Defining index funds

A mutual fund or exchange-traded fund (ETF) known as an index fund has a portfolio built to replicate or follow the components of a financial market index, such as the Standard & Poor's 500 Index (S&P 500). A mutual fund that invests in indexes is considered to offer low operating costs, broad market exposure, and minimal portfolio turnover. No matter how the markets are doing, these funds continue to invest in their benchmark index.

For retirement accounts like individual retirement accounts (IRAs) and 401(k) plans, index funds are typically regarded as the best core portfolio holdings. Index funds are a safe shelter for retirement money, according to legendary investor Warren Buffett. He has stated that it makes more sense for the typical investor to purchase all of the S&P 500 firms at the cheap cost that an index fund offers rather than choosing specific stocks for investment.

How do they work?

A type of passive fund management is "indexing." A fund manager develops a portfolio whose holdings mimic the securities of a specific index rather than actively stock selecting and market timing, that is, deciding which assets to invest in and planning when to buy and sell them. The theory is that by closely matching the index's profile—the stock market overall or a significant portion of it—the fund will match its performance.

For almost all of the financial markets in existence, there is an index and an index fund. The most well-liked index funds in the US follow the S&P 500. However, a number of other indices are also extensively used, such as:

- The largest U.S. equity index is the Wilshire 5000 Total Market Index.

- European, Australian, and Far Eastern foreign equities make up the MSCI EAFE Index.

- The whole bond market is followed by the Bloomberg U.S. Aggregate Bond Index.

- 3,000 equities that are traded on the Nasdaq market make up the Nasdaq Composite Index.

- 30 large-cap firms make up the DJIA, or Dow Jones Industrial Average.

For instance, an index fund tracking the DJIA would make investments in the same 30 sizable, publicly traded businesses that make up that index.

Index fund portfolios only see significant changes when their benchmark indices do. The management of a fund that tracks a weighted index may occasionally adjust the percentage of various securities to reflect the weight of those stocks' participation in the benchmark. A technique called weighting equalizes the impact of each asset in an index or portfolio.

The importance of index weighting for index funds

Different weighting algorithms are used by indexes to follow their underlying assets, and the decision made can significantly affect how an index fund performs. A price-weighted index considers the market price of each asset: Assets with higher prices make up a larger portion of the index than those with lower prices. Price-weighted indexes include the Dow Jones Industrial Average (DJIA): Each firm tracked by the DJIA has a weighting in the index based on its share price.

In contrast, a market-cap weighted index calculates each asset's portion in the index based on its market capitalization, or the total amount of money invested in it. A market-cap weighted index, the S&P 500: The weighting of each component firm in the index is based on its market capitalization.

Why is this important? A fund that follows a price-weighted index must alter its portfolio holdings more frequently in order to stay up with the target index when market prices change. Market-cap weighting reduces the amount of buying and selling necessary to keep the fund in line with its aim. However, the performance of the index and any funds based on it can be significantly impacted by large-cap assets.

Independent of price or market value, big or little, an equal-weight index offers the same weighting in its calculation to each asset it tracks. No one holding has an outsized effect—positive or negative—on the performance of an index fund, according to this definition.

How do you invest in index funds?

