Defining short selling

A trading or investment method known as short selling makes predictions about the price drop of a stock or other security. Only seasoned traders and investors should use this sophisticated approach.

Investors or portfolio managers may use short selling as a hedge against the downside risk of a long position in the same security or a comparable one, while traders may use it for speculation. A speculation is a sophisticated form of trading that entails a high potential risk. A more frequent transaction is hedging, which involves taking an opposite position to lessen risk exposure.

In short selling, a position is established by obtaining borrowed shares of a stock or other asset, the value of which the investor anticipates falling. Afterward, the investor sells these borrowed shares to buyers who are prepared to pay the going rate. The trader is hoping that the price will continue to fall so they may buy the borrowed shares for less money before they have to be returned. Since the price of any asset might increase to infinity, the risk of loss on a short sale is essentially limitless.

How does it work?

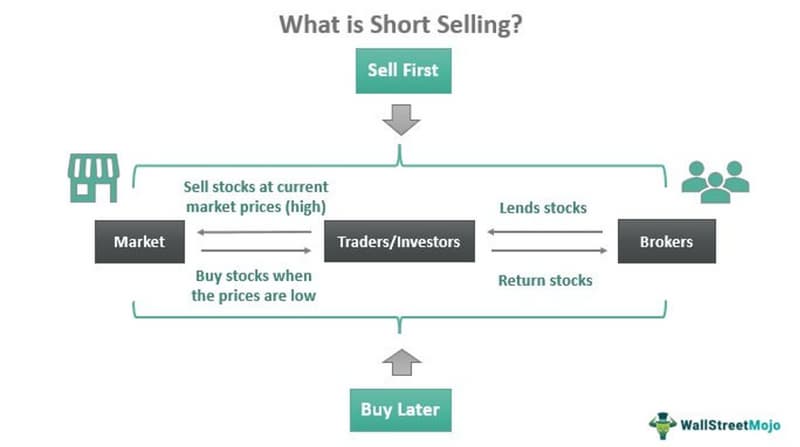

When a seller engages in short selling, they open a short position by borrowing shares, typically from a broker-dealer, with the intention of repurchasing them at a profit if the price falls. Because you cannot sell shares that do not exist, shares must be borrowed. A trader who wants to complete a short position buys the shares back on the market, ideally for less than they were originally lent, and then sells them back to the lender or broker. Any interest or commissions levied by the broker must be taken into consideration by the trader.

A trader needs a margin account to initiate a short position, and while the position is open, they often have to pay interest on the value of the borrowed shares. Additionally, minimum values have been established for the sum that the margin account must maintain (known as the maintenance margin) by the Federal Reserve, the New York Stock Exchange (NYSE), and the Financial Industry Regulatory Authority, Inc. (FINRA), which enforces the rules and regulations governing registered brokers and broker-dealer firms in the United States. More money is needed if an investor's account value goes below the maintenance margin, or the broker may sell the position.

The broker is in charge of finding shares that can be borrowed and returning them at the conclusion of the trade. With most brokers, the trade can be opened and closed using the standard trading interfaces. Each broker, however, will have requirements that must be satisfied before they permit margin trading.

How do you short-sell a stock?

While purchasing a stock only a few quick clicks, the process for shorting a stock entails several procedures. Additionally, the majority of investors are unable to decide to start shorting stocks out of the blue. A step-by-step tutorial on shorting stocks is provided below:

- With your broker, set up a margin account. A margin account, which enables you to borrow money to purchase stocks, is necessary for short selling. You must fulfill the minimal conditions outlined by the Financial Industry Regulatory Authority before you can begin trading on margin. It should be noted that short sellers are often required by federal law to have an initial balance in the margin account equivalent to 150% of the value of the equities they are short, with a maintenance requirement that is typically 30%.

- Examine potential short sellers. You must find an opportunity by studying stocks after receiving authorization from your broker to short a stock. Due to the possibility of losses, it's crucial to develop a strong thesis for why the stock's price would decline and for it to be supported by a careful examination of the business and its stock.

