Defining capital gains tax

Any profit gained from selling an asset is subject to a tax known as capital gains tax.

Capital gains tax is not due until the investment is sold. The capital gain tax is calculated as the difference between the asset's sale price and its original acquisition price. A realized gain (or loss) is the amount of money you make or lose when selling an investment. Unrealized gains and losses, on the other hand, occur when an investment is held without being sold.

Whether you made a short-term or long-term capital gain on your investment will affect how much tax you owe.

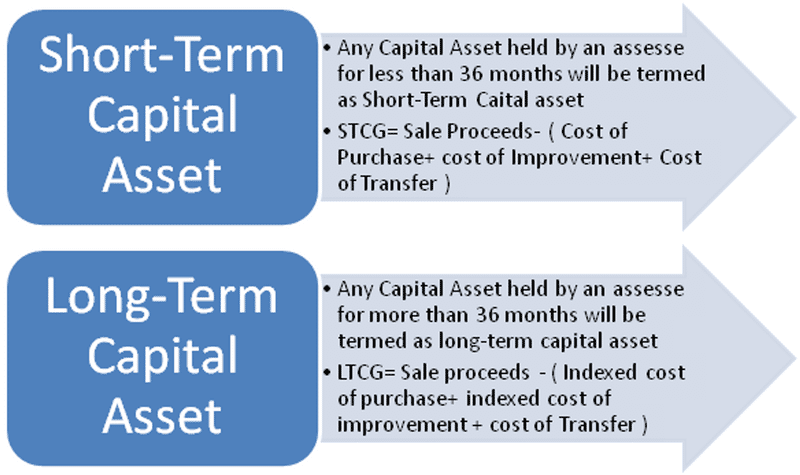

Short-Term Capital Gain

If you sell an asset after possessing it for a year or less, you will be subject to short-term capital gains tax rates.

Any gains from the sale of a capital asset that was held for less than a year are treated as ordinary income and subject to the same tax rate as salary. Comparatively speaking, long-term capital gains taxes are based on established tax rates that are updated for inflation each year, thus this rate is typically higher.

Long-Term Capital Gain

Long-term capital gains tax rates apply to assets sold after one year of ownership.

How does it work?

Capital gains, or profits, are said to have been "realized" when stocks or other taxable investment assets are sold. Unrealized capital gains, or investments that haven't yet been sold, are exempt from taxation. The value of a stockholder's holdings in that stock will not grow for tax purposes until the stock is sold.

Profits from the sale of assets held for more than a year are subject to a lower capital gains tax rate under current U.S. federal tax legislation. A taxpayer may pay either 0% or 15% or 20%, respectively, based on their tax bracket for the current year.

For the vast majority of filers, the tax rate on income is greater than the rate on long-term capital gains. Thus, they have a financial incentive to wait at least a year before selling their investments in order to benefit from the reduced tax rate on the profits they earn.

Day traders and others who take advantage of the speed and convenience of online trading should be aware that the gains they make from the purchase and sale of assets held for less than a year are subject to taxation at a greater rate than the gains made from the long-term holding of the same assets.

To calculate your taxable capital gains for the year, subtract your capital losses from your totals. Your tax bill should reflect the total amount of your capital gain. Net losses can only be deducted to a maximum of $3,000 each year, but any excess losses can be carried over to the next tax year.

2021 and 2022 - Capital gains tax rates

For tax purposes, the gain on the sale of an asset that occurs in the first year after its purchase is often considered as salary or wage income. On a tax return, you would include such gains in your "earned income" or "ordinary income."

Similarly, dividends from an asset, which are profit even if they aren't capital gains, are often treated the same way. Dividends are treated as ordinary income for those in the 15% tax rate and above in the United States.

However, the rules for long-term capital gains are different. Profits from the sale of assets held for more than a year are subject to taxation at rates that vary according to the taxpayer's taxable income for the year. Each year, the rates are changed to reflect the current level of inflation.

The tables below display the rates in effect for 2022 and 2023:

2022 Tax Rates for Long-Term Capital Gains | ㅤ | ㅤ | ㅤ |

Filing Status | 0% | 15% | 20% |

Single | Up to $41,675 | $41,675 to $459,750 | Over $459,750 |

Head of household | Up to $55,800 | $55,800 to $488,500 | Over $488,500 |

Married filing jointly and surviving spouse | Up to $83,350 | $83,350 to $517,200 | Over $517,200 |

Married filing separately | Up to $41,675 | $41,675 to $258,600 | Over $258,600 |

Here's how much you'll pay for profits from taxable assets held for a year or more.

2023 Tax Rates for Long-Term Capital Gains | ㅤ | ㅤ | ㅤ |

Filing Status | 0% | 15% | 20% |

Single | Up to $44,625 | $44,626 to $492,300 | Over $492,300 |

Head of household | Up to $59,750 | $59,751 to $523,050 | Over $523,050 |

Married filing jointly and surviving spouse | Up to $89,250 | $89,251 to $553,850 | Over $553,850 |

Married filing separately | Up to $44,625 | $44,626 to $276,900 | Over $276,900 |

Here's how much you'll pay for profits from taxable assets held for a year or more.

