How do you invest in a recession?

Investors should exercise caution during a recession, but they should also keep an eye out for opportunities to purchase high-quality assets at a bargain. Although these are challenging circumstances, they also present the best opportunity.

The worst-performing investments during a recession are those that are heavily leveraged, cyclical, and speculative. Investors should be aware that businesses that fit into one of these categories run the danger of failing.

Instead, those who want to make money during a recession will put their money into high-quality businesses with solid financial positions, little debt, positive cash flow, and sectors that have historically performed well.

Factors to consider when investing

A bear market is one in which prices are falling significantly and over extended periods of time. A bear market, according to the Securities and Exchange Commission (SEC), is "a period in which stock prices are falling and market sentiment is negative." Or, when there is a fall of 20% or more over a period of around two months.

According to Morgan Stanley research released at the end of October, bonds would decline by 15% and equities will fall by around 19% by 2022. The present declines are enough to have investors concerned about how to manage their portfolios, even though they aren't nearly the 20% the SEC uses as its barometer.

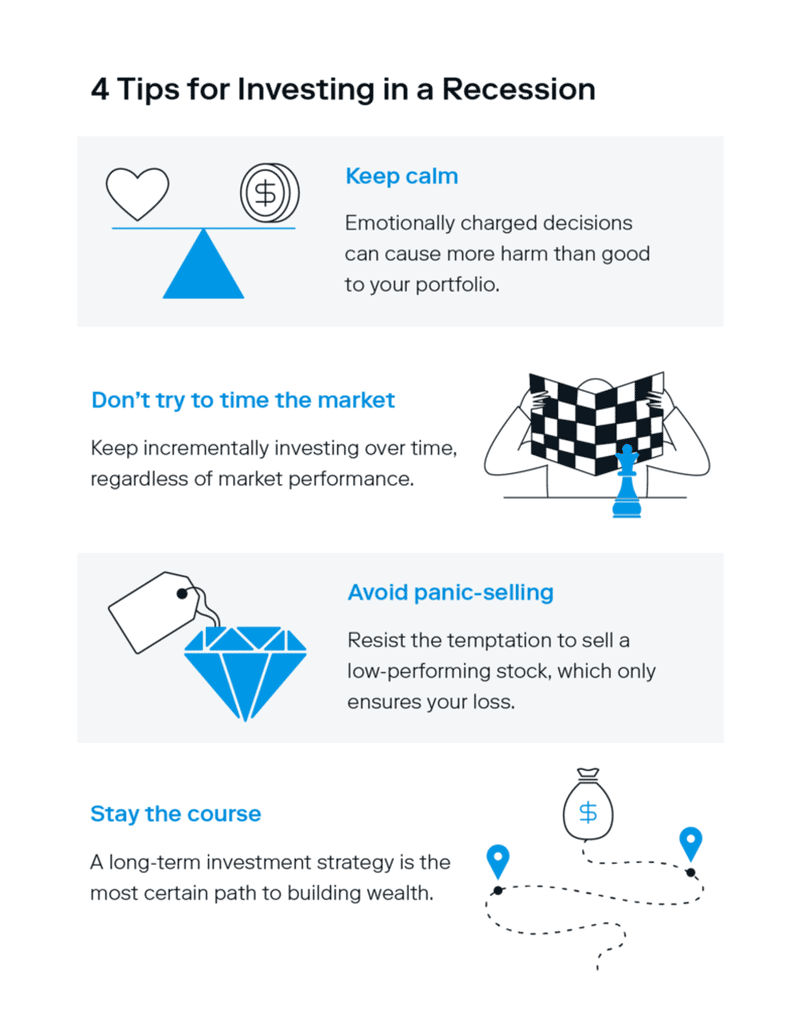

The dos and don'ts for these kinds of situations include keeping your money invested and not withdrawing it, continuing to invest according to your needs, and being aware of the hazards associated with the present economic climate. Not to be neglected is the possibility of taking advantage of sensible possibilities.

Avoid pulling your money out

Your investments should ideally be led by precise investment objectives and choices made based on your risk tolerance and short-, mid-, and long-term plans. However, it can be tempting to abandon this cautious planning and simply withdraw your money from the market when the market gets erratic.

Since we are all human, it is difficult to separate emotions from financial decisions. However, James Martielli, head of investment and trading services for the retail investor organization Vanguard, notes that when you make an emotional decision, you are probably not doing so in accordance with a strategy but rather in response to a triggering event, such as news that incites dread.