- Make a short-sale trade strategy. You should make a plan to enter the trade and, more crucially, to exit the transaction at a profit, accounting for fees and the interest paid on the amount borrowed, before carrying out any component of the deal. Since a short sell is based on the notion that prices would decline, you should also have a backup strategy to limit losses in the event that the stock's price increases.

- Carry out the short sale. After completing the aforementioned steps, it's time to fund your wager. The use of stop orders for transactions may make it simpler to carry out the trade as intended without letting emotions influence your choices.

Advantages and disadvantages of short selling

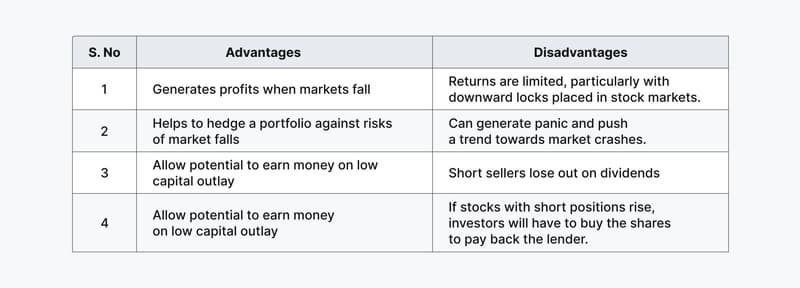

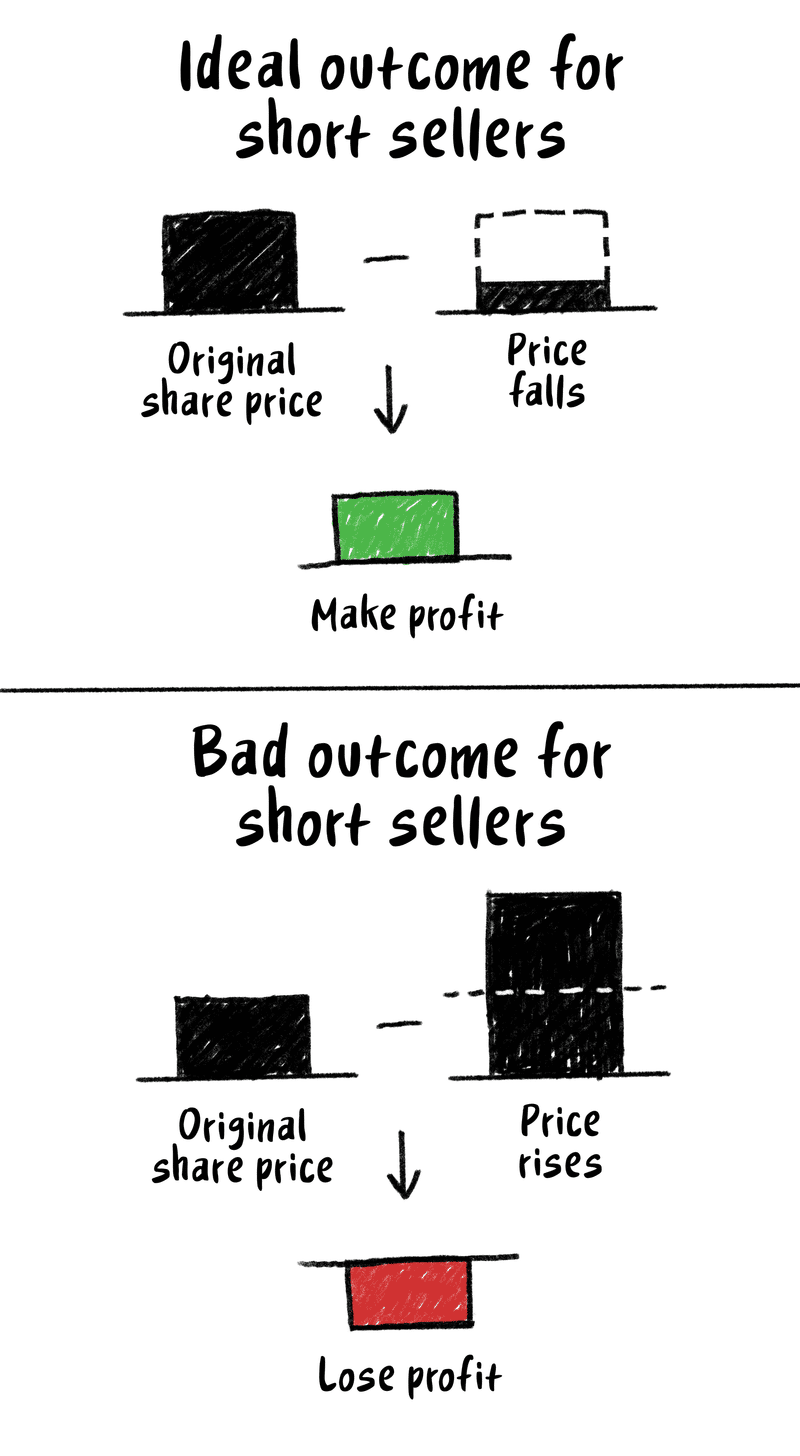

If the short seller predicts the price movement incorrectly, it could cost them money. If a trader purchases stock, they can only lose their entire investment if the stock decreases to zero.

A trader who shorts a stock, however, risks losing considerably more than their initial investment. The risk arises from the fact that a stock's price has no upper limit and can increase "to infinity and beyond," to use a term from Buzz Lightyear, a different cartoon character. Additionally, the trader had to fund the margin account while the equities were held. Even if everything goes according to plan, traders must include the expense of the margin interest when estimating their profits.

Advantages

- Potential for large profits

- Little upfront money needed

- Leveraged investments possible

- Hedge against other holdings

Disadvantages

- Losses that could go on forever

- A margin account is required

- Margin interest incurred

- Short squeezes

If many other traders are also shorting the company or if the stock is lightly traded, a short-seller can have problems locating enough shares to buy when it comes time to terminate a position. Conversely, if the market or a single stock starts to soar, sellers may find themselves in a short squeeze cycle.

On the other side, high-risk tactics also come with high returns. Short sales are not an exception. Sellers who utilize margin to start trades stand to gain handsome returns on their investments (ROI) if they properly forecast price movements. Leverage is made possible by using a margin, which implies the trader needed to deposit less money initially. Short selling can be a prudent, low-cost hedging strategy that acts as a counterbalance to other portfolio assets.