This table shows that the tax rates on long-term capital gains are in line with the general trend of taxing capital gains at lower rates than individual income.

Exceptions and special capital gains rates

When it comes to capital gains taxes, some asset classes are treated differently than others.

Collectibles

No matter your financial situation, the gain you realize on the sale of your collection of art, antiques, jewelry, precious metals, or stamps is subject to a rate of 28%. A 28% tax rate will be applied regardless of your actual tax bracket. Capital gains taxes are capped at the 28% rate even if your tax bracket is higher.

Owner-Occupied Real Estate

Selling your primary house triggers a change in the tax treatment of capital gains from real estate. The procedure is as follows: Taxes are not due on the first $250,000 of capital gains made by an individual (or $500,000 by a married couple) from the sale of their primary residence.

To qualify, the seller must have owned and occupied the property for at least two years.

Selling a home results in capital losses, but unlike with other investments, those losses cannot be deducted from any subsequent profits.

So, here is how it might function. A taxpayer who, as a single person, buys a home for $200,000 and then sells it for $500,000 would have a $300,000 profit. Taking into account the $250,000 exemption, the taxable capital gain for this person is $50,000.

In most circumstances, the amount of taxable capital gain can be reduced by adding the costs of major repairs and upgrades to the cost of the residence.

Investment Real Estate

Owners of real estate can often deduct the cost of depreciation from their taxable income as the property ages. (This decline is due to the house's physical condition and has nothing to do with the house's market worth.)

Taking into account depreciation reduces the "cost" you had to pay to acquire the asset in the first place. That can make your capital gain from selling the home more taxed. The difference between the property's net worth after deductions and the selling price will widen as a result.

If you purchased a building for $100,000 and are eligible to deduct $5,000 in depreciation, you will be taxed as if you had actually spent $95,000 for the facility. With a sale of the property, the $5,000 is considered a recovery of the depreciation expenses.

This amount will be subject to taxation at a rate of 25%. The total capital gains would be $15,000 if the building was sold for $110,000. $5,000 of the total sales price would be considered recoupment of the tax savings previously enjoyed. That recouped sum is subject to a 25% tax rate. The investor's marginal tax rate on the remaining $10,000 capital gain would be either zero percent, fifteen percent, or twenty percent.

Investment Exceptions

The net investment income tax is an additional fee that high-income earners may have to pay.

If your MAGI (not your taxable income) is above the thresholds specified by the IRS, an extra 3.8% will be taxed on your investment income.

For married couples filing jointly or with a surviving spouse, the threshold is $250,000. For single filers or those filing as heads of household, the amount is $200,000. For married couples filing separately, it is $125,000.

Calculating capital gains tax

Gains or losses on the sale of an asset are determined by comparing the purchase price with the selling price.

A capital loss occurs when the proceeds from an asset's sale are less than the seller's original investment in that item.

Your capital gains tax can then be determined using this figure.

How to reduce your capital gains tax

The impact of the capital gains tax on investment returns is substantial. However, there is a lawful strategy that can help certain investors minimize or even avoid paying any net capital gains tax at all in a given year.

One of the most basic methods is to wait at least a year before selling an asset. Generally speaking, the tax rate on long-term capital gains is lower than the rate on short-term profits, so you'd be smart to do so.

1. Use Your Capital Losses

To reduce annual capital gains tax, capital losses can be used to offset gains made in the same year. What if the costs outweigh the benefits, though?

There are two possible courses of action. You are eligible to deduct up to $3,000 from your taxable income if your losses exceed your gains. Any loss that exceeds your taxable income for the year is carried forward and can be deducted from future taxable income.

Here's an example: suppose an investor makes $5,000 in profit on the sale of some stocks but loses $20,000 on the sale of others. For tax purposes, the $5,000 profit can be offset by the capital loss. The remaining $15,000 capital loss might then be used to reduce taxable income.

An investor with a $50,000 annual income would report $40,000 after subtracting the $3,000 annual limit on deductions in the first year. A whopping $47,000 is now subject to taxation.

The $12k in capital losses can be deducted at the rate of $3,000 each year for the next four years.

2. Don't Break the Wash-Sale Rule

Investors should think twice before selling a stock at a loss in order to reinvest the proceeds in the same company. The IRS's wash-sale rule prohibits such a chain of transactions if it is completed in less than 30 days.

Schedule D is used to report any significant financial gains.

It is possible to deduct capital losses from taxable income in future years by "carrying them forward."

3. Use Tax-Advantaged Retirement Plans

Contributing to a retirement plan like a 401(k) or an Individual Retirement Account (IRA) has several benefits, one of which is that your savings will grow tax-free from year to year. In other words, all transactions conducted within a retirement plan are exempt from annual taxation.

