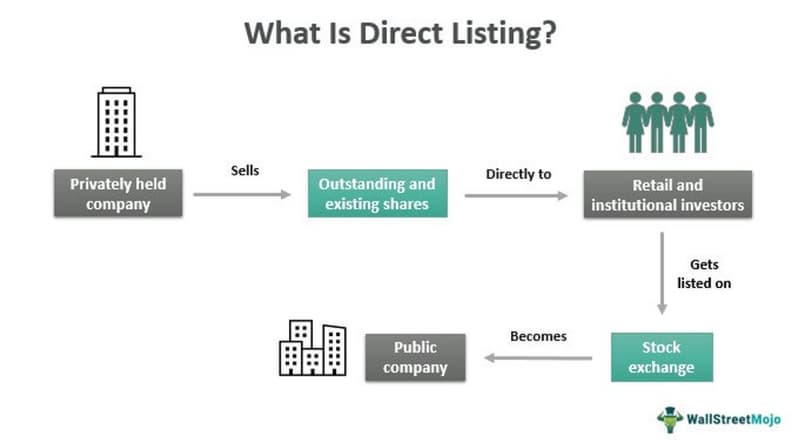

Defining direct listing

Through direct listing, privately owned companies can sell their existing shares to individual and institutional investors. There is no requirement for an underwriter, investment bank, or broker-dealer to assist a company with listing on a stock market, and no lock-up periods apply.

Companies with significant brand value, goodwill, and aims other than raising finance often choose this technique over an initial public offering (IPO). It's cheaper than an IPO because they won't have to issue any new shares or pay any fees to raise capital. Additionally, it increases open market liquidity and volatility for current stockholders (employees or investors).

How does it work?

In most cases, a private company with this strategy will have well-defined objectives. It hopes that by going public, it can reap the benefits of higher liquidity and volatility for its current stockholders. In addition, no investment banks or underwriters are needed, thus businesses save money on such fees. However, before a company's shares may be listed on stock markets, it must hire an investment bank as a financial advisor to manage regulatory filings, price discovery, securities law compliance, and investor communication.

Indirect costs associated with selling the stock at a discount are also avoided. Shares are traded on the stock market, and their availability and demand are guaranteed only by the company's owners (workers and initial investors). They can list on stock markets all they want, but if they don't want to sell, then nothing will happen.

Conversely, a firm that wants to go public through a direct public offering must know and meet certain criteria. Due to the absence of underwriters, success depends on the company's established credibility, the clarity of its organizational structure, and the sophistication of its revenue model. As a result, on the listing date, more money will be spent buying direct listing stocks.

NASDAQ recently requested that the United States Securities and Exchange Commission (SEC) remove restrictions on the exchange's ability to raise capital through direct public offerings and increase the maximum price at which shares can be traded. It's also important to note that the Securities and Exchange Commission (SEC) has approved the New York Stock Exchange's request to list new shares from companies seeking a direct public offering alongside existing shares.

What is the direct listing process?

It's possible that a company that wants to go public doesn't have the funds to hire underwriters, doesn't want to dilute existing shares by issuing new ones, or doesn't want to enter into a lockup agreement. As a result of these reservations, many businesses today opt for a direct listing rather than an initial public offering (IPO).

Direct placement and direct public offering are other names for the direct listing procedure (DLP) (DPO).

When a company uses a direct listing process (DLP), it sells shares to the general public without using any stock exchanges or other middlemen. No new shares are being issued, and there is no lockup period because there are no intermediaries involved.

Any current shareholders, including investors, promoters, and workers, may sell their shares to the general public through a direct offering.

However, investors bear some of the company's exposure to the risks that come along with the zero- to low-cost advantage. No advertising, no guaranteed long-term investors, no choices like greenshoe, and no protection for major shareholders against share price volatility before, during, or after the share listing.

A greenshoe option is a clause in an underwriting agreement that allows the underwriter to sell more shares to investors than the issuer had anticipated.

Companies that choose direct listing and those that go via an initial public offering (IPO) must publicly file a registration statement on Form S-1 (or another applicable registration form) with the Securities and Exchange Commission (SEC) at least 15 days prior to the launch.

Once a company's stock is publicly traded (whether through an initial public offering or a direct listing), it must comply with the same reporting and governance standards as other publicly traded corporations. The Securities and Exchange Commission (SEC) mandates that all publicly traded corporations prepare and submit two disclosure-related annual reports: one to the SEC and one to the company's shareholders. Companies are required to file 10-K filings annually.

Why do companies prefer direct listing?

Directly listed companies differ in their objectives from those of public companies. In an initial public offering (IPO), a company seeks funding or expansion through the sale of its shares to the general public. But direct-listing firms may not necessarily be looking for investors. They're more interested in the other perks of going public, like giving existing shareholders more cash.

Companies seeking an IPO through these channels should also meet specific criteria. Since there will be no underwriters involved in the sale of shares, it will be up to the company to generate sufficient interest from investors. Companies that (1) deal directly with consumers and have a distinctive brand identity, (2) have straightforward business models, and (3) don't have a pressing need for additional capital are good candidates for this approach.