In general, novice investors should refrain from short-selling until they gain more trading expertise. However, because there is less of a chance of a short squeeze, short selling using ETFs is a little safer technique.

Assessing the risks

There are many dangers involved in short selling:

1. Potentially limitless losses.

When you purchase shares of stock (have a long position), your potential loss is capped at your initial investment. However, a stock's price can keep increasing if you short it. That implies that the sum you would have to pay to replace the borrowed shares has no upper bound.

For instance, if you start a short position on 100 shares of the stock XYZ at $80, the stock increases to $100 instead of sinking. To pay back your borrowed shares, you'll need to spend $10,000 at a loss of $2,000 on the transaction. Stop orders can reduce this risk, but they are far from foolproof.

Short-seller losses can be especially high during a "short squeeze," which happens when a heavily shorted company unexpectedly appreciates in value, setting off a chain reaction of price increases as more and more short-sellers are compelled to purchase the stock to close out their holdings. Every wave of buying drives the price of the stock higher, harming those who are still holding short positions.

2. A sudden change in fees.

As was already mentioned, supply and demand factors usually affect the cost of borrowing a stock. For instance, you might log off one evening holding a short position with a 20% interest rate and return the next morning to find it has increased to 85%. You might discover that it is no longer advantageous to keep your position available as a result. The situation would be much worse if the price of the stock you shorted rose together with the associated interest rate at the same time, driving up your cost to carry.

3. Dividend payments.

Dividend payments from borrowed shares are not due to short sellers. Any dividends paid will actually be given to the stock's owner after being withdrawn from the short seller's account on the pay date. To avoid paying a dividend, some short sellers decide to cut their losses before the stock's ex-dividend date. (Recall that the ex-dividend date is the first day that the price of a stock does not include the cost of a declared dividend. This is so because the owner of the shares owes the value of the upcoming dividend payment.)