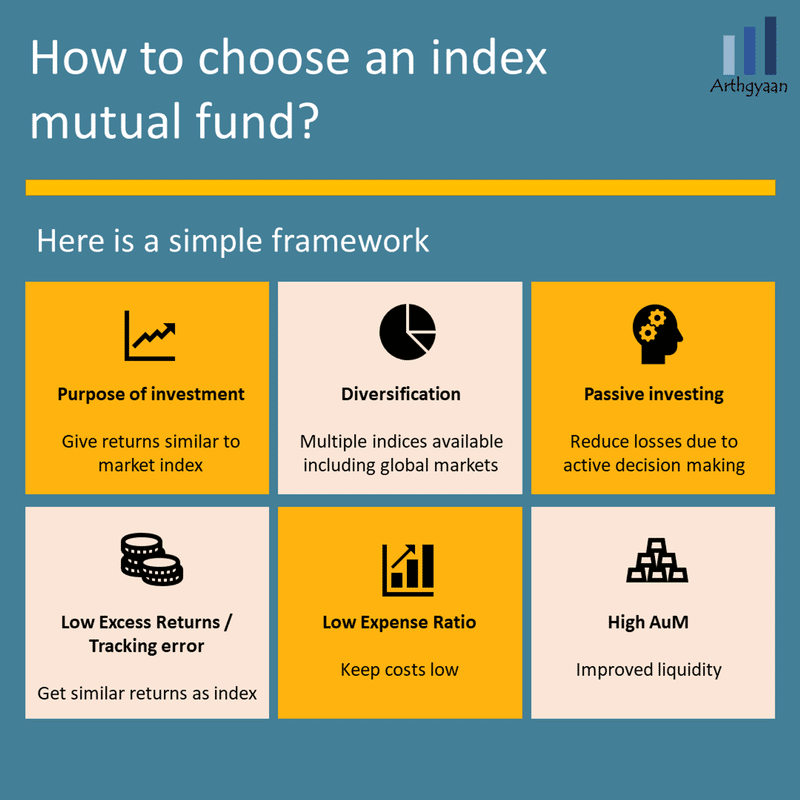

Anyone who wishes to invest money has access to index funds. Although brokers that provide fractional shares can assist you to get around this requirement, ETFs normally demand a purchase of at least one share. However, index mutual funds can require a $1,000 or more down payment at first. Since many of these index funds follow the same index, it's critical to compare them using two important criteria.

- The expense ratio: Since index funds don't have an active manager, their costs are typically quite low. However, there is a price to pay. To determine how much of your funds will be used for administrative and operating expenses, make sure to compare the expense ratio.

- The tracking error: Examine the fund's historical performance as well. The index was matched, but how well? You should search for other funds that have historically been able to keep up better with the index if a fund has a high tracking error, which shows how far the fund deviated from mirroring the index.

Advantages and disadvantages of index funds

Consider the potential benefits and drawbacks before investing your money somewhere. Consider these important aspects while selecting index funds.

Pros

- Low costs: Index funds are a fantastic, affordable method of investing. The asset-weighted average cost ratio for stock index mutual funds in 2021 was just 0.06 percent, which is an unbeatable deal. On an asset-weighted basis, index ETFs came in at a still-cheap 0.16 percent.

- Instant diversification: An index fund gives you the opportunity to spread your stake across a large pool of investing alternatives rather than trying to pick specific equities or bonds. Index fund investment, in the words of Jack Bogle, the late creator of Vanguard, involves purchasing the entire haystack as opposed to searching for the needle in the haystack.

- More tax efficiencies: Index funds don't produce unexpected taxable capital gains distributions because they don't continuously acquire and sell securities, as actively managed funds do on a regular basis.

- Better informed: The equities that comprise an index are known to the general public. You will get informed, for instance, whenever a new business joins the S&P 500. This is a significant distinction from actively managed funds, where the fund manager may wager on a business with a spotty track record without informing you.

Cons

- Market cap weighting can make a fund underperforming: An index fund might not be as diverse as you might assume if it becomes overweighted with certain stocks. Take the S&P 500 index as an example; more than 25% of its assets are in the top 10 corporations. Because of this, the fortune of these funds is heavily skewed in their favor.

- Inability to sell: Although not strictly speaking a disadvantage, this is a crucial lesson to learn when investing in index funds. These aren't intended for continuous trading. When shares of an index fund are sold within a specific time period, such as 90 days after acquisition, some mutual fund firms may impose fees. But don't let that put you off: They do this to keep costs down for all fund investors by minimizing trading and administrative expenditures. Keep in mind that the secret to successful long-term investing is to stick with it through the ups and downs throughout time.