Withdrawals from most plans are not subject to taxation until the money is actually spent. It's important to note that the type of investment doesn't affect the tax treatment of withdrawals.

With the exception of the Roth IRA and Roth 401(k), eligible withdrawals from traditional retirement accounts are subject to income taxation.

4. Cash In After Retiring

To maximize your retirement savings, you should hold off selling profitable assets until after you finish working. If your income drops when you retire, you may pay less in capital gains tax. It's possible you won't owe any capital gains tax at all.

Take the tax burden while you're working rather than while you're retired, but do it with an eye toward the future consequences. The earlier the gain is realized, the more likely it is that you will be subject to taxation on it because you would have moved out of a lower or no-tax category.

5. Watch Your Holding Periods

Keep in mind that in order to be taxed as a long-term capital gain, an asset must be sold more than a year after it was first purchased. Check the trade date of the acquisition if you are selling a security that you bought around a year ago. If you wait only a few days, the gain may not be considered a short-term capital gain.

Obviously, these timing strategies have a greater bearing on substantial deals than they do on little ones. It's the same if you're in a higher tax bracket as if you're in a lower one.

6. Pick Your Basis

When buying and selling shares of the same firm or mutual fund at various dates, the majority of investors utilize the first-in, first-out (FIFO) method to determine the cost basis.

Last-in, first-out (LIFO), dollar-value LIFO, the average cost (only for mutual fund shares), and specific share identification are the other four options available.

The optimum option will be determined by a number of factors, including the amount of gain that will be declared and the basis price of the shares or units that were purchased. In more complicated situations, you may want to talk to a tax professional.

It's not always easy to figure out what your "cost basis" is. In the case of an online broker, your statements can be found on the brokerage's website. If nothing else, make sure you have a record of everything.

Without the original confirmation statement or other evidence from the time of purchase, determining the exact date and cost of a security transaction can be a headache. If you ever need to calculate your exact profit or loss from the sale of a stock, you'll be glad you kept track of your statements. These dates are required for Schedule D.

7. Donate to charity

Your capital gains tax liability might be reduced by the amount of your deductible charitable gifts. Donating stocks or other assets that have increased in value significantly to charity can help reduce capital gains taxes and provide a tax deduction for the full market value of the gifts made.

When are capital gains taxes owed?

Capital gains tax is due in the year in which the gain is realized. If you sell stocks during 2022 and earn a profit of $140, you must include that amount as a capital gain on your tax return for that year.

If an investment is sold for a profit and it was held for more than a year, the investor is subject to capital gains tax. Schedule D is where the taxes are reported.

In the United States, the capital gains tax rate ranges from 0% to 20% of your taxable income. The tax rate is higher for the wealthy. The salary scale is updated every year to account for inflation. (For the capital gains tax rates for 2022 and 2023, please refer to the tables above.)

Gains from investments held for less than a year are called short-term gains and are subject to regular income taxation. That's a greater percentage than the majority of people experience.

FAQ

Can capital gains taxes be avoided?

Taxes on capital gains are something to consider if you plan on investing money and making a profit. However, there are a variety of legitimate strategies you can employ to reduce your taxable capital gains:

- Keep holding on to it for longer than a year.

- Remember that investment losses might reduce your investment gains.

- Expenses for your investment's upkeep should be recorded.

Why is it beneficial to have a low capital gains tax rate?

Many people believe that a low capital gains tax rate would encourage them to save and invest in riskier assets like stocks and bonds. The expansion of the economy can be directly attributed to the rise in investment. Having more capital allows businesses to grow and try new things, which in turn generates additional employment opportunities.

Investors, they add, are spending their after-tax money on these assets. A capital gains tax is double taxation because the money used to acquire stocks or bonds has already been taxed as ordinary income.

Why is it a disadvantage to have a low capital gains tax rate?

The tax rate on passive income is argued to be unfairly lower than the tax rate on earned income by those who oppose a low rate on capital gains. Having a low tax rate on stock gains means that the burden of paying taxes is passed on to those who really earn a living.

Another point of contention is that the tax-sheltering business stands to gain the most from a reduction in the capital gains tax rate. Put another way, rather than investing in new technologies, companies are putting their money into low-tax assets.

How long is a holding period?

A long-term capital gain is a profit made from the sale of an asset that has been held for longer than a year. Gains on investments held for more than a year are taxed at a lower rate than those held for less time and are taxed at the individual's regular income tax rate. Therefore, in order to benefit from the lower rates, it is recommended to hold capital assets for at least a year.

What is excluded from capital gains tax?

If a capital gain exclusion is applicable, the amount of taxable gain is reduced. To most people, the capital gains tax exemption applies to the first $250,000 (or $500,000 if married filing jointly) of profit made on the sale of a primary residence they have owned and used as their primary residence for at least two of the past five years is the most well-known capital gains tax exemption. If you acquired "qualified small business stock" after September 27, 2010, you may be able to exclude all of your gain from the sale of that stock. You may be able to exclude as much as 50% or 75% of the gain if the stock was purchased before that date.