4. Margin calls.

Depending on the company and the specific securities you own, your brokerage may require you to deposit additional funds or assets right away to make up the difference if the value of the collateral in your margin account falls below the minimum equity requirement, which is typically 30% to 35% of the value of the borrowed shares.

For instance, assuming a 30% equity requirement ($8,000 x.30), you'll need $2,400 in your margin account as long as your 100 shares of stock XYZ continue at a price of $80 each. However, if the stock suddenly increases to $100 a share, you'll need $3,000 ($10,000 x.30) and may or may not have the $600 to do so.

Your brokerage company may close out active positions to bring your account down to the required minimum if you don't make the margin call.

Short selling as a hedge

In addition to speculating, short selling serves the helpful aim of hedging, which is frequently viewed as the safer and more reputable version of shorting. Hedging's main goal is protection, as opposed to speculation's sole focus on profit. Hedging is done to safeguard gains or lessen losses in a portfolio, but because it is expensive, the great majority of individual investors don't think about it very often.

Hedging involves two expenses. Then there is the real cost of placing the hedge, which includes the fees for short sells or the premiums for protective options contracts. In the event that markets continue to rise, there is also the lost opportunity cost of capping the portfolio's gain. For a straightforward illustration, assume that 50% of a portfolio that closely resembles the S&P 500 index (S&P 500) is hedged. If the index increases by 15% over the ensuing 12 months, the portfolio would only see around half of that gain or 7.5%.

Metrics for short selling

Short-selling activity on a stock is monitored using the following two metrics:

- Short interest ratio (SIR)— Commonly referred to as the short float, calculates how many shares are currently being shorted in relation to how many shares are available or "floating" in the market. A stock with an extremely high SIR is likely to be decreasing in price or seem to be overvalued.

- The short interest to volume ratio— The total number of shares held short divided by the stock's typical daily trading volume is known as the short interest to volume ratio, sometimes referred to as the days to cover ratio. Another bearish sign for a stock is a high day-to-cover ratio number.

Investors can determine if the overall mood is bullish or negative for a stock using either of two short-selling criteria.

For instance, General Electric Co.'s (GE) energy businesses started to negatively impact the performance of the entire business after oil prices fell in 2014. As short-sellers started to predict a collapse in the stock in late 2015, the short-interest ratio increased from less than 1% to more than 3.5%. The share price of GE peaked at $33 per share in the middle of 2016, at which point it started to fall. Any short sellers who were fortunate enough to short the stock near the top in July 2016 would have had a profit of $23 per share by the time GE dropped to $10 per share in February 2019.

Short selling – the ideal condition

When it comes to short selling, timing is essential. A significant gain in a company may be erased in a matter of days or weeks on an earnings miss or other unfavorable occurrence because stocks normally decrease considerably more quickly than they increase. Thus, the short seller must almost perfectly time the short trade. Due to the possibility that a sizable portion of the stock's decrease may have already taken place, entering the trade too late may result in a significant opportunity cost in terms of lost gains.

On the other side, if the trade is entered too early, it can be challenging to maintain the short position given the associated costs and potential losses, which would soar if the stock advances quickly.

The likelihood of a successful short sale increases on occasion, for example:

During a bear market

During a bear market, the main trend for a stock market or industry is downward. As a result, traders who adhere to the mantra "the trend is your friend" stand a better chance of making money on short sales during a bear market than they would during a bull market. As in the global bear market of 2008–09, short sellers thrive in situations where the market downturn is quick, wide, and steep because they stand to gain unexpected profits.

When stock or market fundamentals are deteriorating

Any number of factors, including slower revenue or profit growth, escalating company issues, growing input costs that are straining margins, etc., might cause a stock's fundamentals to deteriorate. For the overall market, deteriorating fundamentals could be characterized by a string of weaker data points that point to a potential economic slowdown, unfavorable geopolitical developments like the threat of war, or bearish technical indicators like new highs on declining volume and worsening market breadth.

Experienced short sellers would opt to hold out on placing short trades until the negative trend is established rather than doing so in anticipation of a downward move. This is due to the possibility that a company or market could continue to rise despite weakening fundamentals for several weeks or months, as is frequently the case in the closing stages of a bull market.