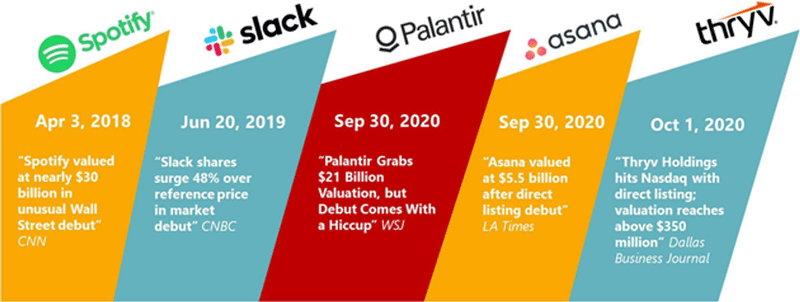

Spotify and Slack are two well-known examples of successful direct listing IPOs. Before going public, both of these companies had established stellar reputations. They saw widespread adoption, and the business model behind the firm's success was plain to see. Together, these factors boost the number of people considering making an investment in the company. This is due to the fact that potential backers are more comfortable putting money into well-known brands.

Direct listing benefits

- Makes it possible for businesses to bypass traditional financing channels like banks and VC funds and instead raise money directly from individual investors.

- Removes the need for fundraising expenses.

- The minimum investment required the number of shares an investor can buy, the settlement date, and the offering price is all specified by the issuer.

- Stocks, REITs, bonds, and preferred shares are just some of the financial instruments that businesses can issue to investors.

- Releases companies from banking constraints.

IPO vs. Direct Listing

An initial public offering (IPO) and a direct listing both allow privately held companies to have their shares traded publicly for the first time, but they differ significantly in other respects.

IPO | DPO | |

What kind of shares are offered? | Company issues new and existing shares during the IPO, which leads to shareholding dilution for existing shareholders. The number of shares on offer is specified. | Until recently, only existing shareholders could sell shares in DPO. SEC December 2020 rule allows for newly created shares. No dilution if no new shares are issued. |

Who can buy shares? | Based on demand for IPO shares and broker’s criteria for allotment. Preference to institutional investors, retail investors may not get shares. | DPO shares are bought and sold on the stock exchange like any other shares. All investors get a chance to trade. |

Role of Investment Bank | Acts as an intermediary between the company and investors. Responsible for the distribution and pricing of newly issued shares. | Only acts as financial advisor. |

Underwriting | IPO underwriters, typically investment banks, help sell shares. Commit to raising capital for the company by buying IPO shares. | No underwriting for a direct listing. Shares trade on the stock exchange. |

Initial Share Price | Predetermined by investment banks and companies. | Exchange market makers set a reference price based on investor demand. |

Shareholder lock-up | Prevents existing company shareholders from selling shares for a certain period (typically 90-180 days) immediately after IPO. | Prevents existing company shareholders from selling shares for a certain period (typically 90-180 days) immediately after IPO. |

Investor communication about the offer | Investor roadshow by invitation, typically for institutional investors. | Online investor day is open to everyone. |

Direct listings for individual investors

Direct listing provides more opportunities for the average investor. Promoting and selling initial public offerings (IPOs) to institutional investors and clients is done through a series of "roadshows" organized by investment banks.

Smaller investors are frequently shut out of IPOs because the shares go to institutional investors. When a stock is listed directly, it immediately becomes available to all buyers.

This means that investors can buy shares in a direct listing through the same broker or trading app they use for all of their other stock trades.

Investor days held by companies prior to the direct listing are open to the public and provide an opportunity for retail investors to learn about the company and its offerings.

Examples

Example #1

Spotify's Direct Listing: How It Came About

Latham & Watkins claims that Spotify proposed a direct listing to them in May of 2017.

Also, during this time, it brought on board Goldman Sachs, Morgan Stanley, and Allen & Co. as financial consultants for the DPO (direct public offering).

The law firm claims that the financial advisors defined Spotify's listing goals, provided guidance on regulatory filings, and aided with the company's public relations.

The financial advisor's primary duty is to aid the firm in determining the fair market value of its shares that are not owned by company insiders. Its value contributes to the satisfaction of the requirements of the stock market on which the shares will finally trade.

After months of DPO talks with the SEC in 2017, Spotify submitted its first public file for a direct listing in February 2018. March of that year marked its second filing with the SEC.

A DPO's next stages typically consist of the issuer satisfying all regulatory and exchange requirements and holding an investor call to inform potential buyers about the issuer and the offering.

Example #2

Amplitude Inc., a data analytics company, went public through a direct public offering and is now worth nearly $7 billion. After opening at $50 versus the reference price of $35 on NASDAQ, the stock price of the company rose 9.6 percent to $54.80.

FAQs

What is direct listing?

Private companies can go public on the stock market through a direct listing, direct public offering (DPO), or direct placement. An initial public offering (IPO) is another option. In spite of this, modern businesses have demonstrated that DPO is a viable option for raising capital and reaping benefits without overpaying banks and underwriters.

How does it work?

Before listing a company's stock, any stock exchange (including NASDAQ and NYSE) will announce the stock's reference price. This price serves as a benchmark to give shareholders an idea of the stock's potential value. Factors such as the company's performance, market valuation, competitors, and financial reports are used in its determination.

How can you buy direct listing stocks?

In a direct listing, as opposed to an initial public offering, there is no application procedure. Investors cannot place a bid because there is no available lot. Stocks can be purchased by the public only after they have been listed for sale.

Is there a “lock-up” period for direct listing?

And unlike initial public offerings (IPOs), there is no "lock-up" period associated with the direct listing procedure. Existing shareholders in a company are not permitted to sell their shares on the public market during the lock-up period of a standard initial public offering.

How long does direct listing usually take?

Typically, it takes ten to twelve weeks from the time the S-1 is filed until the SEC approves the filing and the securities are publicly traded.