiring company declines. The chances are high that the target company's stock would rise if the opposite occurred and the acquiring company's stock price rose.

- Another consequence of the quantity of new stock that the acquiring business must issue to finance the acquisition is the impact of dilution.

- The price might change if there is a rumor of a rival offer, albeit this is often a tiny change.

- The stock price may decline if a dividend is due to be paid between the day the transaction was disclosed and the closing date.

- Depending on speculations about the buyout's development or any challenges the deal may be facing, the stock price may increase or decrease.

- The possibility to withdraw an offer exists for the acquiring company, and the deal may not be approved by securities authorities, shareholders, or both.

FAQ

When a company buys another, why does its stock fall?

Because the acquiring company paid a premium for the target company, burning up part of its cash reserves or maybe taking on debt, its stock tends to decline in the short term. Investors may question the merger's viability or believe the acquiring business overpaid for the target, which might lead the stock to decline.

Are mergers and acquisitions the same thing?

While in an acquisition a larger or more stable firm often buys a smaller or less financially sound company, in a merger similar-sized organizations agree to unite to form a new, unified corporation. In contrast to acquisitions, which usually include cash buyouts, mergers more frequently entail stock-for-stock transactions. Similar to how an acquisition impacts shareholders, a merger typically does as well. In both mergers and acquisitions, shares of the target firm often increase upon the announcement of the deal, while shares of the purchasing company briefly decline.

How long do acquisitions usually take?

The length of time it takes to conclude a corporate merger or acquisition might vary greatly. This period of time might last anywhere between six months and several years. Before two publicly traded firms may be legally merged into one, they must successfully complete a number of separate steps.

What factors must you consider before acquiring?

- Location and industry.

- Market circumstances

- Sales patterns

- Multipliers employed by similar businesses.

- Company size and level of development.

- Earnings in the past and in the future and stability of cash flow.

- Variety of suppliers and customers.

- Intellectual property and goodwill.

What are the main acquisition strategies?

Acquisition strategies might be horizontal, vertical, generic, or conglomerate in nature. The product line, industry, and business activities are used to categorize the purchase, which is a component of the company's expansion plan.