Defining Fundamental Analysis

Fundamental analysis examines relevant economic and financial elements to determine a security's underlying value. An investment's intrinsic value is determined by the financial health of the issuing company, as well as the general market and economic climate.

Fundamental analysts examine all potential influences on a security's value, including both macroeconomic (such as the state of the economy and market circumstances) and microeconomic (such as the efficiency of the company's management) aspects.

The ultimate objective is to arrive at a figure that an investor can use to gauge whether an asset is being undervalued or overvalued by other investors by contrasting it with its present price.

Understanding Fundamental Analysis

Typically, fundamental analysis is conducted from a macro-to-micro perspective to pinpoint securities that the market has not accurately valued.

As a general rule, analysts look at:

- The status of the economy as a whole

- The health of the particular industry

- the business's financial health before issuing the stock

This guarantees they determine the stock's fair market value.

What is typically used?

Fundamental analysis measures the worth of an investment using publicly available financial data. The information is documented on financial statements, such as those seen in quarterly and yearly reports, as well as in filings like the 10-Q (quarterly) or 10-K. (annual). The 8-K is also educational because public corporations are required to submit it whenever a reportable event has a place, such as an acquisition or a change in upper-level management.

The investor relations parts of the websites of the majority of public companies—and many private ones, too—list yearly reports that highlight the financial choices made and the outcomes attained throughout the year.

For instance, you might do a basic analysis of a bond's worth by considering monetary elements like interest rates and the status of the general economy. The bond market would then be assessed using financial information from other bond issuers of a similar nature. Finally, you would examine the financial information provided by the issuing company, taking into account external variables like possible changes to its credit rating. To learn more about the issuer's actions, objectives, and other matters, you might also read through the 8-K, 10-Q, 10-K, and the issuer's annual reports.

To ascertain a company's underlying value and potential for future growth, fundamental analysis examines its revenues, profits, projected growth, return on equity, profit margins, and other financial information.

Intrinsic Value

When compared to publicly available financial data, one of the main presumptions of fundamental analysis is that a stock's present price frequently does not accurately reflect the value of the company. A second supposition is that the value derived from the company's fundamental data will probably be more in line with the actual stock value.

When valuing stocks versus when trading options, intrinsic value has a different meaning. While there are many alternative techniques to calculate a stock's intrinsic value, option pricing employs a standard formula.

For instance, suppose a company's stock was trading at $20 and an analyst determined after conducting significant research on the business that it should be worth $24. A different analyst conducts a comparable analysis and determines the price should be $26.

The average of these estimations is often taken into account by investors, who then predict that the stock's intrinsic value may be around $25. Due to their desire to purchase companies trading at prices that are far below these intrinsic values, investors frequently view these estimations as being of utmost importance.

This brings us to the third essential analysis tenet: The stock market will eventually reflect the fundamentals. The issue is that nobody is really sure how long "the long run" is. It can take hours or years.

This is the main goal of fundamental analysis. An investor can determine a company's intrinsic worth by concentrating on a specific industry and can then look for opportunities to buy at a discount or sell at a premium. When the market catches up to the fundamentals, the investment will start to yield results.

A guide to Fundamental Analysis

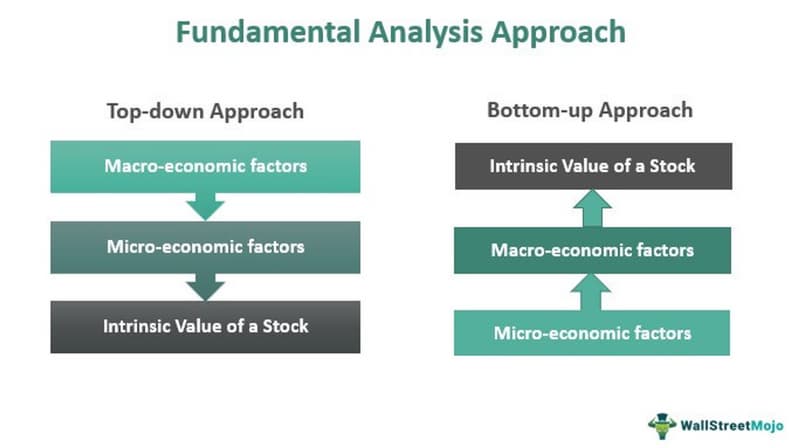

The fundamental analysis of a corporation often uses one of two methods:

The top-down strategy

In this method, specialists evaluate the economy and industry first using macroeconomic parameters. They finally boil down to assessing a company's development, management, and other microeconomic criteria, depending on the state of the market.