Colleen Cunniffe from the Vanguard fixed-income department argues that emotions should only be used when developing your investment plan and determining your risk tolerance. Other investment decisions should be based on data, analysis, and experience once the initial risk decision, which shouldn't change frequently, has been made.

"Short-term uncertainties that are expected to change over time produce volatile markets. Selling into those markets may indicate that your actions are inconsistent with your long-term investment objectives, according to Cunniffe.

Invest based on your own needs

Additionally, even though purchasing costs could be lower in a down market, it is not a good idea to go on a shopping binge. In general, experts advise putting your attention on your long-term goals and priorities in this situation.

A down market can present possibilities with the proper research, but these opportunities must still be examined in light of your objectives and risk tolerance, according to Cunniffe.

When possibilities are thoroughly investigated and aligned with your own investment strategy, down markets can present them.

It's crucial to consider seriously whether reallocating existing funds to invest in a bear market is consistent with your long-term goals, says Cunniffe. "For instance, it would be foolish to utilize money set aside for emergencies or a rainy day fund to make investments merely because the market is down."

The timeframe of your financial ambitions and aspirations is still another crucial consideration when purchasing stocks, whether in a bull or bear market. You should be aware of how long it will take for your purchases to pay for themselves, and you should be sure that this schedule fits with your investing objectives.

Investment choices should ultimately be made based on data, analysis, and experience rather than just the absolute lowest prices. When that information is taken into account, it may turn out that what appears to be inexpensive is actually still expensive. "There may be a solid reason an asset is cheaper now than it was last month," she says. "I wouldn't purchase a bond simply because it is less expensive today than it was yesterday, any more than I would purchase a home on the same grounds—the town might have approved a new waste facility next door. You should constantly conduct research.

Understand the risks of investing in a down market

Make sure you are aware of the hazards before making any purchases in the current market. What's more, the market could not recover as rapidly as you anticipate. Some bear markets only last a few months, while others last for several years.

According to Cunniffe, "each down market has its own peculiarities that will influence both the scope and timing of any recovery."

Additionally, there is a chance for panic, sell-offs, or deteriorating market circumstances that lower prices even further.

When making investments in a down market, it's still crucial to exercise caution. Even if stocks may currently be inexpensive, this does not preclude further undervaluation. Additionally, there is always a chance that a market downturn could develop into a full-fledged market crash, according to Michael Collins, a CFA who is also the founder and CEO of the wealth management and financial planning firm WinCap Financial and a professor at Endicott College in Beverly, Massachusetts.

Take advantage of sound opportunities

Despite all the disadvantages already highlighted, careful investors may still find some chances. Here are a few options to think about.

- Dividend-paying stocks: Stocks that pay dividends can nevertheless generate returns, sometimes even more so, during down markets. An added plus is that you could be able to acquire dividend assets for less money because the cost to purchase these equities may have decreased during a down market.

- Bonds: According to Victor Hernandez, a wealth partner at J.P. Morgan Wealth Management, bonds may present a chance for people looking for income. "The Federal Reserve's aggressive rate increases may present a chance to think about bonds. In contrast to opportunities yielding mid-to-high single digits on US corporate bonds, one may now buy short-term US Treasuries with interest rates above 4% for the first time in more than 15 years," Hernandez said.

Cunniffe proposes studying the industries that have been affected by the current market as yet another choice.

As an illustration, she says, "during the Covid market disruption, our Active Fixed Income Research Team concentrated on Covid-impacted sectors like leisure, restaurants, and travel to discover opportunities to invest in good credit stories at extremely favorable rates."

Making sure your actions are supported by research and that they take your risk tolerance and time horizon into consideration are the keys to any investment decisions you make.

Own defensive stocks in a recession

When the economy is expanding, consumer discretionary equities frequently experience significant increases. Because the gains and losses in this group are based on the ups and downs of economic cycles and consumer confidence, they are known as cyclical stocks.

Utility stocks and consumer staples stocks are examples of defensive names in non-cyclical sectors that are typically sheltered from these ups and downs. Defensive equities can help safeguard your portfolio during a recession.

Companies that provide necessities like food, energy, and housing are typically noncyclical and less vulnerable to economic cycles, according to Katz.

Food, beverages, and home products are examples of consumer staples whose sales are mostly recession-proof because whatever the state of the economy, people still need to eat and use toilet paper. Utilities outperform other stock categories during a recession because demand for them remains stable.

According to NBER analysts, "the health care industry remains steady across the business cycle" in a report from 2021. "If anything, healthcare employment seems to rise when counties undergo more severe economic downturns."

Use Dollar-Cost Averaging

With dollar-cost averaging, you buy a predetermined amount of an investment on a regular basis, regardless of the price.

