Defining fractional shares

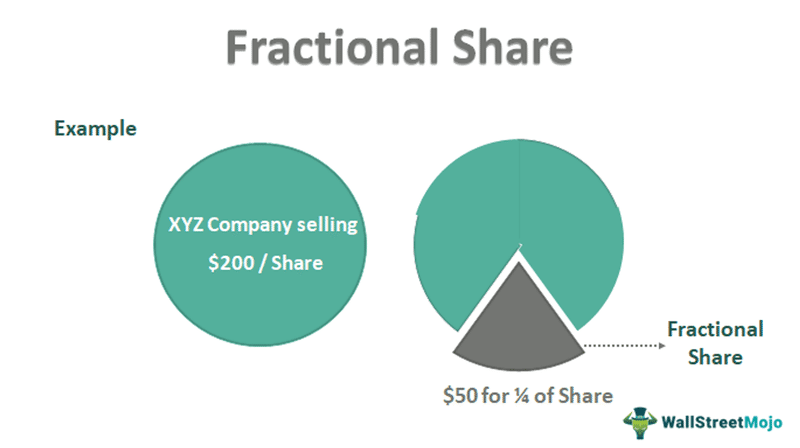

As the name suggests, fractional shares are little bits, slices, or portions of stocks and ETFs.

You could buy fractional shares for a variety of reasons, including: Instead of attempting to buy a round number of shares with a variable stock price, say $90 one month and $150 the next, you may not have enough money to purchase a whole share of a stock or you may prefer to invest a fixed dollar amount—say $100—into a stock or ETF each month.

Investing in fractional shares is a relatively recent trend; until recently, it was virtually difficult to purchase fewer than one share of stocks or an ETF. Long supported by mutual funds, fractional share ownership was formerly only possible in a few select circumstances.

Stock splits or reverses stock splits

When a firm splits its stock, it increases its share count by distributing extra shares to owners. For instance, in a 3:2 stock split, you would get three shares for every two that you already own. Therefore, if you previously held 15 shares, you now own 22 1/2 shares. A fractional share is that extra half-stock. You would receive two shares for every three you currently possess in a reverse stock split of 3:1.

Dividend reinvestment plan (DRIP)

With a DRIP, new shares are automatically purchased with dividends received from a firm or fund. Investors may end up having fractional equity as a result of this. Assume you held 200 shares of a corporation with a $0.30 annual dividend payment. This year, you would be eligible for dividends worth $60. The dividends would automatically purchase one and a half shares if the stock were trading at $40. You would ultimately hold 201 1/2 shares of stock.

Mergers and acquisitions

The stock of a company may be exchanged for new shares when it merges or is acquired. To merge equities from various companies, they typically utilize a ratio, thus three shares of Company B may become five shares of Company A. Fractional shares could be produced by this procedure.

Buying fractional shares

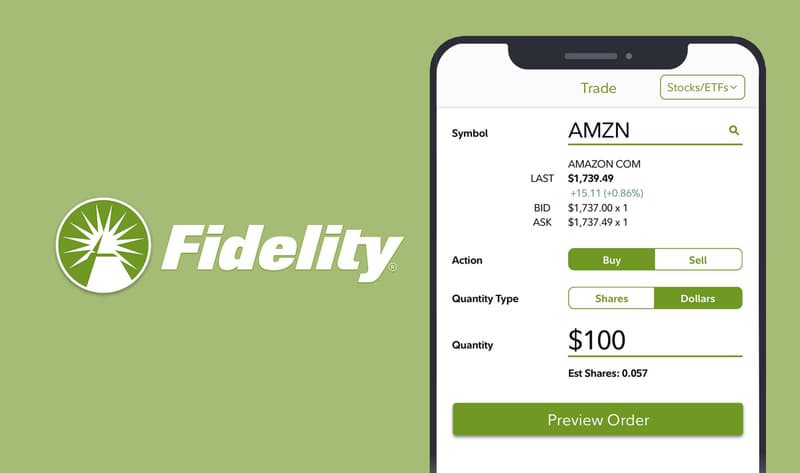

Fractional shares are available on several online brokerage platforms, such as Fidelity, Charles Schwab, and Robinhood. Investing software like Stash, Cash App Investing, and SoFi Invest all provide fractional shares. Acorns and Betterment are two Robo-advisors that buy fractional shares for your portfolio (but not all: Wealthfront holds your money as cash until you have enough to buy whole shares).

You might need to purchase fractional stock worth at least $1 or as much as $5, depending on the brokerage. Additionally, not every stock or exchange-traded fund (ETF) offered for sale on an investment site is offered in fractional shares. For instance, Charles Schwab exclusively offers fractional shares of S&P 500 firms, whereas Stash provides a carefully curated range of equities and ETFs.

If you wish to purchase fractional shares, be sure the online brokerage and investing app you chose supports this before signing up. Check out the list of stocks or ETFs that are offered in fractional shares as well.

Finally, confirm that there are no additional commissions or costs for investing in fractional shares. Due to the fact that fractional share purchases are typically made in smaller cash amounts, fees may significantly reduce your returns.