Index funds – key facts

- They offer a covert means of purchasing the entire market. The stocks that make up a full index are purchased by an index fund. The fund purchases shares from each firm listed on the index, for instance, if the index tracks the Standard & Poor's 500, an index of 500 of the top corporations in the United States (or a representative sample of stocks). Shares of the fund are then purchased by an investor, whose investment will reflect the gains and losses of the index being monitored.

- You actually triumph when you admit defeat. If you choose particular equities, your chances of outperforming the market are probably slim. Even experts don't: More than 90% of active fund managers underperformed their benchmark index from 2001 to 2016, according to research. Thus, achieving market gains is a safer wager than outperforming the market, and index funds are made specifically to do this.

- Investors are becoming more and more interested in index funds. Between April 2014 and April 2017, actively managed mutual funds and exchange-traded funds in the U.S. had withdrawals of almost $514 billion, while passively managed funds experienced inflows of nearly $1.6 trillion. Interest has been stoked in part by the emergence of Robo-advisors and passive investing in general. Here is a more thorough comparison between mutual funds versus index funds.

- There are index funds available for many different asset classes. Investors can purchase funds that concentrate on businesses with small, medium, or big capital values, as well as funds that target particular industries, such as technology or energy. These indices are more diversified than if you were to acquire shares in a small number of companies within a sector, albeit possibly not as diversified as the broadest market index.

Actively Managed Funds vs. Index Funds

Passive investing is the process of purchasing index funds. The opposing approach is active investing, which is implemented in actively managed mutual funds—those with the portfolio that managers mentioned above, which includes securities selection and market timing.

Lower Costs

The lower management expense ratio of index funds over their actively managed equivalents is one of their main advantages. The expenditure ratio of a fund, commonly referred to as the management expense ratio, takes into account all of the costs associated with running the business, including the cost of paying managers and advisers as well as transaction fees, taxes, and accounting fees.

Research analysts and other professionals who aid in company selection are not required by index fund managers since they are only copying the performance of a benchmark index. Less frequent trading results in lower transaction costs and commissions for index fund managers. Actively managed funds, on the other hand, employ larger staff and carry out more transactions, which raises the cost of conducting business.

The fund's expense ratio reflects the additional costs of fund management and passes those costs forward to investors. Since actively managed funds normally charge substantially higher fees, ranging from 1% to 2.5%, affordable index funds frequently have expense ratios below 1%—typically between 0.2% and 0.5%, with some companies offering even lower expense ratios of 0.05% or less.

The entire performance of a fund is directly impacted by the expense ratio. Due to their sometimes-higher expense ratios, actively managed funds are automatically at a disadvantage against index funds and find it difficult to match their benchmarks in terms of overall performance.

Find out which index funds are accessible to you by using the mutual fund or ETF screener in your online brokerage account if you have one.

Pros

- Through diversity, reduce risk

- Low-cost ratios

- Dependable long-term returns

- Ideal for buy-and-hold investors who are passive

- Tax reductions for investors

Cons

- Vulnerable to changes in the market and crashes

- Not being flexible

- No human component

- Restricted gains

Better Returns?

Advocates claim that the majority of actively managed mutual funds have been outperformed by passive funds. In fact, the majority of mutual funds fall short of outperforming their broad market or benchmark indices. For instance, according to SPIVA Scorecard data from S&P Dow Jones Indices, for the five years ending December 31, 2020, over 75% of large-cap U.S. funds produced returns that were lower than those of the S&P 500.

However, passively managed funds don't try to outperform the market. Instead, based on the idea that the market always prevails, their strategy aims to equal the market's overall risk and return.

Over time, passive management usually results in improved performance. Active mutual funds perform better in time periods that are shorter. According to the SPIVA Scorecard, only around 60% of large-cap mutual funds underperformed the S&P 500 over the course of a year. In other words, roughly 25% of them succeeded in the near run. Additionally, actively managed money is required in other categories. For illustration, over 86% of midcap mutual funds outperformed the S&P MidCap 400 Growth Index over the course of a year.