Dollar-cost averaging is an excellent strategy to utilize during recessions since it allows you to buy shares when the price falls. With new funds, you can dollar cost average, or you can get the same result by having your dividends automatically reinvest in the security.

Strong investment options in a recession

When markets decline, many investors immediately sell their positions in an effort to ease the pain of losing money. The market is actually improving future rewards for investors who buy in by discounting stocks at this time. A drop in asset prices means your potential future returns are even higher because great companies are well-positioned to succeed in 10 and 20 years.

Therefore, a recession—when prices are often lower—is the ideal time to maximize returns. If made during a recession, the investments below have the potential to yield higher returns over time.

Stock funds

An excellent approach to investing during a recession is in a stock fund, whether it be a mutual or an ETF. Investors bet less on any one stock than they do on the recovery of the economy and an improvement in market mood, and funds often have lower volatility than portfolios of a few stocks. And if you can handle the short-term volatility, an equity fund offers the possibility of substantial long-term gains.

Investors who don't want the inconvenience and risks of buying individual stocks can choose well-diversified funds. An intelligent option is an index fund based on the Standard & Poor's 500, a well-balanced index made up of a large number of America's top corporations. You thereby own a portion of the market as a whole rather than attempting to predict the winners.

According to Brooke V. May, CFP, managing partner of Evans May Wealth in the Indianapolis region, "investors with a well-balanced portfolio need to remember themselves that the market has always come back" from downturns.

Dividend stocks

You could want to include some dividend stocks in your portfolio if you want it to be a little less volatile. Your portfolio will move less when you invest in high-quality dividend stocks because they vary less than other stock types (growth stocks, for instance). Additionally, they may provide a cash dividend to guarantee that you have some income while you wait for the market to change.

Not confident in your ability to choose your own dividend stocks? Purchase a dividend stock fund to reap the benefits of diversification's lower risk levels while still receiving a respectable dividend return. Additionally, if you purchase shares at a discount, the total yield will be larger.

Real estate

For a number of reasons, real estate can be a desirable investment during a recession. First, you might be able to purchase items at a lower cost than in times of a robust economy. The worth of your real estate could then increase as the economy grows and consumers have more money to spend.

Second, during a recession, when rates are probably considerably lower than they would be otherwise, you could be able to secure a mortgage at a much better rate. A desirable mortgage payment can be fixed for years or even decades, guaranteeing that you will still have it even if interest rates later rise.

In recent years, many investors achieved a 30-year mortgage with a rate under 3 percent. Real estate is a desirable inflation hedge since they are repaying the mortgage with cheaper dollars when inflation grows now and in the future.

High-yield savings account

Cash? Yes, given that most recessions don't last very long, cash might be a decent investment in the near run. You have a lot of possibilities with cash. You can utilize it if necessary, such as if you lose your work during a recession, and it enables you to make an opportunistic investment if the stock market unexpectedly declines or you subsequently find the ideal home.

But keeping too much cash has its drawbacks. Your savings may be eroded by inflation, and it's unlikely that you'll earn enough interest to make up the difference. Therefore, deposit your money in a high-yield online savings account and use it to your advantage.

Investments to avoid in a recession

When a recession strikes, it's crucial to concentrate on choosing your next investment strategy wisely. Additionally, prices will likely have decreased somewhat before it is obvious that the economy is even in a recession because the market is forward-looking. Investments that feel secure now because their price has kept steady or even increased may not be the best choices in the future.

Bonds

In general, bonds are safer than stocks, but it's vital to keep in mind that there are excellent and poor times to buy bonds, and such times are typically associated with changes in the market's interest rates. This is due to the fact that bond prices are driven higher by falling interest rates and lower by rising interest rates. Changes in interest rates will have a greater impact on long-term bonds than they will on short-term bonds.

Investors may turn to the relative safety of bonds as they begin to foresee a recession. Typically, they anticipate the Federal Reserve will cut interest rates, which will support rising bond prices. Therefore, if rates haven't already dropped, entering a recession can be a good time to buy bonds.

On the other side, when interest rates are anticipated to increase soon, it is one of the worst periods to purchase bonds. And during and after a recession, such circumstance arises. Bonds may appear safe to investors, particularly when compared to the volatility of equities, but once the economy begins to expand again, interest rates will likely rise and bond values will decline.

Highly indebted companies

Companies with high debt loads that are susceptible to rising interest rates should be avoided, May advises.