The bottom-up strategy

The top-down method is the opposite of this strategy. It begins by researching the company and its past performance before gradually moving up to macroeconomic issues like market circumstances and a nation's economy.

To conduct a fundamental study of stocks, securities, or companies, a step-by-step execution is started. Its crucial features include:

- Analysis of the economy, industries, and companies

FA takes into account the structure, economy, and dynamics of the sector, as well as facets of broader markets and all other macroeconomic factors.

The specialists investigate the accessible alternatives to the company's goods, services, and rendered labor as well as the cost structure, revenue model, and composition.

- Financial statement evaluation

Every report from a corporation, including the balance sheets, income statement, cash flow, the price-to-book value of equity, the net market value of assets, and other critical ratios with revenue, is carefully examined.

- Researching non-financial factors

Non-financial factors, such as competition, management, business practices, and others, have an impact on a firm in addition to its financial results. As a result, in the FA of stocks, analysts also search for elements that may enhance or detract from the performance of the company.

- Employing fundamental analysis tools

Financial ratios are used by analysts and investors to assess a company's financial health. It is used to assess future growth, stability, and investment combined with the financial data that is currently accessible from prior reports.

- Suggestions

Decisions about investments are made in light of the study. Analysts offer recommendations to investors based on their thorough evaluation of a security's fundamental value and financial health.

The Pros and Cons

Advantages

- Analytical techniques: Fundamental analysis employs techniques and procedures that are founded on reliable financial information. It does away with the possibility of bias.

- 360 Degree Focus: Fundamental analysis also takes long-term societal, technological, economic, and consumer developments into account.

- A methodical technique for determining the value: The statistical and analytical techniques employed assist in producing a suitable Buy/Sell recommendation.

- Greater Understanding: Thorough accounting and financial analysis contribute to a greater overall understanding.

Disadvantages

- Time-consuming: Conducting financial modeling, industry study, and valuation takes time. It can require a great deal of effort and get complicated.

- Assumptions-focused: When predicting the financials, assumptions are essential. Therefore, it is essential to think about both the best and worst-case situations. Unexpectedly bad legislative, political, or economic changes could be problematic.

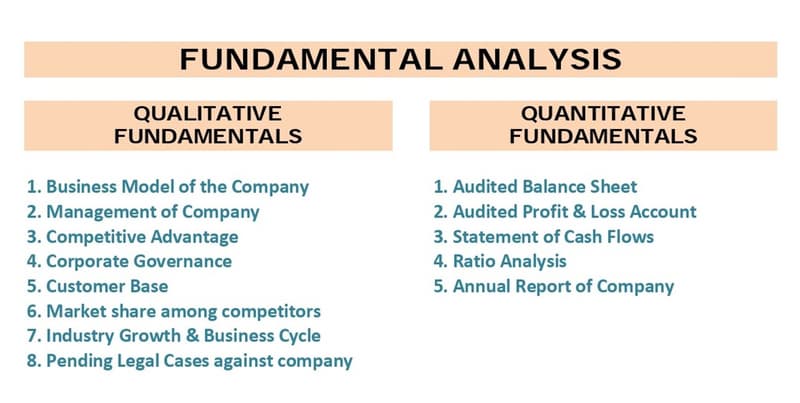

The two types of Fundamental Analysis

The difficulty in defining the term "fundamentals" is that it can refer to everything that affects a company's financial health. They might encompass anything from a company's market share to the caliber of its management, as well as figures like sales and profit.

Quantitative and qualitative fundamental components might be combined into one category. These terms' definitions according to to finance aren't all that different from well-known definitions:

- Quantitative: Information that can be represented quantitatively by utilizing numbers, figures, ratios, or formulas

- Qualitative: It is the quality, standard, or nature of something rather than how much there is of it.

Quantitative fundamentals are actual numbers in this sense. They are the aspects of a business that can be measured. Financial statements are thus the principal source of quantitative data. Assets, revenue, profit, and other things can all be measured precisely.