Index fund example

Since the 1970s, index funds have existed. They have soared in value in the 2010s thanks to a combination of factors including the popularity of passive investing, the allure of low fees, and a protracted bull market. Investors put more than $400 billion into index funds in 2021, across all asset classes, according to Morningstar Research. Actively managed funds lost $188 billion within the same time period.

The initial fund, established by Vanguard chairman John Bogle in 1976, is still among the top because of its overall long-term success and affordable price. The performance and composition of the Vanguard 500 Index Fund have closely mirrored those of the S&P 500. Vanguard's Admiral Shares (VFIAX) had a very slight tracking error as of Q2 2022, with an average 10-year cumulative return of 237 percent compared to the S&P 500's 238.1 percent. The minimum investment is $3,000, and the expense ratio is 0.04%.

Common index funds

U.S. stock indexes

One of the most popular benchmarks for equities of major American corporations is the S&P 500 index. While the S&P represents around 80% of the overall value of the American stock market, some investors choose extended market index funds to help them monitor the other 20%. The FT Wilshire 5000 index accurately depicts every publicly traded stock in the nation, whereas the Russell 1000 index covers the 1,000 largest U.S. stocks.

Another well-known index is the Nasdaq 100, which includes a large concentration of prominent tech firms like Apple and Amazon and has historically produced excellent returns.

International stock indexes

Many index funds that track stocks in developed and emerging markets around the world are available to investors who want to take advantage of growth prospects there as well. There are total international index funds as well, which include everything outside of the United States.

Bond indexes

You can invest in a variety of bond index funds in addition to broad-based stock index funds, including short-term bonds with impending maturities, long-term bonds with maturities greater than ten years, emerging market government bonds, and more.

Dividend indexes

Some fund managers develop and maintain their own exclusive indexes, such as indexes for dividend-paying stocks. Only equities that pay a dividend are included in dividend indexes, and exchange-traded funds (ETFs) are a well-liked option for investors to access a diversified portfolio of dividend-paying businesses.

FAQ

How do index ETFs work?

Exchange-traded funds (ETFs) can be arranged as index funds (index ETFs). These items essentially consist of professionally managed portfolios of stocks, where each share is a little ownership position in the overall portfolio. In the case of index funds, the financial institution's objective is to merely match the performance of the underlying index rather than to outperform it. The index fund manager will try to replicate the index's composition by having a certain stock make up 1% of its portfolio, for instance, if that stock makes up 1% of the index.

Do index funds require fees?

Yes, there are costs associated with index funds, but they are typically substantially cheaper than those of similar products. Active funds frequently impose costs of more than 1%, whilst many index funds offer fees of less than 0.2%. When compounded over longer time periods, this disparity in fees can significantly impact investors' results. This is one of the key causes of index funds' recent surge in popularity as a form of investing.

What is better – stocks or index funds?

Index funds monitor stock-heavy portfolios. As a result, diversification has advantages for investors, such as raising the portfolio's projected return while lowering total risk. Even while any given stock could experience a sharp decline in price, the effects would be less severe if the stock were only a minor part of a bigger index.

Are index funds considered good investments?

The majority of experts concur that index funds provide excellent long-term investments. They are affordable solutions for getting a portfolio that passively tracks an index and is well-diversified. To ensure that you are monitoring the finest index for your objectives at the most affordable price, make sure to compare various index funds or ETFs.

Are index funds passive investments?

Investments that are passively managed are index funds. While the merits of actively managed mutual funds versus passive index index funds are up for dispute, there is a compelling case to be made that passively managed index funds are less expensive and may provide superior long-term returns.

Mutual funds that are actively managed make an effort to outperform a benchmark index. For instance, an actively managed fund that compares its performance to the S&P 500 would use a variety of trading strategies to try to outperform the index's annual returns. This strategy calls for greater manager participation, more frequent trading, and hence higher potential costs.

The goal of passive management is not to find profitable investments. An index fund's managers merely try to replicate the performance of the target index. Since this technique uses less administrative resources and involves less trading, actively managed mutual funds typically charge higher fees than index funds.