Before and during a recession, the shares of highly indebted corporations typically see considerable declines. Investors discount the stock price to account for the risk that the debt on a company's balance sheet poses. The business could not be able to pay the interest on its loan and will have to default if sales decrease, which is normal during a recession.

Therefore, recessions can be especially challenging for enterprises with debt. However, as Ozanne admits, if the business can endure, it might present an alluring return. To put it another way, the market might be pricing in the company's demise, but if it doesn't come, the stock price may rise sharply. However, it's still a real possibility that the business would fail, leaving the remaining investors holding the bag.

High-risk assets such as options

Options and other high-risk investments are not appropriate during recessions. Options are a wager that the price of a stock will end above or below a specific price by a specific date. Although they are a high-risk, high-reward approach, the uncertainty brought on by a recession increases their risk.

With options, you must accurately anticipate not only what will happen to a stock price in the future but also when it will happen. And if you're wrong, you can end up having to put up more money than you had planned to contribute or lose your entire investment.

How to prevent a recession panic

Experts frequently stress how crucial it is to control your emotions when there is turbulence, which frequently occurs during recessions. Even the strongest financial strategy can be derailed by emotional decision-making, so here's how experts advise handling it:

- Maintain your long-term strategy. No matter how the economy is performing, have a long-term investment strategy or plan and adhere to it, advises Ozanne. He emphasizes the benefit of diversifying one's holdings, which can aid investors in surviving market upheaval.

- Keep emergency money on hand. In times of economic uncertainty like a recession, having an emergency fund can be very beneficial. It can not only keep you afloat but also keep you invested, giving your investments time to recover. During a recession, you don't want to have to use your investments to cover your expenses.

- Put an end to market watch. Avoid daily value monitoring if the volatility keeps you awake at night, advises May.

- More years than bad years have passed. According to Ozanne, there have historically been far more prosperous years for the financial markets than bad ones. In a downturn and correspondingly unfavorable market environment, it is wise to keep in mind that better investment times are undoubtedly still to come.

- Find a knowledgeable counselor. "Having an objective party communicate reason, logic, and strategy during an emotionally charged moment might stop investors from making errors that could substantially affect the long-term impact on their financial outcomes," adds Ozanne.

Post-recession

Investors should modify their strategy if the economy transitions from a recession to a recovery. Low-interest rates and increasing growth are characteristics of this economy.

The most successful businesses are those that made it through the recession and are cyclical, speculative, and highly leveraged. They are the first to recover as economic conditions return to normal and gain from rising fervor and hope as the recovery takes hold. Countercyclical stocks typically do poorly in this setting. Instead, as investors shift to more growth-oriented assets, they see selling pressure.

In conclusion

It can be risky to invest during a recession because the market can be very unpredictable and you'll probably try to limit your short-term losses. However, you can damage your long-term gains in the process. Therefore, it's crucial to maintain attention on your long-term strategy and the better times to come once the market starts to recover. Whatever method suits you best, try to prevent your emotions from influencing your choices.

FAQ

Is the US currently in a recession?

The United States has not yet formally entered a recession.

Two consecutive quarters of negative GDP are one common sign of a recession. In the first half of 2022, the U.S. met this requirement with GDP growth of -1.6% in the first quarter and -0.6% in the second. However, it's important to note that this fact alone does not indicate that the country is in a recession as the GDP declines were brought on by supply-chain disruptions.

How will the next recession be?

Investors can anticipate that if a recession does occur in 2023, it will have a smaller effect on the market than previous recessions like The Great Recession.

Is it considered risky to invest if a recession is nearing?

Markets are likely to decline as profits decline and growth turns negative in an economy that is on the verge of entering a recession. Stock investors should exercise extra caution during a recession as there is a good chance that the value of their investments will decline. However, it's challenging to predict when a recession will occur, and selling into a declining market might not be a wise move. The majority of experts concur that even during a recession, one should stick to their course, keep a long-term outlook, and take advantage of the situation to purchase stocks "on sale.”

What are the best assets in a recession?

A recession does not have the same effects on all assets. Consumer staples, utilities, and other defensive stocks may perform better as spending shifts to necessities. A company's ability to weather a brief drop in profits will also be greater than that of a growth stock with high capital expenditures. In response to a downturn in the economy, interest rates may decrease and bonds may increase outside of the stock market.

Which stocks are most affected by a recession?

Growth stocks are frequently the most susceptible to a recession if their balance sheets are weak and they have high debt loads. This is because as the economy weakens, they might find it difficult to raise new capital, and at the same time, lower consumer spending could reduce their profits. As a recession begins, speculative stocks with shaky fundamentals rank among the riskiest investments.