Less tangible are the qualitative principles. The caliber of a company's top executives, brand recognition, patents, and exclusive technologies are a few examples.

Both qualitative and quantitative analyses can be useful. Many analysts take these into account together.

Qualitative principles to take into account

Analysts always take into account four fundamental factors while analyzing a company. Instead of being quantitative, all are qualitative. They consist of:

The Company Model

What precisely does the business do? It's not as easy as it seems to do this. Is a corporation making money if its core strategy is to sell chicken at fast food restaurants? Or are they merely living off of royalties and franchising fees?

Competitive Advantage

A company's capacity to sustain competitive advantage—and keep it—is the primary factor in determining its long-term success. Strong competitive advantages, like Coca-Cola and Microsoft's dominance of the personal computer operating system, build a moat around a company, preventing competitors from entering and allowing the business to expand and prosper. A company's stockholders may get generous payouts for many years if they can secure a competitive advantage.

Management

Some people think the most critical factor for investing in a company is its management. It is logical: If the company's executives don't carry out the plan as intended, even the strongest business model will collapse. Retail investors may find it challenging to meet and properly assess managers, but you can look at the company website and review the board members and senior management's resumes. How did they perform in their prior positions? Have they recently sold a significant amount of their stock shares?

Corporate Responsibility

Corporate governance is the term used to define the rules that regulate how management, directors, and stakeholders interact inside an organization. The firm charter, its bylaws, and corporate rules and regulations all establish and specify these policies. You want to conduct business with an organization that is conducted morally, equally, openly, and effectively. Pay close attention to whether management upholds the interests and rights of shareholders. Ensure that their communications with shareholders are open, straightforward, and transparent. They likely don't want you to understand it if you don't.

Industry

It's also crucial to take into account the industry in which a company operates, including its clientele, market share among competitors, growth overall, competition, rules, and seasonality. An investor's comprehension of a company's financial health will increase as they have a better understanding of the industry.

Quantitative principles to consider - Financial Statements

A corporation exposes information about its financial performance through financial statements. Fundamental analysts base their investing recommendations on quantitative data from financial accounts. Income statements, balance sheets, and cash flow statements are the three most crucial financial statements.

The Balance Sheet

A company's assets, liabilities, and equity at a specific time are listed on the balance sheet. The three sections—assets, liabilities, and shareholders' equity—must balance according to the following formula, which is why it is called a balance sheet:

Liabilities + Shareholders' Equity = Assets

The resources that the company now controls or owns are represented by its assets. This covers things like money, stock, equipment, and structures. The entire financing value that the business used to purchase such assets is shown on the other side of the equation.

Liabilities or equity are the sources of financing. Liabilities are commitments or debts that must be paid. Contrarily, equity is the sum of all the capital that the owners have invested in the company, including retained earnings, or the profit that remains after paying all current liabilities, dividends, and taxes.

Financial Statement

The income statement measures a company's success over a set time period, whereas the balance sheet examines a corporation at the moment. Although technically a balance sheet might be for a month or even a day, public corporations only report on a quarterly and annual basis.

The Income Statement

The income statement displays the period's revenues, costs, and profit made by operating the business.

Cash Flow Statement

A record of a company's cash inflows and outflows over time is shown in the statement of cash flows. In a statement of cash flows, the following cash-related activities are typically highlighted:

- Cash from investing (CFI): Cash used for investing in assets as well as the revenues from the sale of other enterprises, machinery, or long-term assets.

- Financed cash flow (CFF): Cash received or paid as a result of the issuance and borrowing of funds

- Operating Cash Flow (OCF): Money derived from ongoing business activities.

As it is difficult for a company to control its cash condition, the cash flow statement is crucial. Aggressive accountants can easily falsify earnings, but it's difficult to create bogus money in the bank. The cash flow statement is a more conservative indicator of a company's performance, according to some investors.

In order to develop conclusions about a company's value and future, the fundamental analysis uses financial ratios derived from information on corporate financial statements.