Technical indicators confirm the bearish trend

When various technical indications support the negative trend, short sales may also be more likely to succeed. A breakdown below a significant long-term support level or a bearish moving average crossing like the "death cross" are examples of these indications. When a stock's 50-day moving average drops below its 200-day moving average, this is an illustration of a bearish moving average crossover. A moving average is nothing more than the mean price of a stock over a predetermined period of time. A new price trend may be indicated if the current price breaks the average, either upward or downward.

Valuations reach elevated levels amid rampant optimism

Occasionally, valuations for specific industries or the market as a whole may rise to extremely high levels due to unbridled optimism on the long-term prospects of such industries or the overall economy. Market experts refer to this stage of the investing cycle as "priced for perfection" because they know that investors will eventually be let down when their high expectations are not satisfied. Experienced short-sellers may wait until the market or sector rolls over and starts its downward phase before jumping in on the short side.

The economic theories developed by famous British economist John Maynard Keynes are still in use today. The phrase from Keynes that is particularly applicable to short selling is "The market can stay irrational longer than you can stay solvent." When all of the aforementioned elements are present, short selling is most advantageous.

Naked short selling

In general, investors cannot short a stock unless they can borrow the required shares or demonstrate that they can get the shares within the short sale's clearing period (the day of the trade plus two business days).

The illegal act of shorting shares that the investor never really acquired is known as naked short selling. Selling shares that are either unavailable or nonexistent is how naked short sellers make money. They anticipate that shares will become available before the clearing window closes, allowing them to close out their short position before the original sale is even completed.

Because naked short-selling can go horribly wrong in a variety of ways and hurt the innocent party on the opposite side of the deal, it is prohibited in the United States. The naked short seller can be compelled to close their short bet due to a margin call before acquiring the shares, or they might be unable to buy the shares inside the clearing window.

A failure to deliver might result from this, in which the party on the other side of the exchange is simply conned; they pay money for shares in hopes of obtaining them or having their money back.

Short selling – a real-world example

Unexpected developments in the news can cause a short squeeze, which may compel short sellers to buy at any price in order to meet their margin obligations. For instance, after a massive short squeeze in October 2008, Volkswagen briefly surpassed Apple as the most valued publicly traded corporation in the world.

Investors were aware in 2008 that Porsche was attempting to expand its holdings in Volkswagen and take a controlling stake. Short sellers heavily shorted the shares because they believed it would lose value if Porsche gained control of the organization. The sudden disclosure by Porsche that they had surreptitiously purchased more than 70% of the business through derivatives set off a large feedback cycle in which short-sellers bought shares to cover their positions.

Due to Porsche controlling another 70% of Volkswagen and a government entity owning 20% of the company that was not interested in selling, there were relatively few shares available on the market (float) to purchase back, which put short sellers at a disadvantage. In essence, the stock jumped from the mid $200s to over $1,000 since the short interest and days-to-cover ratio both skyrocketed higher overnight.

Short squeezes have a tendency to dissipate rapidly, and within a few months, Volkswagen's stock had dropped back into its usual range.

FAQ

Why is it defined as ‘selling short’?

A short position is a wager against the market that wins money when prices fall. Such a wager is made when one sells short. This contrasts with a long position, which is purchasing an asset in anticipation that its price would increase.

Why do short sellers borrow money?

Something that doesn't exist cannot be sold. A short seller must first locate some of a company's outstanding shares because there are only a certain number of them available for sale. As a result, the short seller borrows those shares from an existing long and pays the lender interest. One's broker frequently supports this process in the background. The interest expenses associated with selling short will be higher if there are few shares available for shorting (i.e., if borrowing is difficult).

Is short selling considered a bad option?

While some people believe that betting against the market is unethical, the majority of economists and financial experts concur that short sellers give market liquidity and price discovery, increasing its efficiency.

Is it possible to sell short in a brokerage account?

Short selling is permitted by many brokers in individual accounts, but you must first open a margin account.

What is a short squeeze?

Due to the fact that short sells are offered on margin, even very minor losses might result in increasing margin calls. The short seller must purchase back their shares at ever-higher prices if a margin call cannot be fulfilled. By doing this, the stock price is raised even further.