An example of trading fractional shares

Orders for fractional shares may be placed in either share or dollar denominations. The nearest cent will be added to every purchase.

You can specify the price at which you want to buy or sell a stock by placing an order to Buy in Dollars or Sell in Dollars. Given the current market conditions, Robinhood will convert this cash amount to the corresponding number of shares and then buy or sell the stock at the best price.

With the app:

- Visit a specific stock detail page.

- Choose Trade, Buy, or Sell.

- In the top right corner, touch the green word (this might say Shares)

- Select Buy in Dollars.

- Then, enter the amount of money you want to exchange.

Keep in mind that you must specify a value of at least $1.00 when buying or selling fractional shares. However, if you own any fractional share for less than $1.00, you will be given the choice to Sell All.

Selling fractional shares

Fractional shares can only be sold through a big brokerage company, which can combine them with other fractional shares to create a complete share. Selling the fractional shares could take longer than expected if there is a low level of market demand for the selling stock.

Not everyone wants to keep their fractional shares, especially if they acquired them accidentally due to stock splits or other similar events. A stockholder may have 225 shares of XYZ valued at $12 each. After a stock split of three for two, they would have 33712 shares at an $8 per share price. Finding a brokerage prepared to accept the fractional share will be easier if there is a large demand for XYZ stock in the market. Alternatively, they could locate a brokerage business ready to sell another half-share, bringing their total share count to 338.

Why would you buy fractional shares?

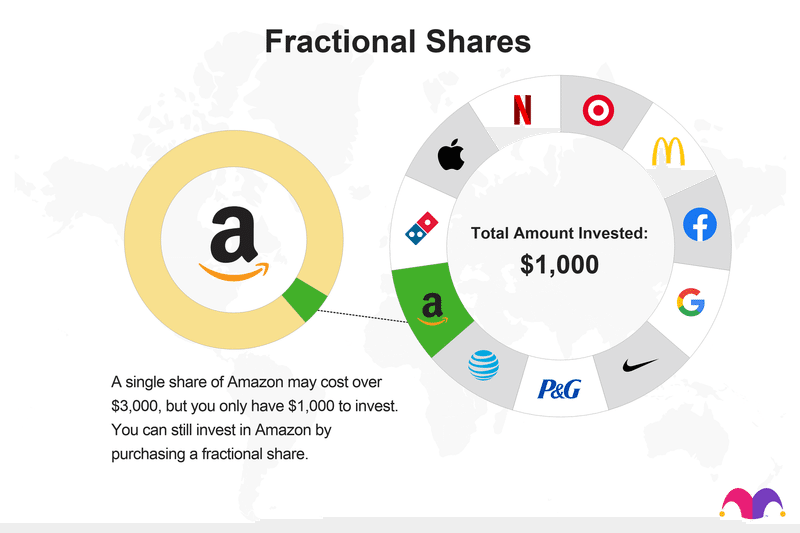

To purchase equities that you otherwise couldn't afford

You can create the portfolio you want but couldn't previously afford it with the help of fractional shares. For instance, you would need at least $3,000 merely to add a company to your portfolio if it traded for $3,000 per share, which isn't unheard of. Want to purchase several shares? You will need to buy in $3,000 increments ($6,000 for two shares, $9,000 for three shares, etc.). You'll need to make another investment if you don't have that much money saved away.

With fractional shares, however, this is not the case. You can purchase as much stock as you can afford, whether that is $5, $50, $500, or $5,000, thanks to fractional trading.

ln order to have a diversified portfolio

These days, some of the most well-liked stocks are also some of the priciest. Even with just a few shares of each stock, assembling a well-diversified portfolio may cost tens of thousands of dollars upfront.

Say you had $6,000 to put into investments. With fractional shares, you can divide your funds across the businesses you want to invest in. No matter the share price, if that percentage is 10%, you may buy $600 worth of stock each in ten different businesses. When compared to investing a big sum in a single company, this helps you create a portfolio that is far more broadly diversified.

In order to maximize your investment

It's exceedingly unlikely that, if you consistently make a predetermined monthly payment to an investment account (a practice known as dollar-cost averaging), you're purchasing exactly that amount of stock with each contribution.

Fractional shares can solve this problem, according to Michael Pappis, a certified financial adviser and the chief executive officer of Amity Financial Planning in Pittsburgh.

Dollar-cost averaging with fractional shares enables you to invest the entire sum of money you regularly deposit into your investing account, according to Pappis. "Instead, without fractional shares, some of your funds might have been in cash before there was enough to buy a whole share," the author writes.

You can only purchase one whole share, for instance, if your monthly contribution is $100 and the stock you want to invest in is now trading for $55. You would be leaving $45 in uninvested funds languishing in your brokerage account if you didn't have the opportunity to purchase fractional shares.

Advantages of fractional shares

Start out by making tiny investments

Fractional shares can be really helpful if you're just starting out and don't have much money to invest. They enable you to enter the market right away and benefit from compounding gains more quickly.

Reduce the cost of portfolio diversification

Diversification is one of the fundamental principles of portfolio construction. You can lessen your risk of losing money if one of your stocks crashes by investing in a range of equities, especially ETFs. You may be able to purchase a wider variety of stocks than you would be able to otherwise because fractional investing enables you to purchase several shares for $1 to $5.