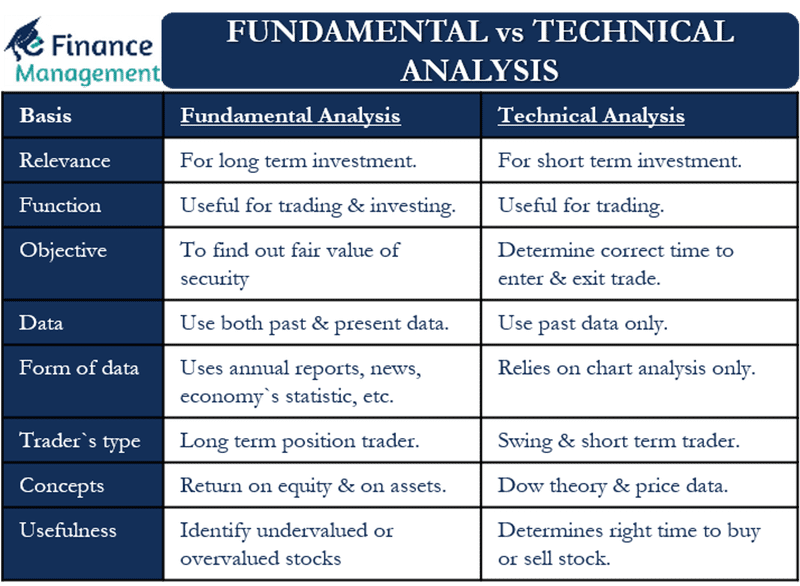

Technical Analysis vs. Fundamental Analysis

- Fundamental analysis suggests data analysis over a number of years and is focused on a long-term strategy for appraising the stock. This kind of strategy aids investors in choosing stocks to invest in whose worth is anticipated to rise in the future. Technical analysis bases its stock evaluation on a short-term perspective. This makes it more applicable to day traders since the goal of the analysis is to choose stocks that can be bought right away and sold for more money in a shorter amount of time.

- A stock's intrinsic value is taken into account by fundamental analysts when looking for potential long-term investment opportunities. The technical analysis analyzes a stock's previous price alterations. It foretells a stock's future performance, i.e., whether its price is anticipated to rise or fall over a shorter time frame.

- Given that investment is a long-term strategy, investing is the goal of fundamental analysis. Technical analysis, however, is focused on trading goals.

- In fundamental analysis, conclusions are drawn based on the information at hand and the financial accounts. On the other hand, in technical analysis, choices are based on charts and patterns of price movement.

- Technical analysis just takes into account the previous data, whereas fundamental analysis takes into account both the past and the present data about a stock.

- Long-term investors can benefit from fundamental analysis. Technical analysis, on the other hand, is helpful for day traders and short-term investors who want to make money by selling the stock for a longer time.

- Fundamental analysis involves no assumptions. Many presumptions must be made while performing technical analysis, one of which is that price will continue to follow the historical trend.

- Based on an asset's underlying worth, fundamental analysis can assist in determining whether a stock is overvalued or undervalued. On the other hand, based on price changes, technical analysis aids in selecting the ideal time to buy or sell a stock.

What to conclude with

Stock analysts utilize fundamental research as a valuation tool to assess whether the market has overvalued or undervalued a stock. It takes into account a company's financial performance as well as the economic, market, industry, and sector conditions in which it works.

To evaluate a corporation, financial ratios derived from financial reports as well as government, industry, and economic information are used. You can find that a stock is valued differently than another analyst because not all analysts use the same resources or have the same perspectives on equities. It's crucial that the stock you study satisfies your value criteria and that your analysis provides you with the knowledge you can use.

FAQ

Is fundamental analysis useful?

Fundamental analysis is most frequently used to evaluate stocks, although it may also be used to evaluate any security, from bonds to derivatives. If you consider the basics, from the general state of the economy to the particular of the company, you are conducting a basic analysis.

What is the objective of fundamental analysis?

Fundamental analysis employs data that is readily accessible to the public to assess whether the market has correctly priced a stock and the corporation that issued it.

What 3 layers make up fundamental analysis?

When conducting an analysis, you first look at the economy, then the sector, and finally the company.

Is fundamental analysis important?

You can determine a company's market value through fundamental analysis. Instead of investigating the company's fundamentals, many investors merely consider the price a stock is presently trading at and what it has previously traded at. Since a stock was issued by an organization, the financial success of that organization has an impact on the stock's overall performance.

What tools are needed for fundamental analysis?

Many tools are used by analysts. Financial reports, ratios from the reports, spreadsheets, charts, graphs, infographics, reports from government agencies on the economy and various industries, and market reports are a few examples.