Better possibilities for dollar cost averaging

You routinely invest a predetermined sum of money when you use dollar cost averaging. This may allow you to pay less per share over time than you would if you purchased all of your shares at once. Dollar-cost averaging works best when you can invest the full amount because it concentrates on a consistent dollar amount rather than a steady share amount. If not, you will need to wait until you have enough cash in an account to acquire a whole share.

Drawbacks of fractional shares

A limited selection of stocks

Not all stocks can be purchased in fractional shares. If you buy fractional shares, you might not have as many options for firms.

Liquidity

With your fractional shares, you could not have instant asset liquidity. It's possible that fractional shares don't move as frequently or quickly as complete shares. Order filling times may be slower since brokers hold off on purchasing whole shares until they have enough fractional orders. Additionally, it may take longer to buy or sell your fractional shares occasionally because not all fractional shares are in great demand.

Shareholder Rights

If you own less than a full share, you might not be allowed to use your voting rights on corporate matters, depending on your broker. For instance, Robinhood converts fractional shares into entire shares in order to record votes to corporations. While Stash requires that you own at least one share of a firm before you may vote on corporate matters.

Transfers

Some brokers forbid you from transferring fractional shares to different brokers. Instead, they sell any fractional shares and transfer any complete shares to pay you cash. If you can immediately repurchase shares at your new brokerage, this might only be a minor annoyance. However, if the value of your fractional shares has increased, liquidation them may result in unforeseen tax repercussions.

Dividends

If you own fractional shares, you will get portions of the stocks' dividends, just like fractional stocks do. Therefore, if a distribution is $0.50 per share and you own half of a share, your payout will be $0.25.

Make sure you comprehend the policies of your brokerage regarding fractional shares and the advantages and disadvantages of buying shares in smaller amounts before making a purchase.

Canceling a fractional order

The method for canceling a pending fractional order is the same as the method for canceling a pending order in general. A few circumstances, nevertheless, prevent you from canceling a pending fractional order.

An unfulfilled fractional order cannot be canceled:

- During a trading halt: A number of factors might cause trading on specific security or in the market as a whole to be suspended. You will have the ability to cancel pending fractional orders if single security or the market as a whole is experiencing a trading standstill, but the cancel requests won't be completed until the halt is lifted. The timing of these halts is out of our hands, and neither is the decision to implement them.

- If a trading halt is implemented before the order executes but the order has been routed to a market center, you won't be able to change your fractional order at that time. Once the halt is lifted, the order would then go into effect.

- Between 9:20 and 9:30 AM ET: You have until 9:20 AM ET to cancel a fractional order that you made outside of trading hours before the market opens. Fractional orders cannot be canceled between 9:20 and 9:30 AM ET since it is too close to market opening.

Fractional shares example

The first of the main online brokers to provide fractional share trading was Interactive Brokers in November 2019. Fidelity stated on January 29, 2020, that it will provide fractional share trading for stocks and ETFs.

FAQ

Can you buy fractional shares in the form of dividends?

Yes, you can purchase fractional shares of dividend stocks, but the number of dividends you receive will depend on how many shares you own. As a result, if you invest $25 in a stock with a $100 per share price and a $1 dividend, your dividend will only be 25 cents.

A business may decide to give its shareholders a cut of its profits in the form of a dividend that is distributed once or possibly more frequently each year and is calculated according to the number of shares that each shareholder owns. Similar to how having shares of a corporation entitles a shareholder to dividends, owning a fractional share also entitles a shareholder to a dividend, albeit one for a correspondingly smaller fractional amount.

What happens if there is a stock split after the fractional shares are bought?

Stock splits, which occur when a corporation lowers the price of its stock while increasing the number of shares you must own to make up the difference, won't have any different effects on your fractional shares than they would have if they were full shares. If a business splits its shares two for one, you would now hold seven shares instead of just 3.5. However, the overall value of those shares remained constant.

Can ETFs be bought as fractional shares?

Yes, certain brokers provide fractional shares of ETFs. In case you forgot, ETFs are index funds that can be traded all day long, just like stocks (compared with traditional index funds, which can only be bought and sold for a determined price at the end of the day). Your portfolio can be significantly (and simply) diversified with just one ETF. Fractional share purchases of numerous ETFs give still another level of diversification.

Do all brokers follow the same rules when it comes to fractional shares?

Due to the fact that fractional shares are still a relatively new offering, it is crucial to read the fine print for each broker to determine the options available. For instance, SoFi Active Investing has a small selection of stocks and ETFs to pick from, but Fidelity offers fractional shares for almost any stock listed on a major market.

When you sell fractional shares from reinvested dividends, what happens?

Similar to how an investor would sell fractional shares obtained through any other method, fractional shares from reinvested dividends can be sold. In most circumstances, selling fractional shares will require you as an investor to go via an intermediary (often a brokerage business). In order to sell a whole share, the company may combine your fractional share with those of others, or it may resell your fractional share to a buyer. Only if you sell all of your shares in the company at once will some corporations buy your fractional share directly.